Real wage growth in Hungary continues

After a technical drop in June, wage growth picked up again in July. Our focus is on the 2022 minimum wage discussion, which can strengthen wage-push inflation

| 7.9% |

Wage growth (YoY)ING forecast 7.5% / Previous 3.5% |

The June wage data was significantly distorted by base effects as healthcare workers got a huge bonus in 2020. Things are normalising in July, so we see the (more-or-less) usual elevated wage dynamics again. According to the Hungarian Central Statistical Office, both gross and net wages increased by 7.9% year-on-year. Despite the fact that this lags the growth rate seen at the beginning of the year and inflation is flying high, we can still talk about a 4% increase in real wages.

The main reason for the high average wage dynamics continues to be the wage settlement in the public sector, which resulted in double-digit wage growth (11.8% YoY). In contrast, growth in the private sector has continued to slow gradually. The 6.2% YoY increase has been the slowest pace of growth in 2021 so far. And yet we can say that it is distorted upwards by one-off factors, as we check the details.

Wages rose far above the average rate in the financial and insurance sectors, where presumably the mid-year bonuses pushed the average wages higher. Earnings also grew above average in wholesale & retail trade, information & communication and real estate sectors. Meanwhile, in the majority of the services sectors the rate of wage growth was close to or below average.

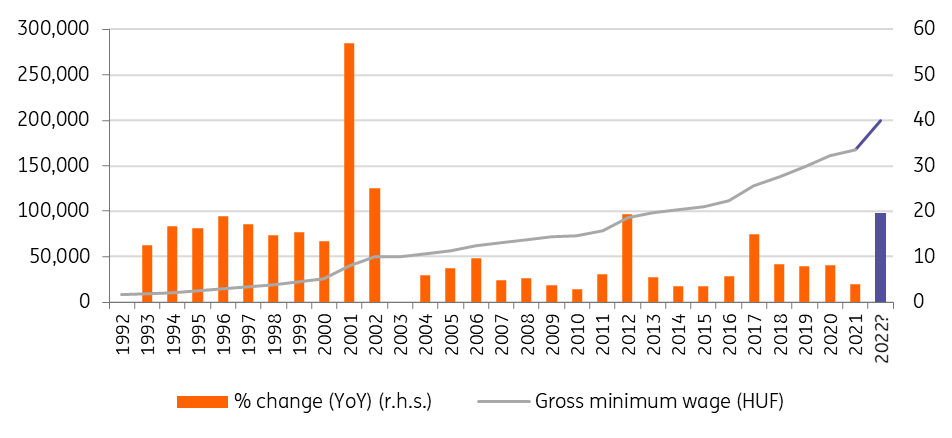

Looking ahead, the most exciting issue regarding the labour market is the ongoing discussion about the 2022 minimum wage. The negotiations are ongoing and based on the incoming information, the HUF200,000 minimum wage is clearly on the cards. This would mean a 19.5% increase from this year.

Minimum wage in Hungary

Despite a probable cut regarding the payroll tax, such a change would cover the increase in labour cost only partially. This could cause a major headache (and cost pressure) for micro- and small businesses. To avoid wage congestion, after such a significant increase in the minimum wage, we expect employees earning somewhat above this level to demand higher wages too. The proverbial icing on the cake is the labour shortage situation, which gives employees a bit more leverage in wage negotiations.

Against this backdrop, this minimum wage increase carries a significant upside risk to inflation. Adding this to the targeted lump-sum personal income tax refund in February 2022 (which will cost about HUF600bn to the budget), we can expect a significant increase in aggregate demand early next year.

Download

Download snap