Poland: Surprise improvement in current account balance in September

The current account deficit was €1.6bn in September, clearly below the consensus of €3.1bn and our forecast, and down from the €3.3bn deficit recorded in August. The reading is positive for the zloty

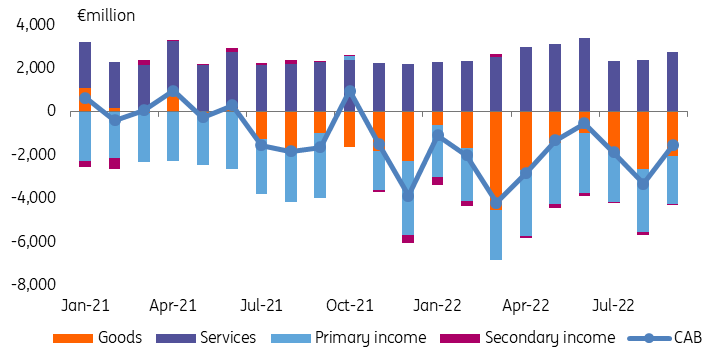

On a 12-month basis, we estimate that the balance improved to around -3.7% of GDP in September after -3.8% of GDP in August. The merchandise trade deficit was €2.1bn in September after €2.6bn in August. In cumulative terms, there was a slight deterioration in the balance here to around -3.9% of GDP from -3.8% of GDP a month earlier. A positive services balance of €2.3bn did not offset a deficit in primary income of €3.0bn. The secondary trade balance was close to zero.

Foreign trade turnover, measured in euro, is growing at a rate of more than 25% year-on-year, but this is mainly due to increases in transaction prices of exports and imports. The National Bank of Poland's communiqué states that real changes remain relatively small. Annual imports of goods (28.9% YoY) still exceeded that of exports (25.5%), but the difference was clearly smaller than in the first half of the year (almost 12pp on average). Polish companies are taking advantage of opportunities to increase foreign sales due to the weakening of the zloty and the easing of tensions in global supply chains. This is also evidenced by better-than-expected eurozone industrial production data published today for September (up 0.9% month-on-month against a consensus of 0.5%).

The NBP communiqué states that in September, as in the previous two months, the increase in exports was mainly driven by higher sales in the automotive sector, thanks to improved availability of key components for production. Exports of both auto parts (especially batteries and engines) and new cars and vans increased. Further growth in supplies of petroleum products to Ukraine also continued. Exports, however, were dampened by stagnation in durable consumer goods production. Imports were supported by a further increase in fuel imports, including coal, and an increase in imports of auto parts and components.

Today's data is positive for the zloty, as the current account deficit turned out to be clearly below expectations. However, the zloty's exchange rate has recently been influenced by global factors (weakening of the dollar) and - after last week's positive inflation surprise in the US - is benefiting from increased investor appetite for riskier assets. We expect a gradual widening of the current account deficit in the coming months, but the 5%GDP level at the end of the year seems more distant than a few weeks ago.

Current account balance and its components, in € million

Download

Download snap