Poland: strong retail sales in November – robust consumer demand and accelerating prices

Following better-than-expected growth in industrial output, retail sales also outperformed in November, expanding by 12.1%YoY in real terms, after 6.9% in October

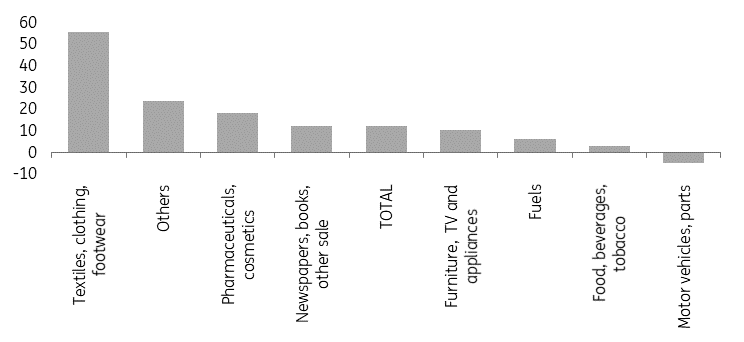

The high reading of retail sales was driven by sales of textiles and clothing (55.8%YoY, after 29.3% in the prior month), furniture, radio-tv, household appliances (10.3%YoY, after only 0.2% in October) and other sales (23.8%YoY, after 13.2% in the previous month). These categories are typical for consumer demand. The solid reading in retail sales was suggested by labour market performance and the structure of industrial production, where, for example, production of textiles and clothing surprised on the positive side.

Sales of motor vehicles continued falling (-4.9%YoY, following a decline of -5.2% in October). Most probably this is as a result of further problems with the availability of semi-conductors that is significantly impacting the automobile industry in particular. Growth of fuel and food sales was comparable with October.

Solid growth of retail sales confirms the resilience of consumer demand in Poland. It may also result from accelerated purchases due to rising prices and concerns about the growing fourth wave of the pandemic. The share of internet sales in total retail (11.4%) was 3 percentage points higher than in October. These factors may slow down, however, in the year end. Nevertheless, the growth momentum in the Polish economy in 4Q21 remains robust and supports our growth forecast of 5.4% in 2021 as a whole.

Today’s data reflects accelerating inflation – the deflator of retail sales increased from 7.5 to 9.1% YoY. Accelerating prices are visible in typically demand-driven categories: textiles, clothing, food and other sales. Fuel and energy prices reflect global trends in commodity prices. In addition to strong industrial production, high tariff increases in natural gas and electricity from 2022, as just announced by the Energy Regulator, support the continued hikes in the National Bank of Poland’s interest rates. In our view, an interest rate of about 4.0-4.5% will be reached in late 2022/early 2023.

Change in retail sales in November (constant prices), %YoY

Download

Download snap