Poland’s record-high current account deficit in December

The record-high monthly current account deficit on a monthly basis in December resulted, to a large extent, from changes in the timeline of the EU’s membership payment. But even accounting for this correction, the deficit exceeded expectations

Poland's current account (CA) deficit in December (around €4bn) was record-high on a monthly basis and significantly higher than the market consensus (€2.2bn), after a €0.6bn deficit in November. This outcome resulted from a high deficit in merchandise trade of €2.5bn, an elevated (but lower than usual) surplus in services (€1.5bn), a €1.8bn deficit in primary income and an exceptionally high deficit in secondary income (former transfers) of €1.1bn. The difference between annual growth rates of imports (35.9% YoY) and exports (19.4% YoY) increased from 13.1pp in November to 16.5pp in December.

Average secondary income payments amounted to barely €0.3bn a month in 2021, but in December it amounted to more than €1.1bn and resulted – to a large extent – from an EU membership payment. These payments were usually made in January or February, therefore the change in the timeline added around €0.8bn to the current account deficit in December. However, even after accounting for this correction, the monthly CA above €3bn indicates a swift deterioration in Poland’s external balance.

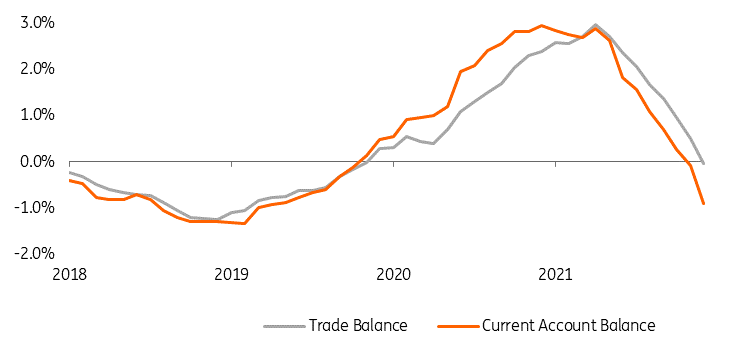

According to our estimates, in 12-month cumulative terms, the CA deficit widened to 0.9% of GDP from just 0.1% in November. During 2021 as a whole, the deterioration amounted to almost 4%of GDP. In December 2020, the CA balance posted a surplus of 2.9% of GDP. In the final quarter of 2021, net exports had a significant negative contribution to GDP growth, which exceeded 7% in YoY terms; the data will be released tomorrow (Tuesday).

High merchandise trade turnover in December was consistent with the earlier readings of industrial output. Import bills were heavily inflated by high energy commodity prices, in particular natural gas prices, and a solid rebound in consumption and investment. Export growth (19.4%YoY) was the highest from June 2021 but was still contained by shortages of chips in the automobile industry. High natural gas prices in Western Europe allowed for a temporary export boost of Polish coal-based electricity. According to NBP’s press release, strong export growth was also recorded in such categories as coke, computers, tractors and buses.

December’s Balance of Payments data is slightly negative for the zloty. In recent weeks, its exchange rate has been largely influenced by expectations on the NBP’s interest rate hikes and tensions resulting from risks associated with Russia’s potential aggression against Ukraine. Nevertheless, in the difficult external environment, especially for countries being net energy importers, a CA deficit of about 1% of GDP remains a favourable outcome, though it's set to deteriorate further in 2022.

Current account and trade balances, 12-month cumulative, as % of GDP

Download

Download snap