Romanian inflation keeps rising

Given the available information, we are revising our forecast for average 2022 inflation to 8.8%, with the year-end rate at 8.0%. For 2023, we see average inflation at 5.5%, and 4.5% by year-end

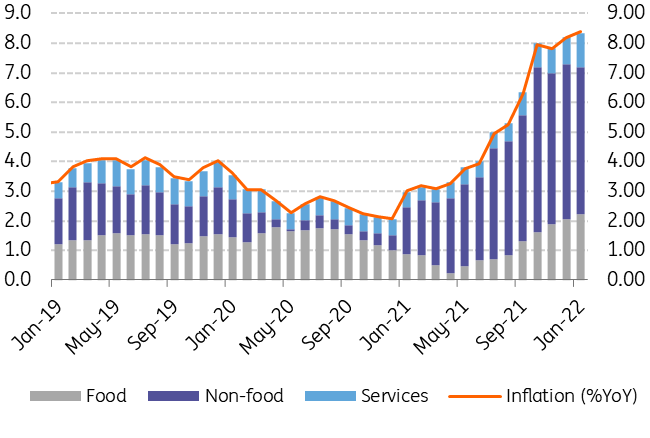

As usual and as everywhere lately, inflation continues to surprise to the upside. At 8.4%, the January 2022 inflation rate is the highest in the last 14 years and the peak is still ahead of us.

| 8.4% |

January 2022 inflation |

| Higher than expected | |

The 0.4ppt forecast error on our side came largely from natural gas prices which advanced by over 6.00% compared to the previous month, versus our call for flat monthly prices. Again it seems that the inner mechanics of a liberalised, but temporarily capped market are still eluding our attempts to estimate price moves. A 1.3% monthly increase in tobacco prices and 6.4% in heating energy have also taken us by surprise a bit.

Inflation (YoY%) and components (ppt)

Key to the inflation path going forward will be the administrative measures already under discussion to curb energy prices in particular. The latest official statements suggest that policymakers will attempt to take the needed measures in order to prevent double-digit inflation this year. In the short term, the most effective would most likely be a VAT cut (targeted or broad-based), but the action plan will likely be more complex than that.

In its latest Inflation Report, the National Bank of Romania forecast headline inflation to exceed 10% in the second and third quarters of 2022, under the assumption that current support measures for households will not be prolonged. However, as these measures will most likely be extended in one form or another, we believe that an eventual peak of inflation above 10% will be rather short-lived. Nevertheless, this will also mean that the downward trajectory of inflation will be less abrupt. We do not foresee headline inflation re-entering the NBR’s target range of 1.5%-3.5% before mid-2024.

Given the available information, we are revising our forecast for average 2022 inflation to 8.8%, with the year-end rate at 8.0%, while for 2023 we see average inflation at 5.5%, and the year-end rate at 4.5%. Despite the higher forecasts, the central bank’s reaction will likely be rather limited. Maintaining a quasi-flat EUR/RON exchange rate for the rest of the year will likely be the top priority. On the interest rate side, we expect the key rate to reach 4.00% this year with adjusting liquidity conditions every now and then in order to make the Lombard rate (which is 100bp higher than the key rate) more relevant.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap