National Bank of Hungary preview: Too early to quit

Has the central bank seen enough progress to start implementing its exit strategy from the hawkish 'whatever it takes' stance? We see a gloomier outlook, and no change in its current view, which might be good news for Hungarian assets

| 13% |

ING's callNo change in the base rate |

The rationale behind our call

The National Bank of Hungary (NBH) has made it clear on several occasions that the temporary and targeted measures, introduced in mid-October, will remain in place until there is a material and permanent improvement in the general risk sentiment. This general risk sentiment is defined by the combination of external risks (war, global monetary policy, energy, general investor sentiment) and internal risks (Rule-of-Law procedure, current account imbalance).

Although we’ve seen some progress here, we don't think enough has changed to trigger an adjustment in the monetary policy’s hawkish “whatever it takes” setup. Maybe the single most important change – which impacts two external risk items – is that some regions have seen a silver lining in inflation. The headline inflation in the eurozone dropped more than expected in November, while the US price pressure looks to be abating based on the past two data points. In both cases, we would warn against complacency as we have been hurt by the “inflation is transitory” narrative several times.

However, general investor sentiment does seem a bit more upbeat, and in line with that, rate hike expectations regarding the US Federal Reserve and the European Central Bank have been scaled back recently. In our assessment, this is hardly fulfilling the criteria for a “sustained shift in financial market conditions” and a “trend improvement in risk perception”. A step in the right direction, yes, but the wait-and-see approach might still be warranted.

When it comes to the biggest local risk factor, we also saw improvement. The European Union and Hungary have been able to break the logjam regarding EU funds, closing the Rule-of-Law procedure in a less painful manner. Hungary has secured the ability to have access to the full amount of RRF grants and accepted a reduced hit of EUR 6.25bn regarding the Cohesion Fund. Though the agreement doesn’t mean automatic transfers, as some further conditions prevail to receive payments, we definitely see this outcome as a positive development. With Hungary dropping its veto on Ukraine aid and on global minimum tax, these clearly help to improve investors’ perceptions about the country.

But again, we are still not there yet, where the money flow is directly easing pressure on Hungary’s financing needs and FX reserves. We aren't keen on the idea of calling this a sustained shift and a trend improvement. Against this backdrop, we expect the National Bank of Hungary to maintain the recent monetary policy setup and continue signalling that more development is necessary to implement its exit strategy, moving away from the 18% effective marginal rate (defined by the one-day deposit quick tender).

ING's inflation and base rate forecasts for Hungary

The updated staff projection will also point to that maintained hawkishness direction. We expect the central bank to review its short-term inflation forecast upward, showing a tight range of around 14.5% in 2022. While the 2023 CPI projection will see a material upward revision to a 16-18% range. This could be a realistic call, though we are a bit more pessimistic than that with an 18-19% inflation outlook for next year. When it comes to 2024, yet another review upward (to the range of 3.5-5.5%) will cement the short-term hawkishness of the central bank.

On the GDP outlook side, the 2022 forecast will get a positive update, in our view, to around 4.5-5.0%. The big question is whether the NBH will be ready to show the possibility of a full-year contraction in its range forecast for 2023. We think it will downgrade next year’s GDP growth into a -0.5-1.0% range, followed by a marked rebound in economic activity in 2024.

With new GDP and CPI profiles, if our view is confirmed, we see the central bank starting to cut the marginal rate (approaching the 13% base rate gradually) as soon as we reach the second quarter of next year. When it comes to regular rate cuts, we think the NBH will follow in the footsteps of major central banks.

The main interest rates (%)

Our FX and rates call

Rates and bonds remain largely driven by the EU story and headlines. We saw a brief episode of the market moving higher again after November's normalisation, but we think the downward trajectory and steeper curve is the main story for the months ahead. Tangible progress in the EU story and the avoidance of money loss has put the forint back on the path to stronger values and hence the potential upward rate spikes should be less frequent than before. Thus, if the situation remains under control, which is our baseline scenario, the NBH will move closer to the possibility of rate normalisation, which should be reflected in a decline in the short-end of the curve, resulting in a bull steepening.

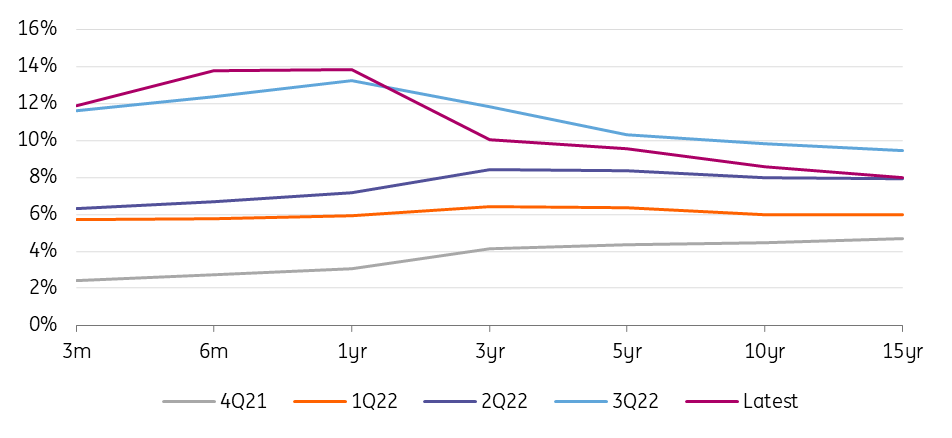

Hungarian yield curve

On the bond side, Hungarian bonds' (HGBs) bull steepening should be supported by solid fiscal consolidation for next year, in our view. 10y asset-swap spreads (ASWs) have finally normalised, returning to the average of the past two years at the long-end of the curve. With the expected positive fiscal outlook, the maturity calendar concentrated more in 2H23, and a solid cash buffer, we could see relative richening in HGBs again in ASW terms.

CEE currencies vs EUR (1 Feb = 100%)

The significantly volatile forint in recent weeks obviously reflects the dramatic negotiations between the EU and the Hungarian government. Although the story is still not over, tangible progress should keep the forint on the stronger side and limit potential losses. Moreover, the NBH liquidity measures have clearly worked, and implied FX yields once again soared to record highs during December. Although they have fallen slightly again in recent days, they are still on average double that of regional peers, protecting the forint from further sell-off in our view. Market positioning has shifted from a significant overbought to a neutral or slightly short position during the misleading headlines from Brussels, and also due to the unexpected lifting of fuel price caps. As a result, this, in our view, opens up room for an easier rally if the EU story progresses further, while also limiting a significant sell-off. Overall, we expect the forint to move towards 400 EUR/HUF this year and below that level next year.

Download

Download snap