Key sectors still support Hungarian industry

Industrial activity strengthened further in July, fuelled by good performances from the three most important sectors. But as we see it, the good times will soon be over

| 6.6% |

Industrial production (year-on-year, wda)ING forecast 2.2% / Previous 4.8% |

| Better than expected | |

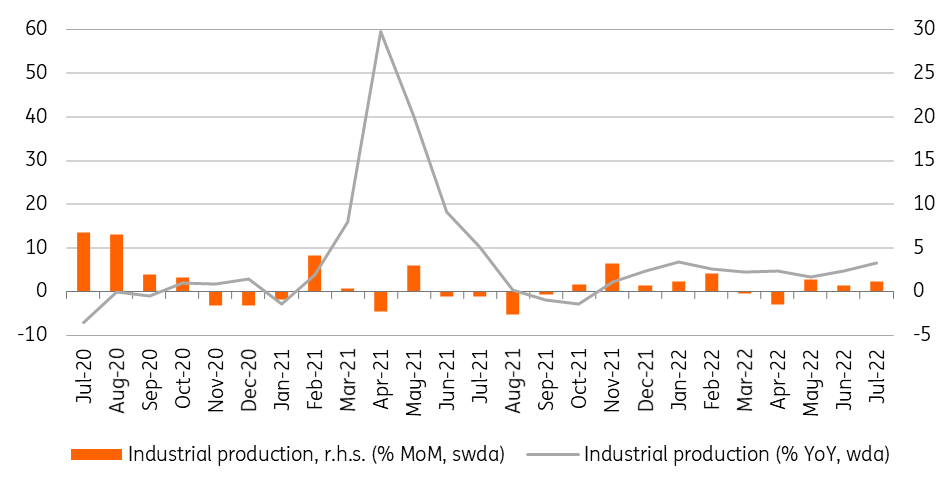

In light of the somewhat disappointing retail data (at least that’s how we see it), the July industrial performance paints a better picture about the state of the Hungarian economy at the start of the third quarter. According to the latest data release, the volume of industrial production rose by 6.6% on a yearly basis, adjusted for working days. This is a result of the low base and a solid, 1.1% month-on-month growth rate. After the low point in April, industrial output has been on an upward trend, as manufacturers are increasingly able to deal with problems arising from supply chain issues caused by the war in Ukraine. At the same time, our biggest fear is that galloping energy prices will cripple production both from the supply and demand side.

Performance of Hungarian industry

The Hungarian Central Statistical Office will release the detailed data in a week, but the statement has already shed some light on the drivers of growth. All three major sectors of the local industry (car manufacturing, electronics and food industry) performed well in July. In contrast, among other sectors, the most typical outcome was a decline in production. Presumably, smaller sectors have already begun to adapt to the higher cost structure and lower aggregate demand. The June data showed a similar structure (major sectors doing well, others suffering), so this division seems to be becoming a trend. As long as the key sectors can remain resilient to the tsunami of shocks, Hungarian industry as a whole can continue its expansion.

Volume of industrial production

In the food industry, the weather and energy issues and related shortage of fertilisers are causing more and more serious problems both in the short and long run. In the field of electronics and car manufacturing, supply chain disruptions are about to arise again either because of Covid problems or due to typhoons hitting Asian countries. Looking ahead, we see an extreme degree of uncertainty in forecasting industrial production. And although the manufacturing PMI in Hungary is still pointing to continued industrial growth, a turning point seems to be at hand.

Moreover, we would take the results of the PMIs with a pinch of salt, as only two main factors are driving the optimism suggested by the survey. Firstly, there is a high volume of orders. However, this will be worthless if new supply difficulties arise due to, or in parallel with, the energy crisis which could push market players to rationalise production. The second factor is the increase in input prices and the ability to pass rising costs onto consumers. This ability could suddenly disappear as global purchasing power is quickly vanishing due to the cost-of-living crisis in several major economies. In a nutshell, we see the optimism shown by the PMI reading as somewhat exaggerated.

Manufacturing PMI and industrial production trends

Although the July industrial data paints a favourable picture at face value, we cannot ignore the writing on the wall (i.e. global recession). In our view, the following months are likely to bring a slowdown in industry as major sectors are tied to the performance of Germany, and the energy crisis will take its toll locally. In this respect, the overall performance of the Hungarian economy will shrink on a quarterly basis, taking the first step towards a technical recession.

Download

Download snap