Japan: Labour market recovery continues but retail sales tumble

The labour market continues to recover slowly but the sudden drop in retail sales should be temporary. We think the Japanese economy will recover modestly next year, but the Bank of Japan's policy normalisation (end of negative policy rate) is still a long way off

| 2.5% |

Jobless rate |

| Lower than expected | |

| -1.1% |

Retail sales%MoM sa |

| Lower than expected | |

Labour market continues to recover but no clear sign of wage growth

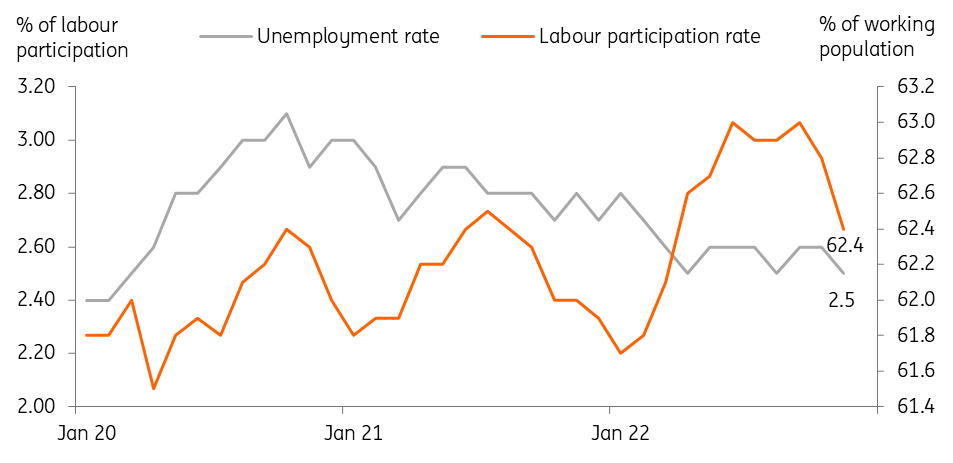

The jobless rate edged down to 2.5% in November (vs 2.6% in October, 2.6% market consensus) while the job-to-application ratio was unchanged at 1.35. Labour market conditions continue to tighten but it is not strong enough to lead wage growth, which is sought by the Bank of Japan. Also, the jobless rate has fallen, but it was mainly because the number of workers that dropped out fom the labour market was higher than that of employment. We think that service employment in the tourism and hospitality sectors are likely to rise in the future, but manufactuting employment is expected to decline due to weak manufacturing and investment activities.

Labour participation rate declined in November

Retail sales dropped quite sharply

In a separate report, retail sales unexpectedly dropped -1.1% month-on-month seasonally adjusted in November (vs 0.2% in October and 0.2% market consensus), for the first time in five months. Apparel sales fell the most (-7.5%) mainly due to mild weather, while motor sales increased (3.4%) in November. Looking ahead, we expect retail sales to rebound on the back of government subsidies for fuel and a revival of tourism. But, considering the high inflation conditions, the recovery is expected to slow slightly compared to the previous quarter.

Bank of Japan Watch

Market expectations are growing for policy change by the Bank of Japan. We also agree with that to some extent. But, as mentioned in our previous reports, we still believe that the Bank of Japan won't be in a hurry to end its negative interest rate policy. Prime Minister Kishida also noted that policy reviews between the government and the central bank are not being considered at this point, and it is more important who will lead the Bank of Japan when current Governor Kuroda steps down in April.

As we enter 2023, Japan's inflation may heat up a little more, but without wage increases, inflation is not expected to be more than 2% in upcoming quarters. Thus, the spring salary negotiation next year is the most important to watch for further meaningful policy change for the Bank of Japan. We think once the new govenor is appointed, then the policy review will follow in the second quarter of 2023. Another tweak in yield curve control is possible in the first half of 2023, but a rate hike is expected in late 2023 or early 2024.

Download

Download snap