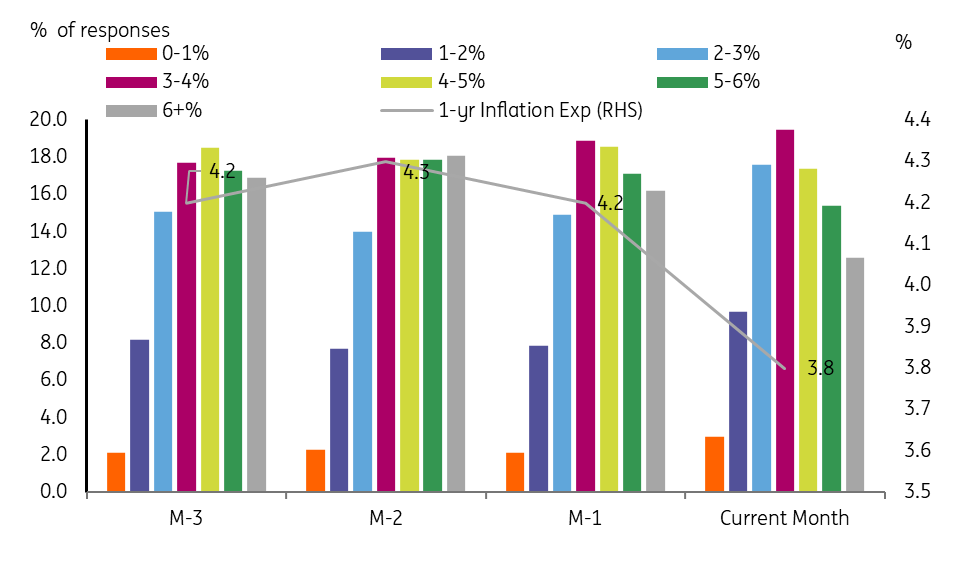

South Korea: Inflation expectations have slowed considerably

Although utility and public service fees are scheduled to rise next year, inflation expectations have fallen to the 3% level for the first time in six months

| 3.8% |

Inflation expectations |

Consumer sentiment index improved in December

The consumer sentiment composite index rose slightly to 89.9 in December (vs 86.5 in November), but has remained in contraction territory for seven straight months. Despite the continued price adjustment of the housing market and high interest rate environment, expectations for consumers' living standards and economic conditions have improved. We believe that this unexpected improvement is based on better views regarding employment and the interet rate environment. The interest rate expectation sub-index fell by 18 points while the employment expectation rose by 4 points.

Inflation expectations returned to the 3% level

Bank of Korea Watch

The most important reading in today's consumer sentiment survey was inflation expectations, which dropped to 3.8% in December (vs 4.2% in November) as the Bank of Korea keeps a close eye on consumer inflation expectations in terms of its monetary policy decisions. We expect consumer inflation to slow to 4.9% year-on-year in December, mainly due to the base effect and falling gasoline and fresh food prices. The slowdown in both actual inflation and inflation expectations underpin our view that the Bank of Korea may take a break in January and resume rate hikes in February.

The government plans to raise utility bills (details will be announced on 30 December) and public service fees quite meaningfully next year and reduce the amount of gasoline tax cuts (from 37% to 25%) from 1 January. However, this will mostly be offset by falling global oil prices and a stronger KRW, in our view. Also, the recent sharp drop in housing and rent (jeonse) prices is expected to be reflected more prominently in next year's CPI. Thus, we believe that CPI inflation should come down to the 3% level by early 2Q23. Then, the Bank of Korea will likely take a pause for a while to monitor how inflation moves and how monetary policies of other major central banks change.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap