Indonesia’s central bank keeps rates on hold to steady the currency

Bank Indonesia keeps its policy rates at 5.75% in a move to shore up the rupiah

| 5.75% |

Bank Indonesia 7-day reverse repurchase ratePolicy rate |

| As expected | |

BI on hold for 4th straight meeting

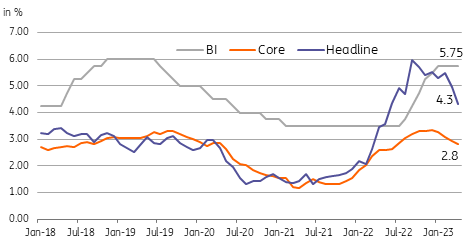

Bank Indonesia (BI) kept policy rates at 5.75%, extending its pause for a fourth straight meeting. BI retained its growth outlook for GDP to settle between 4.5-5.3%YoY and expects growth to remain robust going into the second half of the year. BI also expects the current account to fall between 0.4 to -0.4% of GDP for 2023, with robust exports still proving a reliable source of foreign currency inflows.

The bank's decision to pause was likely in line with their directive to ensure FX stability, with the IDR coming under renewed pressure in recent weeks. On the other hand, price pressures have moderated somewhat, with both headline and core inflation coming off their respective peaks and they're heading back to target.

The central bank announced it would be extending its “operation twist” of selling short-term bonds to help attract foreign portfolio flows to support the local currency.

BI likely to extend pause even as inflation moderates

BI likely entering an extended pause

BI extended its pause for another meeting to ensure ample support for the IDR, which is down 1.6% this month. With inflation now clearly headed back toward target, future BI decisions on policy will likely hinge on the currency's stability in the coming months. Ongoing talks over the US debt ceiling and uncertainty over the Fed's policy direction will likely go unresolved in the near term, suggesting pressure on the IDR could continue for a little longer.

So we expect BI to remain on hold for the next few meetings to shore up the IDR before considering a reduction for its key policy rate. In the meantime, we expect the central bank to continue efforts to stabilise the currency while also ensuring ample liquidity to support the healthy expansion of bank lending.