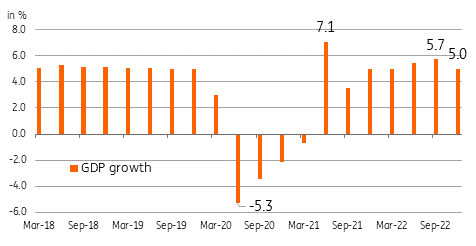

Indonesia: fourth quarter GDP surprises on the upside but growth momentum is fading

GDP growth in the fourth quarter of last year beat market expectations, but signs point to a slowdown in 2023

| 5%YoY |

4Q 2022 GDP growth |

| Higher than expected | |

Fourth quarter GDP growth beats consensus

Economic activity rose 5% year-on-year in the fourth quarter of 2022, up 0.4% from the previous quarter and better than the market consensus of a 4.9%YoY gain. The better-than-expected growth performance takes full-year growth to 5.3%YoY. Solid household spending (4.5%YoY) offset a contraction in government spending (-4.8%YoY) as well as compensating for slower capital formation (3.3%YoY vs 6.5% previous) and a narrowing trade surplus. Indonesia’s export and manufacturing sectors benefited from rising commodity prices in early 2022 but this key support has now faded. Exports, mining/quarrying and manufacturing all managed to eke out gains in the fourth quarter but at a more measured pace compared to the previous quarter.

We can expect exports and the manufacturing sector to face headwinds in 2023 with the economy needing to rely more heavily on household consumption for growth. Household spending proved resilient in 2022 but stubbornly high inflation (January inflation at 5.3%YoY) could weigh on consumption at least in the first half of 2023.

Fourth quarter GDP surprises on the upside but 2023 brings fresh challenges to growth outlook

Bank Indonesia shifting its stance?

Bank Indonesia (BI) has been busy over the past few months, lifting its policy rate from 3.5% to 5.75% to deal with above-target inflation. BI Governor Perry Warjiyo however recently hinted that the current policy rate hike cycle could be coming to an end soon. BI will likely consider reversing its current stance to dovish should inflation continue to soften amid slowing growth momentum.

If inflation continues to edge lower, we could see BI pause policy rates as early as the first quarter of the year to shift focus back to growth support amid the global economic slowdown.

Download

Download snap