Hungary: inflation to move even higher despite jump

Both headline and core inflation accelerated significantly in November due to processed food and services. The scrapped fuel price cap will push inflation even higher in the coming months

| 22.5% |

Headline inflation (YoY)ING forecast 22.4% / Previous 21.1% |

| Higher than expected | |

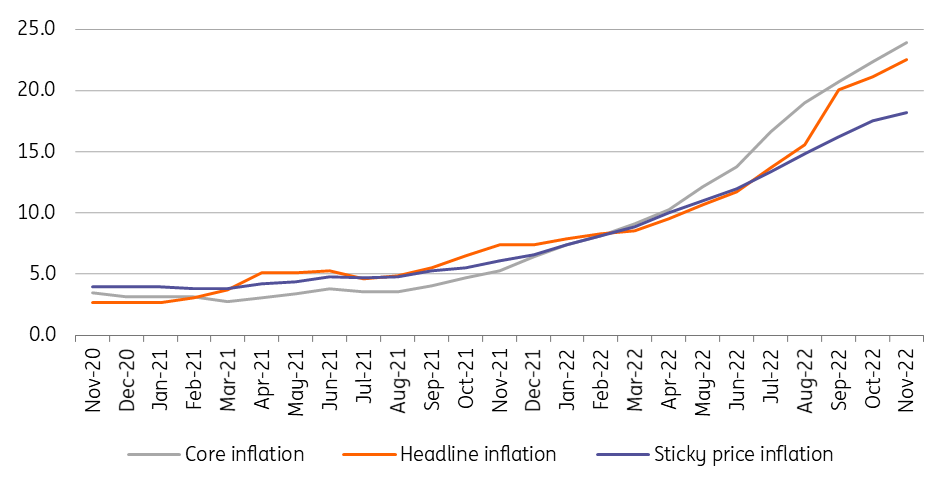

Inflation pressure reaches 1996 highs

Inflation continues to surge in Hungary. The November result was another serious surprise compared to the market consensus. The year-on-year inflation reading came in at 22.5%, which is the result of another 1.8% general price increase on a monthly basis. The usual suspects are behind the 1.4ppt acceleration from October to November, with only one real surprise.

Main drivers of the change in headline CPI (%)

The details

- Price changes in food have remained the single most important contributor to the acceleration in inflation. Prices rose by roughly 44% on a yearly basis in this product group, with both processed and unprocessed food showing a significant increase. According to the central bank’s estimation, 75% of the rise in food prices came from processed foods. Supply chain issues in agriculture, labour shortages, drought, and higher energy bills along with productivity issues in the food industry are all contributing to rising food prices.

- The only real surprise came from the services sector. Inflation in this part of the consumer basket strengthened again both on a monthly and a yearly basis. In November, services inflation typically tends to weaken rather than strengthen, due to seasonality. But not this time. The increased price pressure stems from households, transportation, and recreational services as well as from a price increase in gambling.

- To rebalance all the negatives, we have one positive development in inflation: the annual inflation of durable goods has moderated somewhat. This may be due to the strengthening of the forint since it reached a record low in October. It probably eased the pressure on imported inflation. However, this had only minor implications in the year-on-year headline reading.

The composition of headline inflation (ppt)

Underlying price pressure is looking even worse

As the most significant upward effect in inflation came from processed food and services, it hardly comes as a surprise that the acceleration in core inflation was even stronger than the move in the headline reading. Core inflation jumped by 24% year-on-year, well above market expectations. This is the highest reading since early 1996 and shows major underlying price pressures. That can also be ascertained from the share of items showing above-average inflation. According to our estimates, 49% of the items in the consumer basket already showed at least a 20% YoY inflation figure in November.

Headline and underlying inflation measures (% YoY)

More acceleration ahead

Looking ahead, we expect further significant acceleration in the headline reading. The sudden end to the fuel price cap will push inflation higher. Two-thirds of the additional impact will show up in December, while the price increase will affect the headline reading in its entirety from January. According to our calculations, if the market price does not change significantly, inflation in Hungary may be higher by another 2ppt. Since this item is not part of the core inflation basket, that indicator is not affected by the change.

Against this backdrop, the inflation rate is expected to peak around 25-26% early next year. At the same time, recent economic activity data has indicated that the performance of the Hungarian economy is increasingly slowing down. As a result of the technical recession, the repricing ability of companies is also weakening, which means that the monthly rate of inflation is expected to be less severe from the beginning of next year than it was a year ago. All of this will translate into a gradual deceleration in the annual inflation index.

We raise our inflation forecast and expect the central bank to do the same

At the same time, the minimum wage negotiation carries a serious inflation risk. If an agreement is reached on an extremely high, one-time increase, it will push companies to increase their wage costs more significantly than originally planned. And this could start (or strengthen) a wage-price spiral. This represents the greatest risk to our call regarding the timing and the level of the zenith in inflation.

In light of today's data and due to the end of the fuel price cap, this year's average inflation may reach 14.5%. Next year, the increase in the average price level will be much higher, around 18-19%, in our view. We expect the National Bank of Hungary to have a similar view in its December Inflation Report, showing an 18%-ish upper bound for their 2023 inflation forecast. However, the level of the top in inflation won't necessarily change the central bank's exit strategy from its hawkish “whatever it takes” policy as it is not tied to a level but rather to dynamics (e.g. retreating inflation). Against this backdrop, we still see a realistic chance that the central bank might start cutting the 18% marginal rate around the second quarter of next year, as inflation is expected to slow during the first half of 2023, along with an improving current account balance.

Download

Download snap