Poland’s central bank keeps rates flat

The Monetary Policy Council left interest rates unchanged (the main one still at 6.75%), in line with the consensus and market expectations

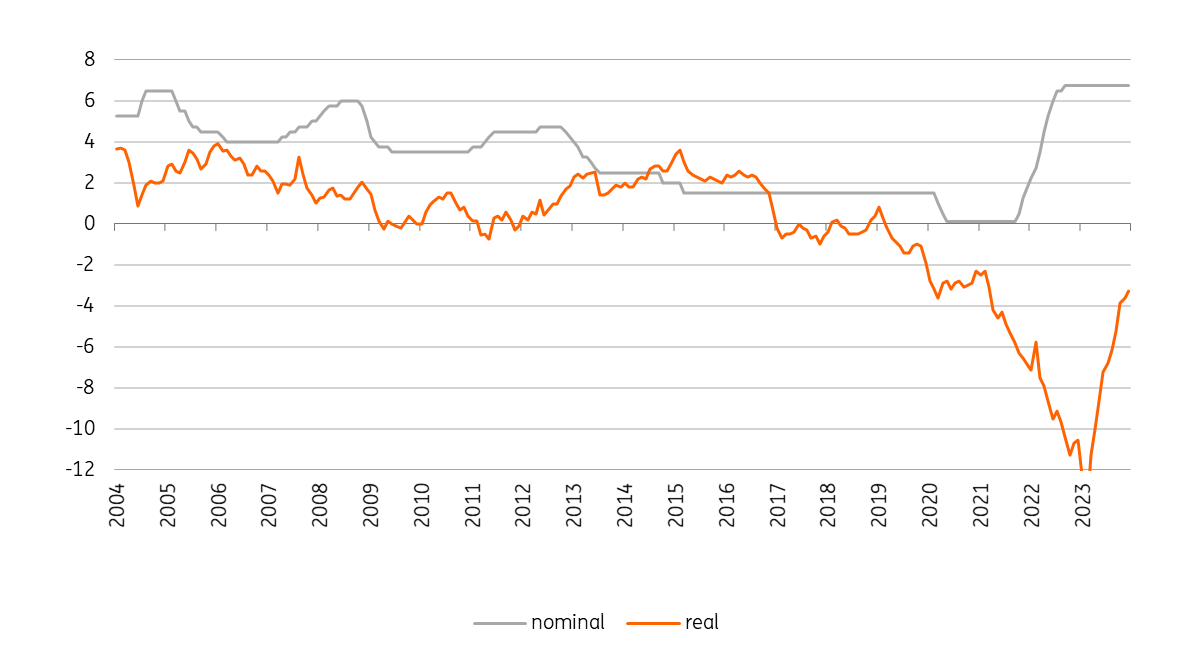

NBP real rates (ex-post) should stay negative even with CPI expected to fall in 2023

NBP nominal and real rates (ex-post)

Our take on the decision

The National Bank of Poland has not formally closed the tightening cycle, but effectively this already happened a month ago when the MPC also decided to leave rates flat despite new higher CPI projection showing:

(1) higher inflation in 2023 by 0.8 percentage points, at 13.1% year-on-year on average;

(2) unfavourable CPI structure – the NBP shared our concerns about stubbornly high core inflation and raised its 2023 forecast by as much as one-third;

(3) additionally, the November projection showed a return of CPI to the target range (2.5%, +/-1%), only in the second half of 2025, and this under rather optimistic assumptions about commodity markets and a rapid expiration of second-round effects and a marked deterioration in Poland's labour market.

The decision to hold rates flat is no surprise. The MPC sticks to its de facto target, which the Council has defined as: (1) slow disinflation and (2) allowing a mild deceleration of GDP. The de jure target assuming inflation at 2.5% +/-1% is of less importance now. That is why the MPC decided to leave rates unchanged, despite the many risks of long-term high inflation.

Outside the Polish economy, there are 'green shoots' showing a softening of global inflation pressure, i.e. a big improvement in supply chains, and a drop in energy commodity prices. Also, inflation has passed its peak in countries unaffected by the gas shock, such as the US, but not Europe. As 2021-22 saw the biggest price shock since the 1970s and many investors stayed short duration, now we see a massive unwind of these positions taking place. This has resulted in a strengthening of Polish debt and and in our view masks a short-sighted monetary policy.

ING inflation forecast

But we stick to our view that Poland's inflation outlook remains poor, and current monetary policy may prove too loose to bring inflation back to the NBP's target in a sustainable and credible way in the medium term.

In 2023, CPI inflation should fall from over 20% YoY in February to around 10% YoY in the fourth quarter of 2023, but this will be due to base effects in food and energy prices.

We expect a persistently high core inflation in the next two years. Also, the 'freezing' of energy prices in 2023 should cause an inflationary overhang that could generate further waves of secondary effects, cost increases and the need for price increases for a range of goods and services in subsequent years. The NBP seems to put more importance on the short-term economic costs of monetary tightening rather than to the medium- and long-term losses to households and businesses from sustained high inflation.

Experiences of other countries where inflation expectations were 'unanchored' and the price spiral was set in motion shows that in order to combat stubbornly high inflation, a decisive tightening of the policy mix, i.e. monetary and fiscal policy, was necessary.

Therefore, in 2024 expect either further rate hikes or a strong tightening of fiscal policy. The ultimate cost of fighting long-term high inflation will be higher than if the tightening of the policy mix were greater today.

The post-meeting statement and Thursday’s press conference

The statement following the MPC meeting was almost unchanged from November, except for an update with new data. Also, the summary passages are almost identical as in November.

After such a decision, Thursday's press conference by the NBP president should be important. The NBP governor should probably allude to the decline in CPI inflation in November and the weak GDP structure in the third quarter of 2022. The Council has further arguments for keeping interest rates unchanged in order to assess the effects of the hikes so far – especially in the context of a stable zloty.

So far, Chairman Glapiński has been holding back on declaring the end of rate hikes, but effectively this phase of the fight against inflation has ended. A new chapter is likely to begin in 2024.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap