Hungary: Industry rebounds as supply chain issues fade

Supply chain issues in car manufacturing is still a thing but at least producers were able to ramp up capacity utilisation in February. This translated into a significant rebound in production

| 3.9% |

Industrial production, YoYING forecast 0.7% / Previous -2.8% (Working Day Adjusted) |

| Better than expected | |

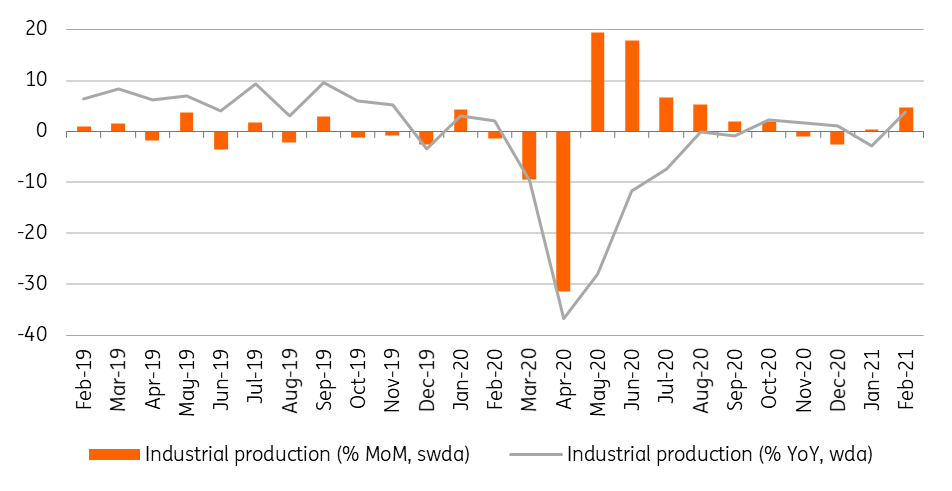

Car manufacturing faced tough supply-side constraints in January as there was a shortage in semiconductors and chips. It translated into shutdowns and a reduction in shifts. The problem hasn’t been fully resolved yet, but car producers were able to restart their operations, which translated into a significant month-on-month jump in output. Industrial production increased by 4.8% MoM in February 2021, outperforming all expectations. With that rebound, industry’s output was up by 1.9% YoY and adjusting for working days, it is even better at 3.9% YoY.

Performance of Hungarian industry

So, this looks pretty good but it doesn’t mean that Hungarian industry is out of the woods. As usual, the recent data release from the Statistical Office doesn't contain any detailed figures, just highlighting that almost all of the subsectors performed well.

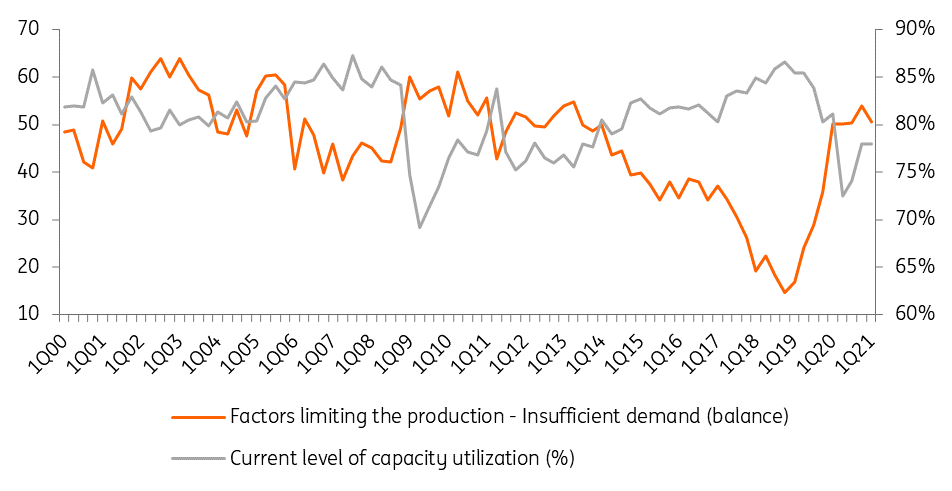

As for car manufacturing, the statement points out that it is still showing a drop on a yearly basis. This means that car producers couldn’t fully work out the supply side related disadvantages just in one month. This is also reflected in the current level of capacity utilisation, which remained flat in 1Q21 compared to the last quarter. This probably contains a significant drop in January and a rebound in February-March.

Capacity utilisation and factors limiting the production

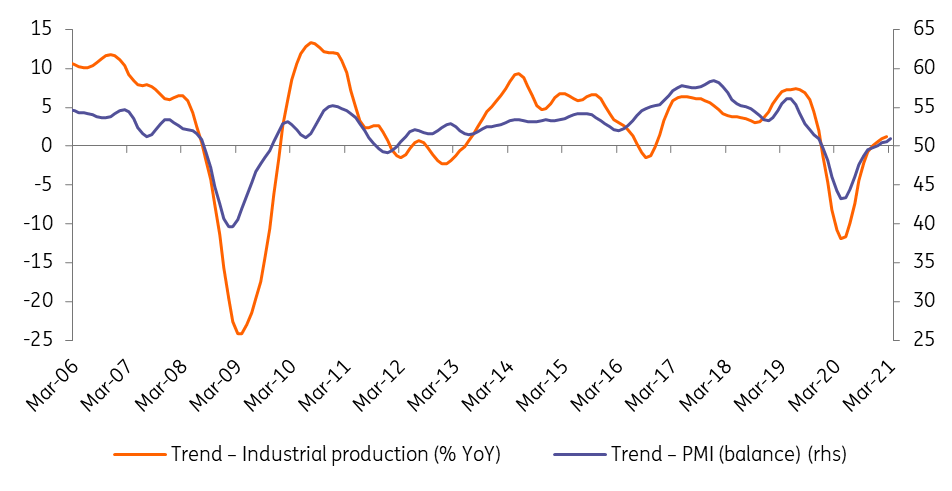

Looking forward, March probably was challenging for the manufacturers. Besides the still present supply-side issues, the Ever Given fiasco in the Suez Canal might also impact local parts of the global supply chains. On top of all that, the full lockdown from March due to the third wave of Covid-19 could cause labour issues as schools and kindergartens are closed (and won’t open until mid-April at the earliest). The second quarter is expected to bring a huge jump because of base effects and the PMI trend is also pointing north, suggesting further improvements in production.

Manufacturing PMI and industrial production trends

During the first two months of 2021, industrial production dropped by 2.3% YoY and March is expected to be rather weak, we can easily see industry being a drag on growth during the first quarter or be neutral at best. This means we are facing a shrinking GDP figure again on a quarterly basis in the first quarter of this year. Afterwards, we see industry being one of the main force behind the rebound in GDP.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap