A mixed economic picture in the Czech Republic

Industrial production fell by 2.6% YoY in February amid weak production of cars due to reduced semiconductor chip supplies. Retail sales fell by 3% YoY, but given the pandemic restrictions, this was not too bad a result

Industry affected by supply chains problems

Czech industrial production weakened in February, declining by 2% month-on-month, and by 2.6% year-on-year. The January decline was revised lower from -4.4 to -5% YoY, but January was impacted by a lower number of working days, so after that adjustment things were slightly more positive at 0.3% YoY (revised from 0.9% WDA YoY). The main reason behind the weaker figures was lower car production, which fell by -8% YoY in February (-9% YoY in January), as supply chain disruptions and missing chipsets are causing shutdowns. Still, new orders improved and increased by 7% YoY, mainly from abroad. All in all, weaker production comes on the back of supply-side problems which will very likely remain an issue in the months ahead.

Retail sales fell just slightly given Covid restrictions in February

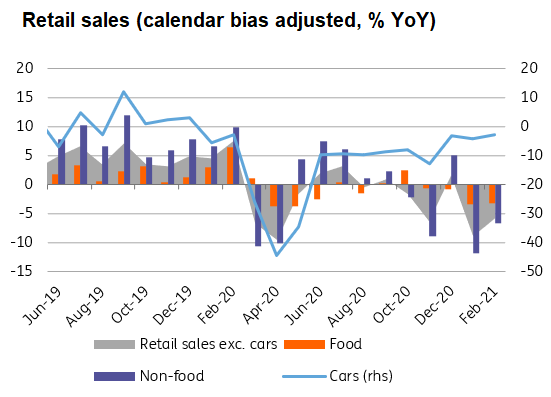

February retail sales (without cars) increased by 2.8% MoM; in YoY terms, it fell by 5.8%, but adjusting for the leap year 2020, the yearly fall reaches only 3% (food sales stagnating, non-food items sales falling by 4.6%). Internet sales accelerated by more than 40%, while sales in traditional shops fell by double digits (eg. footwear and clothes by 70%). Still, last February we saw a build-up of food stocks due to the arrival of Covid-19, therefore February had a relatively high base and given restrictions this year, the February retail numbers are relatively positive (the market expected YoY fall by 7.8%). Car sales fell by 3% YoY, which is also better than expected as new registration fell by 15% YoY in February.

Retail sales

March unemployment rate slightly lower

The share of unemployed people declined from 4.3% to 4.24% in March, which is the result of typical seasonality as some jobs restarted after the winter. In past years, however, seasonality was usually 0.2-0.3 percentage points between February and March, so we see only a negligible improvement this March given the Covid crisis. But unemployment remains below 2017 levels so that's still relatively low amid government supportive measures.

Share of unemployed people

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

Czech RepublicDownload

Download snap