Philippines: Imports expand after long slump but trade deficit stays modest

Philippine imports post first expansion in 21 months but this isn't a clear-cut sign of recovery just yet

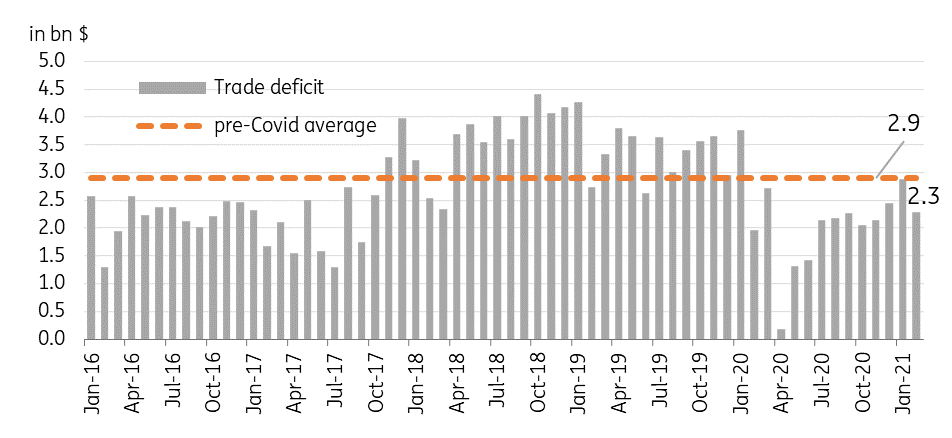

| -$2.3 bn |

Trade balance |

Exports unexpectedly slip but imports rebound after long slump

Philippine February trade data showed exports slip unexpectedly while imports managed to expand for the first time in 21 months. Exports dipped 2.3%YoY (vs +2.7% expectation) with meagre gains in the mainstay semiconductor sector (0.4%) unable to offset the 5.5% contraction for the rest of the export sector with shipments to ASEAN partners down for the month. Meanwhile, imports finally grew after an almost 2-year slump with most sectors expanding, led by raw materials imports (6.4%), capital goods (5.7%) and consumer imports (3.9%). The 2.7%YoY rebound in imports, however, might be more a result of base effects rather than a true recovery for the sector with the economy still stuck in recession amidst an ongoing 12-month lockdown with daily Covid-19 infections spiking in March. With exports down and imports expanding, the trade deficit remained modest at $2.3 bn, well below the pre-Covid 19 average of $2.9bn which has lent some support to the PHP since 2020.

Philippine trade deficit

Imports to sustain expansion but trade deficit to stay modest

Inbound shipments of goods and services will continue to expand in the coming months, benefiting from a favorable base and with manufacturers replenishing depleted inventories. But although we’ve seen growth in raw materials and capital goods, overall investment activity in the Philippines remains soft with corporates and households postponing expansion activities until the economic outlook improves. Meanwhile, exports may face some challenges in the near term with global trade expected to take a hit after select countries reinstate lockdowns to deal with spiking Covid-19 cases in their areas. Despite these trends, we expect the trade deficit to remain modest compared to pre-Covid-19 averages which should translate to a current account surplus and near-term support for the Peso.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap

8 April 2021

Good MornING Asia - 9 April 2021 This bundle contains 2 Articles