Hungarian inflation ends 2023 with a downside surprise

Rapid disinflation continued in December, with the fuel component stealing the show. Despite favourable domestic developments, external risks are rising, so we expect the central bank to maintain the previous 75bp pace of easing

| 5.5% |

Headline inflation (YoY)ING estimate 5.7% / Previous 7.9% |

| Lower than expected | |

Base effects combined with falling fuel prices stole the show

Inflation in Hungary continued to fall in December, with the Hungarian Central Statistical Office (HCSO) reporting better-than-expected data. Compared with November, headline inflation fell by 2.4ppt to 5.5%, which was the result of two factors: a high base from last year, combined with a decline in general price pressures. Although the year ended on a more positive note, 2023 will be remembered for extreme inflation, with the annual average reaching 17.6%.

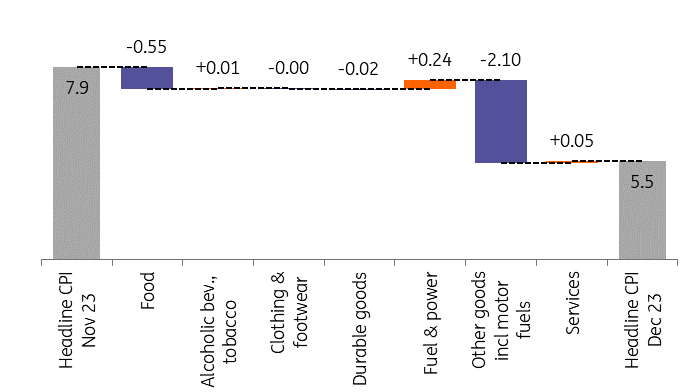

Similar to last month, the decoupling of headline and core readings has continued on a monthly basis. While headline inflation fell by 0.3% month-on-month, core inflation in fact increased by 0.2% MoM, signalling that the strong deceleration in the headline rate is mainly due to items which are not incorporated into the core basket. At the component level, we can highlight two main drivers: food and fuel prices, which were the main contributors to the slowdown from November to December.

Main drivers of the change in headline CPI (%)

The details

- In line with regional developments, food prices decreased by 0.1% MoM, which together with last year’s high base brought the annual food inflation rate below 5%. Compared to November, the decrease in prices of processed food was stronger than the decrease in prices of unprocessed food.

- Fuel prices dropped by 5% MoM, in line with falling global oil prices. This, combined with large base effects, pulled inflation down significantly. The story is that a year earlier the fuel price cap was lifted, which led to huge price increases. However, a year later, the unit price of fuel was already lower than the market price in December 2022.

- Deflation in durable goods inflation continued, with prices for durable goods down 1% year-on-year in December, helped by yet another negative monthly reading. This can be explained by the relative strength in the forint, which has appreciated significantly since the turmoil of last year. Plus, the easing of external inflation helps, too.

- Services prices rose by 0.6% MoM, which is the highest monthly reading since July. It is likely that a significant proportion of service providers have responded by raising prices to the 10-15% minimum wage increase (which was brought forward by one month to December) and other impending cost increases (e.g. excise duty hike on fuel prices, rising road tolls).

The composition of headline inflation (ppt)

Disinflation was broad-based, mainly driven by non-core elements

This time in December, the main factors behind the slowdown were non-core items, like fuel and unprocessed food prices, while the decrease in processed food prices also contributed. However, with services prices up 0.6% MoM and the annual rate still above 12%, the picture for core inflation is a little less rosy. We suspect that the impending cost increases were the main reason for the higher-than-usual monthly repricing. Nevertheless, we will have more information on the dynamics of services prices in light of the January inflation report, which will be crucial in assessing whether or not there has been a second round of price increases (due to the minimum wage increase). The latest retail price expectations suggest that underlying dynamics of repricing could continue at a relatively strong pace in early 2024.

The correlation between retail price expectations and core inflation

On a positive note, core inflation decelerated to 7.6% YoY in December, while short-term dynamics are encouraging, as core inflation on a three-month on three-month basis was below 3%. At the same time, the National Bank of Hungary's measure of inflation for sticky prices also decreased, displaying a reading of less than 8.7% YoY.

Headline and underlying inflation measures (% YoY)

Inflation could fall within the central bank’s tolerance band in January

Based on the latest data, we conclude that inflation could slow further in early 2024, and ING's latest forecast suggests that it could fall below the upper band of the central bank's 4% inflation target tolerance band as early as January. But this will be more a result of base effects than the lack of underlying price dynamics.

However, it would be premature to declare victory as positive base effects will soon run out. As a result, we expect inflation to rise again in the second half of this year. While inflation could average a tad below 4% in the first half of the year, it could be around 5% in the second half of 2024 and around 6% at the end of this year.

We expect the central bank to remain cautious as external risks rise

Although favourable domestic developments via lower-than-expected inflation readings could pave the way for the central bank to cut interest rates at a faster pace, new inflation risks have emerged in the form of rising shipping costs. Several shipping companies have already suspended shipments on the Red Sea routes due to the ongoing Houthi attacks.

Container freight benchmark rate per 40 foot box (USD)

The result of trade diversion is reduced transport capacity, longer transit times by sea and a dramatic increase in shipping costs. In this regard, we have already seen shipping costs increase by up to 120% on average in the main routes in late December and early January. The Shanghai-Rotterdam route has been hit the hardest (276%), posing serious risks to supply chains and the inflation outlook, especially in Europe. This could soon be reflected in producer prices and, of course, in consumer prices as well.

The impact of the Red Sea conflict on supply chains is already being felt in Europe, with Tesla announcing that it is suspending most car production at its Berlin factory. In addition, a conflict in Taiwan cannot be ruled out, which could pose an additional inflation risk. Moreover, the coordinated US and UK airstrikes against the Houthis in Yemen overnight have once again pushed up global oil prices. Adding to the tension is the fact that Iran has also seized an oil tanker in the Gulf of Oman.

In our view, all these global developments have increased external risks and therefore warrant caution, which is why we expect the National Bank of Hungary to maintain the previous pace of 75bp of easing at the January meeting.

Download

Download snap