50 years after the May 1968 protests, the French are marching again

This time it is a limited protest against a double reform of public services. At the same time, consumer optimism remains low despite the recovery in the jobs market. This casts doubts on the expected private consumption rebound

| 100.4 |

Average consumer confidence in 1Q18, the lowest since 2Q17 |

Upbeat about the labour market, consumers still refrain from spending as they fear for their financial situation

Exactly 50 years after the May 1968 protests, part of the French population is marching in the streets again. 50 years ago it was to ask reforms. Today, it seems that it is mainly those who last year did not vote for Mr Macron’s reform agenda who are marching. The protests were mainly triggered by national railways employees whose special status (in terms of pension rights notably) are put into question by reforms currently discussed by the government. They are joined by other public servants who have been enduring wage moderation since 2010 and fear that more is to come in the government’s “Public Action 2020” plan in the making. Unless these movements increase in numbers, they are unlikely to succeed as general public support is generally low and is likely to decline further during the railway strikes scheduled for the long weekends in May.

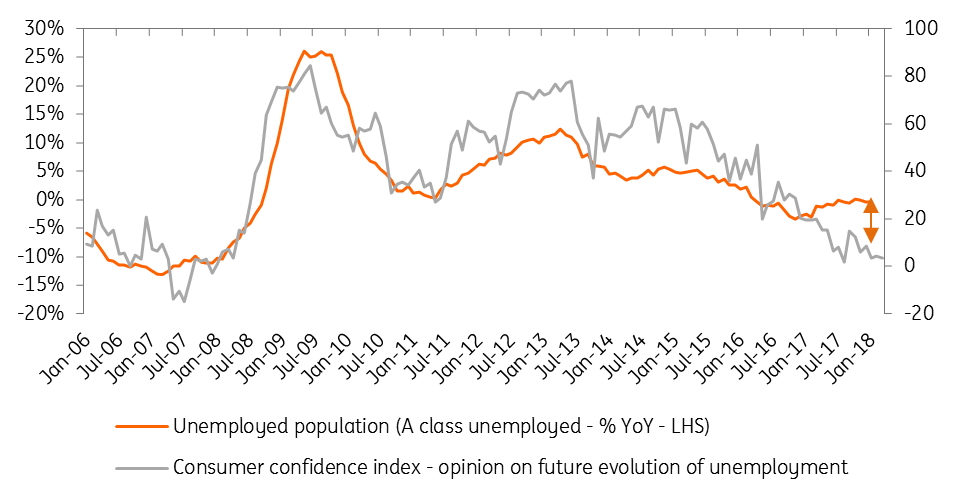

Still, it seems that the French are worried. The last consumer confidence figures show only a slight rebound in March, to 100.2, lowering the first quarter average to 100.4, its lowest level since 2Q17. It seems that the job market is not really the main concern: in fact, French consumers are still upbeat about the economic recovery. However, they fear for their own financial situation, and this affects their purchasing intentions, which have been declining since December. The trend is surprising as the 2018 budget was scheduling several positive tax measures for their budget. One could see an effect of the monthly tax payments that will be put in place in 2019. However, 70% of the French are already opting for a monthly payment, so it is hard to see a concrete impact beyond the psychological change that it implies.

If it remains unexplained, this trend could nevertheless impact growth as private consumption was already fairly aenemic in 4Q17, at 0.2% QoQ. Given the current levels of consumer confidence, it is hard to count on a strong acceleration. We still believe that private consumption growth could reach 1.8% this year after only 1.3% in 2017, but this will require a rebound in confidence. Although labour market and fiscal conditions are improving for French households, it seems that French consumers are still to be convinced.

Consumers remain upbeat about the labour market

Download

Download snap