Switzerland: KOF barometer brings down hopes of further growth acceleration

The decline in the KOF barometer mainly came from the more pessimistic view in the metal sector and given that Switzerland is a small open economy, President Trump’s protectionist policies could have a serious impact

Protectionist policies are bringing the barometer down

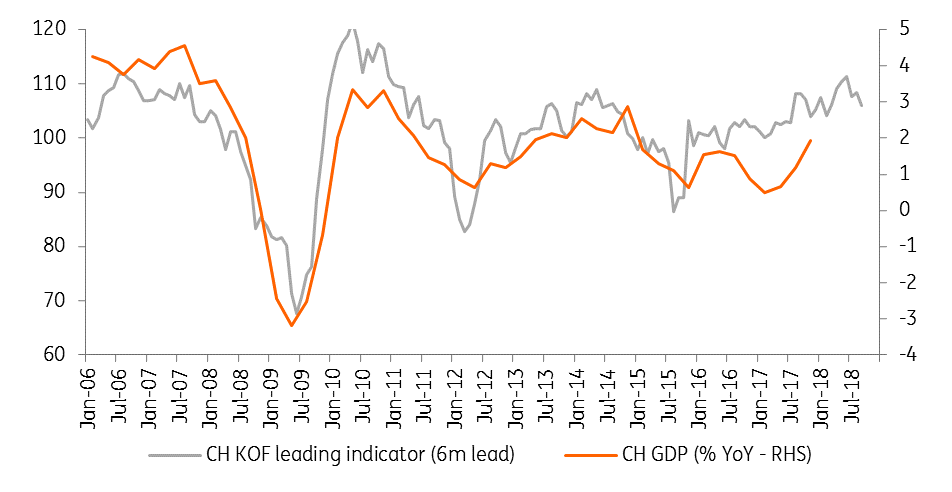

The KOF Economic barometer, the leading indicator of the Swiss economy, fell more than expected in March, to 106.0 from 108.4 in February. The indicator reached its peak in 4Q17 but in March below its 2017 average of 107, limiting the possibility of growth acceleration after the first quarter

The decline mainly came from the manufacturing industry, especially the export sector and more specifically the metal sector, where the overall business situation was assessed more pessimistically than in February

Given that Switzerland is a small open economy and net exports contributed positively to growth in 4Q17, this pessimistic view is probably due to US President Donald Trump’s protectionist policies. Contrary to the EU, Switzerland is not exempt from the new 25% tariffs for steel and 10% for aluminium.

KOF leading indicator and GDP

Still strong growth outlook for 2018

After slow GDP growth (1.1%) in 2017 with a buoyant second half, Switzerland started 2018 on a strong footing. If the pessimism subsides, we believe the Swiss economy should grow by 2.1% in 2018.

Swiss national accounting recently started to reveal the effects on GDP of large sporting events, such as international soccer competitions and the Olympic Games. They result in the sale of TV rights and increase the revenues of entities (like the FIFA and IOC) domiciled in Switzerland. This kind of events gave a short-term boost to GDP growth each time they occurred. In 2018. The effect is estimated by the KOF institute to add 0.3 pp to GDP growth.

| 2.1% |

2018 ING’s growth forecast for the Swiss economy |

Bottom line

For the second half of 2018, we expect the Swiss Franc (CHF) to further depreciate against the EUR which is likely to increase the profitability of export-led companies, especially as we expect the Eurozone to continue to post strong growth figures in the second half of 2018. However, protectionist policies could seriously harm their performance too.

In this context, we don’t expect the Swiss National Bank to hike interest rates before the ECB does so, which in our view would not happen before the second half of 2019. All in all, we expect a strong first half of 2018 and a somewhat slower growth rate in the second half. Inflation should stay low and well below the SNB target at about 0.8% in 2018.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

SwitzerlandDownload

Download snap