Czech GDP as expected in 1Q but risks abound

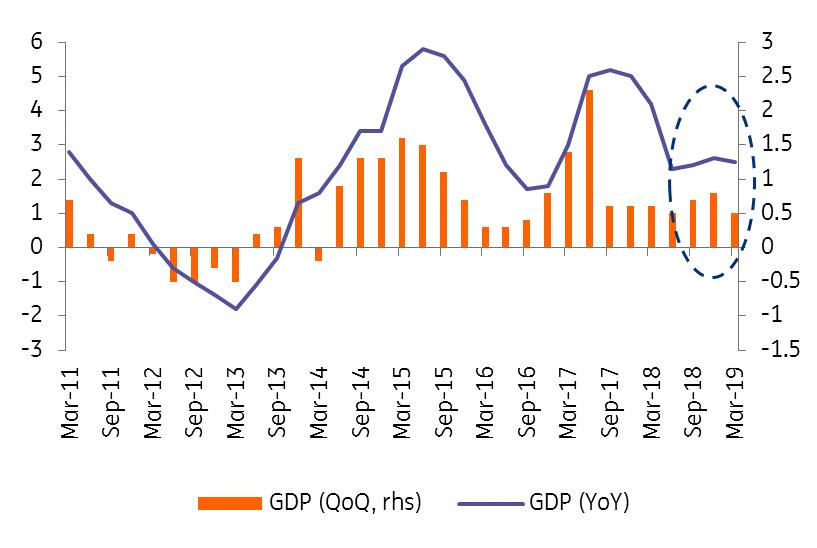

The first estimate of Czech economic growth in 1Q19 came at 2.5%, broadly in line with expectations. After almost 3% growth last year, the Czech economy will likely decelerate towards 2.5% this year amid weaker foreign demand

Broad-based growth

The preliminary estimate does not yet specify the breakdown of GDP, the Czech Statistical Office (CZSO) simply says: External demand and household consumption were the main GDP growth factors in Q1. Dynamic growth of gross fixed capital formation continued. Manufacturing contributed the most to the gross value added formation; after a year, it has thus become again the dominant growth factor of the domestic economy. Most of the economic activities of services as well as construction continued to be successful.

More information will have to wait until the end of May when the CZSO publishes a more detailed GDP structure.

Surprisingly positive contribution of industry

Given the above-mentioned comments we know that growth in the domestic economy was driven mainly by household consumption and solid investment activity in the first quarter of this year. Already-released data confirms that services and construction performed quite well at the beginning of the year, as the CZSO said. Still, a strong contribution from the manufacturing segment- as mentioned by the CZSO- is surprising, because according to previously published monthly figures, the manufacturing industry declined by almost 1% in quarterly terms and its annual growth stagnated in 1Q. As such, a change of inventories and/or intermediate consumption had to play an important role in the Gross Value Added calculation in 1Q19. This doesn't mean that industry is not slowing down and external demand remains a concern.

Czech GDP growth (%)

Czech economy will decelerate this year

This year, the domestic economy should continue to slow slightly, with consensus expectations moving to around 2.5%. However, at the moment, the risks are skewed in the direction of weaker growth, mainly due to slowing industrial production and external demand. Another risk is the escalation of trade wars and the slowdown in the Chinese economy. Although it is a less important destination for direct domestic exports (around 1% of total Czech exports), it is one of Germany's largest export destinations and, indirectly, it is also essential for the domestic economy.

Positive message from the GDP data so far

An acceleration in the German economy in the first quarter of this year, by 0.4% quarter-on-quarter, is certainly positive, as the Czech Republic's most important trading partner was on the edge of recession at the end of last year. According to preliminary data, GDP growth in Germany, as in the Czech Republic, was driven by favourable household consumption. However, industry is still lagging behind and the growth of the German economy in the first quarter can thus be interpreted as a sign of stabilisation rather than a significant improvement. In general, however, given the less favourable signals from abroad, GDP figures in the first quarter of this year from the domestic economy can be interpreted in a positive way.

Download

Download snap