Hungary: GDP growth feels like it’s 2000 again

Hungary's 1Q GDP growth hit a 19-year high but it could have been even better. The National Bank of Hungary faces a major overhaul in its forecast

| 5.3% |

Real GDP growth (YoY)Consensus (5.1%) / Previous (5.1%) |

| Better than expected | |

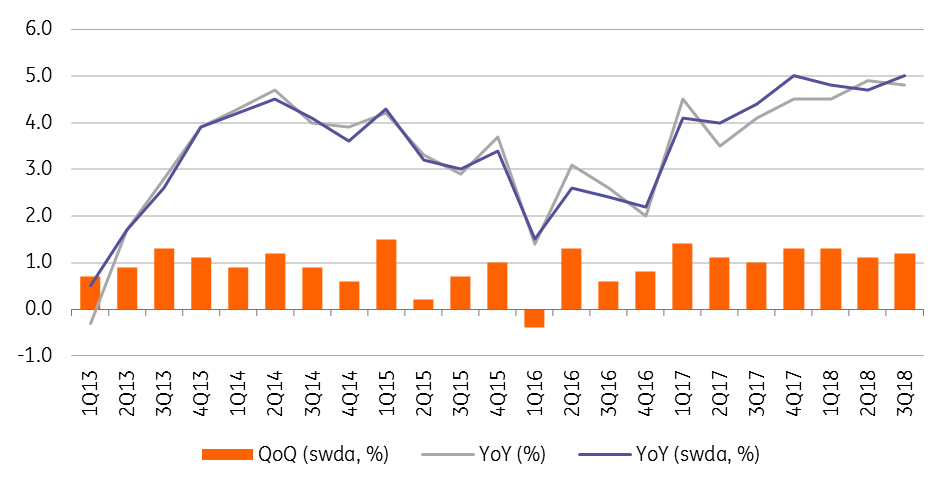

Hungary's GDP increased by 5.3% year-on-year in 1Q19, the second highest growth rate ever, according to the preliminary release of the Hungarian Central Statistical Office (HCSO). Yes, the measure outperformed market expectations but it could have been even better, taking into consideration the high frequency data in industry, construction and retail sales. That said, it was higher than the consensuis and still something to cheer about. More importantly, 1Q19 GDP growth was 1.1 percentage point higher than the NBH's forecast of 4.2% YoY. The NBH now faces a significant overhaul in June when it releases its new economic outlook (Inflation Report).

As the preliminary data release does not contain an exact breakdown of GDP, we have to rely on the HCSO’s commentary and our own estimates to explain what drove the strong result. The main contributors to growth were industrial production, construction and market services. The strong performance of construction was mainly due to government and EU funded projects, complemented by the housing boom and investments by manufacturers. Market services could soar on the back of rising employment and continued high real wage growth. Industrial production could accelerate despite problems in the eurozone, new emissions standards and the Audi strike in January.

Looking forward, we expect Hungary to remain one of the better performing economies in Europe despite GDP growth smoothly and gradually decelerating throughout the year, reaching a 4.3% YoY rate on average in 2019. The slowdown is expected to arise from the unfavourable external environment, i.e. weak eurozone economies, the trade war and uncertainty around Brexit. Prevalent capacity constraints, labour shortages and a higher base from last year could also prevent the economy from maintaining its current pace of growth.

Still, our forecast looks quite optimistic compared to the latest NBH forecast in March, which predicted 3.8% YoY growth in 2019 as a whole. Despite both GDP and CPI data coming in higher than the NBH expected in its base case, we see hardly any change in its stance. We expect the central bank to stick to its 'one-and-done' approach, meaning a one-off hike in June without any pre-commitment.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap