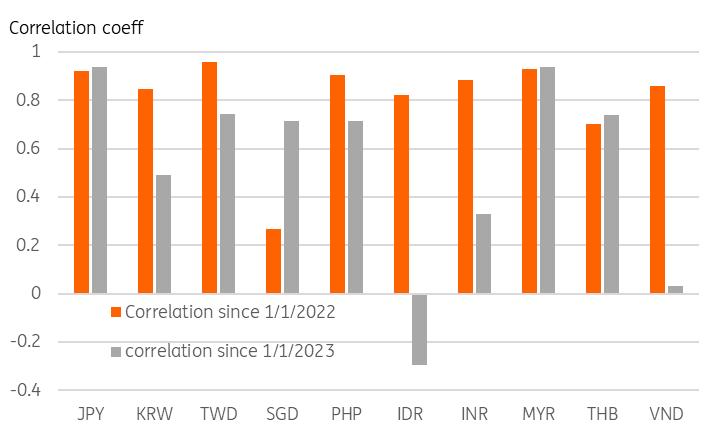

Correlations with China’s yuan are weakening in Asia

The Chinese yuan still exhibits a strong gravitational pull on other Asian currencies, but it is not as strong this year as it has been

Gravity model of FX

There is such a thing as the "gravity model of foreign trade", and if you are interested, the following Wiki link will tell you as much as you probably want to know.

As far as I am aware, there is no such thing as the "gravity model of FX", though I find it is a useful analogy for thinking about currencies in the Asia-Pacific region. Maybe I can try to popularise it...

If you use the analogy of the solar system to think about currencies, then the US dollar is clearly the sun, around which all other currencies revolve. But there are patches of space where other large celestial bodies, further away from the sun can have a significant influence, and here in the APAC region, the CNY is clearly that currency. Think of it as the gas-giant Jupiter if you want.

Much of the time, it is the ebb and flow of the USD that drives exchange rates in the region, and cross rates remain fairly steady. That isn't happening now, and the reason for this lies in the CNY.

Asian FX correlations with the CNY

One of these currencies is doing its own thing

Right now, China is bucking the global trend and cutting, not raising rates, reflecting what is a very mediocre and rather disappointing reopening following zero-Covid. We have written about this in a couple of notes recently which you can access here, and here. And one of the upshots of this is that the CNY has been weakening, with the People's Bank of China (PBoC) seemingly quite tolerant of such weakness with all policy levers being considered to help offset the economy's weakness.

Furthermore, what we see is that the gravitational pull - as described by the correlation coefficient - of the CNY is dragging down some local currencies with it, though the strength of this pull is weaker than in the past. This tends to confirm that what is happening to the CNY right now is more than just a generalised bout of USD strength taking all currencies along for the ride, but something more unique to China.

Two currencies do remain tightly bound to the Chinese yuan, namely the Japanese yen and the Malaysian Ringgit. Both are historically at the higher end of correlations, reflecting strong trade links and perhaps as a result, these two currencies remain in a tight orbit to the CNY.

Elsewhere, the links are very much weaker, or in the case of the Indonesian rupiah, actually negative. The IDR has benefited from a solid inflation-fighting period by Bank Indonesia (BI), a sustained current account surplus and an improved growth outlook, helped in part by its strong commodity endowments that mean it should benefit from the global energy transition and demand for electric vehicle batteries, which is becoming a new source of growth.

The correlation of the Vietnamese dong is also close to zero so far this year. The VND, however, is a heavily managed currency unit and has shown no signs of following the CNY during its recent slide. That is simply a local policy decision. And at some point, it may re-set.

Perhaps more surprisingly, the Taiwan dollar also seems to be shaking off any CNY influence and has been notably less responsive to movements in the CNY than past history would suggest. This may be due to portfolio inflows into Taiwan's stock market, as investors seem keen to buy almost any stock with even a vague hint of AI or semiconductors in their business description right now. Taiwan's stock market is up almost 22% year-to-date as a result, while China's CSI 300 is virtually flat in local currency terms, and down 4.1% in USD terms.

Looking ahead

At some stage, there is a chance that the Chinese government will come out with a broader package of support measures than it has done so far, and that will likely see the CNY rally. That said, we aren't looking for a bazooka from the authorities, more of a shot-gun approach of smaller measures, and believe that any uplift may be short-lived.

One-way traffic in the currency is not something the PBoC will want to see either, but we don't believe they will be totally averse to seeing the CNY weaken further if it does so in a controlled fashion, especially as we doubt that they are done with cutting rates just yet. Market forecasters are toying with near-term targets of USD/CNY 7.30 which looks plausible and in line with the 2022 highs. 7.40 would take the CNY into territory that it has not visited since 2007 and seems a step too far at this juncture, though not something we would rule out.

But even 7.30 could drag other Asian FX with it, with the JPY and MYR likely tracking the CNY most closely (subject to any JPY support that may follow a tweak to their yield curve control policy, which we think could happen in July) while the IDR (and even India's rupee) may partly shrug off any such move.

Download

Download snap