Chinese May Metals Trade: Aluminium exports rise, Copper stays robust

China registered a robust month for total imports and exports indicating good manufacturing demand and positive demand overseas. In metals, we note the pick-up of aluminium semi exports and continually strong copper figures

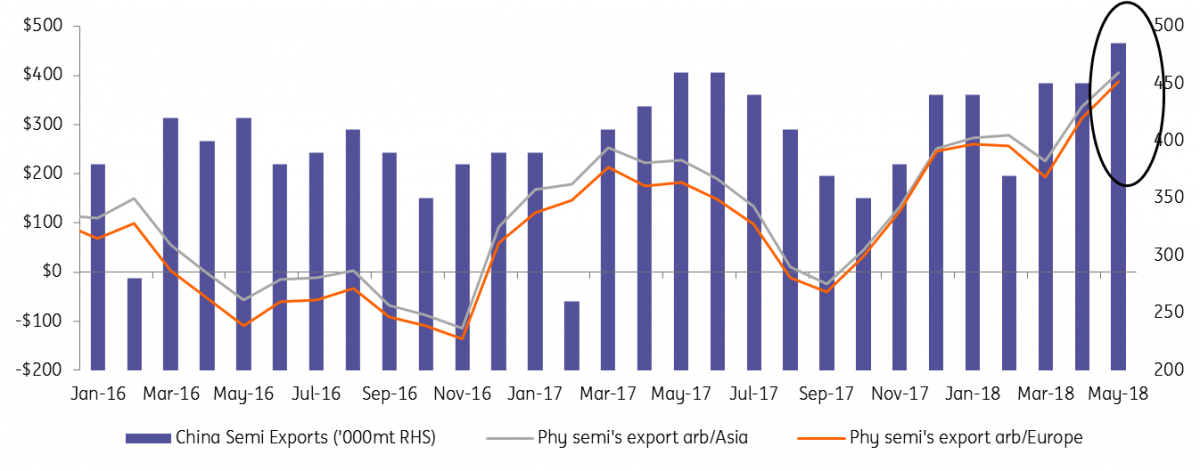

Chinese Aluminum semi exports rise with open arbitrage

Aluminium semi-fabricated aluminium exports totalled 480kt in May, the largest since 2014 as the wide arbitrage between LME and Shanghai incentivised exports. The market was fairly surprised to see that the April figures did not register such an increase but as we wrote back then, there was likely to be a lag in the increase. May's figures are up by 35kt month-on-month, which is all the more impressive considering the effect of trade tariffs (last year China exported c.40kt per month to the US). We calculate the arbitrage for exporting the aluminium products through May averaged more than $400 for exports to Asia and $380 for Europe.

Failing the lifting of Rusal sanctions (commentary seems to suggest this could happen in July/August), we expect the arbitrage to remain open and continue increasing Chinese semi exports. While semis get a 15% VAT rebate, primary metal carries an additional 17% export tax. After becoming closed amid the initial Rusal panic, the primary metal arbitrage remains closed and is unlikely to be incentivised to open unless Rusal sanctions roll on past the 23 October deadline for consumers to wind down offtakes.

Higher exports of aluminium semis are expected to prevent aluminium prices breaking much higher until the 4Q18 Rusal deadline approaches. China's aluminium semi flows depress LME markets by cannibalising would-be demand for primary metal.

China Aluminium semi exports and arbitrage

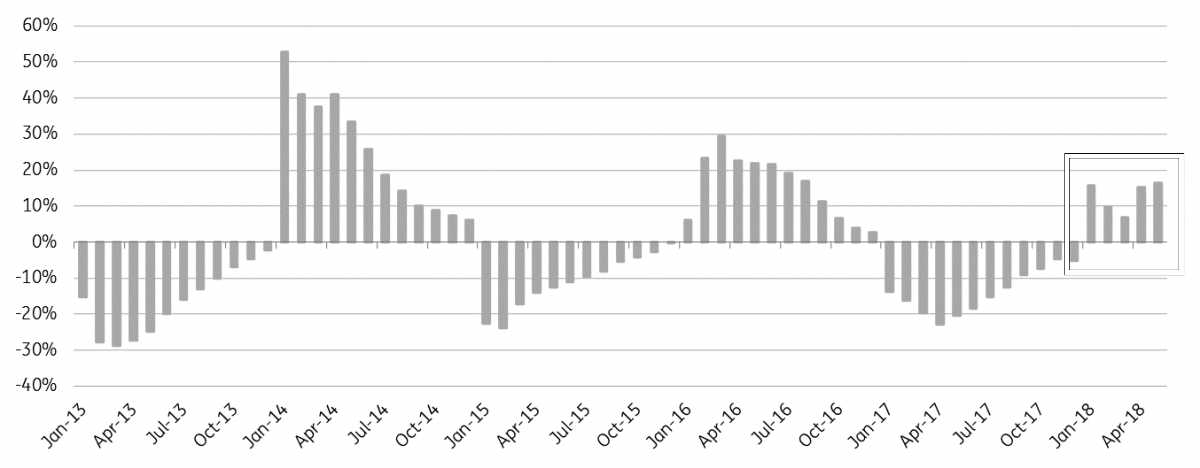

Copper import figures stay strong

China’s total copper imports (wrought and unwrought) are up a solid 17% year-on-year for January to March. We expect the commodity grade cathodes are up by about the same (+215kt on January-May last year) which goes some way to explain the c.100kt draw from LME stocks year-to-date. Given the arbitrage window for copper imports is closed and domestic stocks remain elevated (Shanghai stocks are up 30% YoY), we think these flows may be running ahead of actual demand and contributing to a build up of stocks, rather than alleviating any genuine tightness. The drop in the Chinese import premium (SMM reports down $5 through May to $76.50/mt) would seem to support this view.

Raw materials (ores and concentrates) also continue to hold onto strong gains. Year-to-date imports are up 9.8%, which is fuelling increasing production as China’s growing smelting capacity base bids for more feed. Smelter TC/RCs (treatment and refining charges) increased by about $10/mt through May pointing to easing supplies and higher profitability for the smelters. We also expect concentrate previously sent to Vedanta's 400ktpa Tuticorin smelter will be made available to the Chinese market.

China Copper imports back to positive growth in 2018 (YTD total copper imports, %YoY)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap