Hungary: Inflation close to target

Headline CPI increased more than expected mainly due to rising fuel prices. But core inflation remained flat, and we don't expect any action by the central bank

| 2.8% |

Inflation (YoY)Consensus (2.7%) / Previous (2.3%) |

| Higher than expected | |

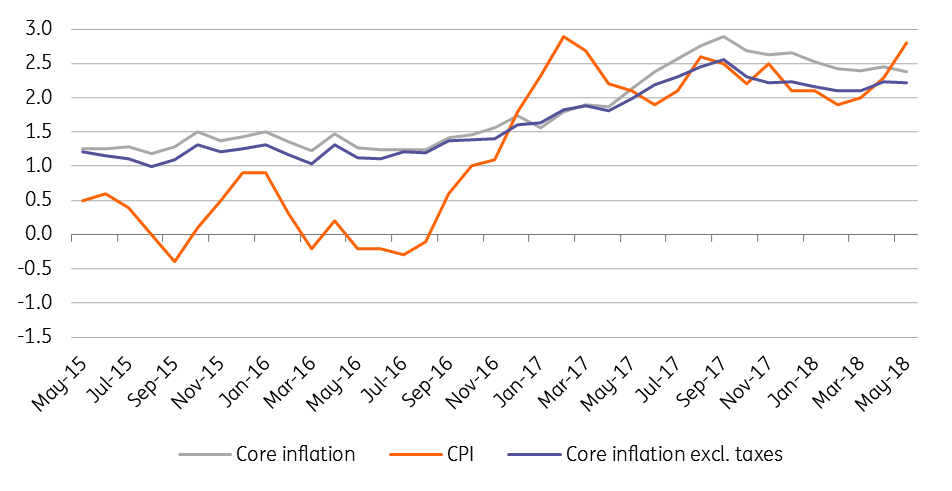

Headline inflation came in at 2.8% year on year in May, posting a 0.5ppt acceleration compared to the previous month's data. This is the first time since Feb-17, that the headline inflation rate came close to the Hungarian National Bank's (NBH) 3% inflation target. Before this date, we have to go back to 2013 to see higher CPI figures. Still, the recent uptick in inflation has been purely due to items outside of the core inflation basket. Core inflation remained unchanged at 2.4% year on year. As such, we think the NBH is unlikely to see the current acceleration as permanent and we don’t expect any change in monetary policy.

Headline and core inflation measures (% YoY)

In line with expectations, the main driver behind the acceleration was the 9.5% YoY increase in fuel prices, up from 2.1% YoY compared to April data. In practice, this alone explains the 0.5ppt acceleration in the headline indicator. Food, alcoholic beverages and tobacco prices slowed down but have remained above average. In contrast, we saw a further drop in prices of durable goods. Despite the 1.7% YoY inflation in services (an eight-month high) we still can’t consider this a serious price pressure.

CPI by main groups in May

Orange signs point to an acceleration while grey signs signify a slowdown in inflation compared to the previous month. Orange in grey border means the level is unchanged.

We believe inflation could reach or even overshoot the NBH target in June, though the degree largely depends on global oil prices and weakness in the Hungarian forint. As prices slow, mainly due to base effects in the second half, we see inflation coming in at 2.6% YoY in 2018 as a whole.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap