Taiwan: Trade growth stronger in May but fundamentals weak

Taiwan's export and import growth look good because of the low base last year but the data confirm our view that the economy isn't particularly strong

With a low base last year, export and import growth rates look good, at 14.2% year on year and 12% YoY respectively, up from 10% YoY and 4.9% YoY.

But China continues to be essential to Taiwanese trade even following the set up of big Taiwanese handset factories in the US. Mainland China, together with Hong Kong, is the biggest trading partner of Taiwan, accounting for around 38% of total exports. Exports to China and Hong Kong grew by 19.3% YoY, beating Taiwan's export growth to the US at 13.5% YoY.

Taiwan export destinations, 12-month rolling

Looking forward, trade prospects dim

But the low base technical effect won't last. From June to September, there will be high base effects, so even if the global trade environment remains the same, Taiwan export growth prospects will dim over the coming months.

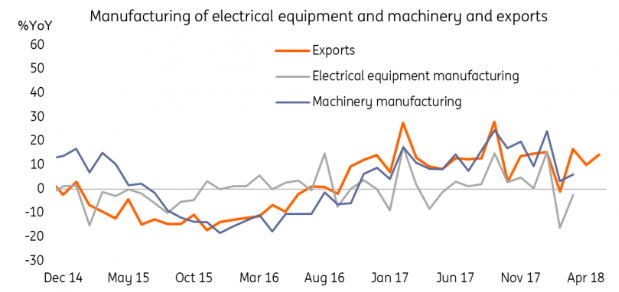

An additional factor is that more Mainland Chinese tech companies are under US investigation for "national security" reasons, which seems to be delaying the growth of the whole technology industry and this, in turn, lowers demand for electronic goods - the biggest item of Taiwanese trade.

This suggests that Taiwan's trade growth will slow over coming months.

Forecast USD/TWD at 30.0 by end of 1H18

Today's data confirms our view that Taiwan's economy is not particularly strong.

Given the strong dollar and political uncertainties in Europe, we expect USD/TWD to weaken to 30.0 by the end of 1H18.

We are reviewing our USD/TWD forecast for the end of 2018, which is currently 29.40.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap

8 June 2018

Good MornING Asia - 11 June, 2018 This bundle contains 4 Articles