Briefing Romania

Looking for a successful February 2025 auction

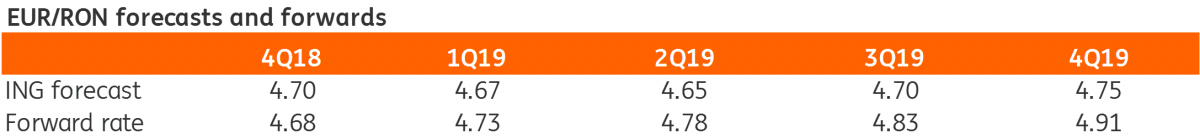

EUR/RON

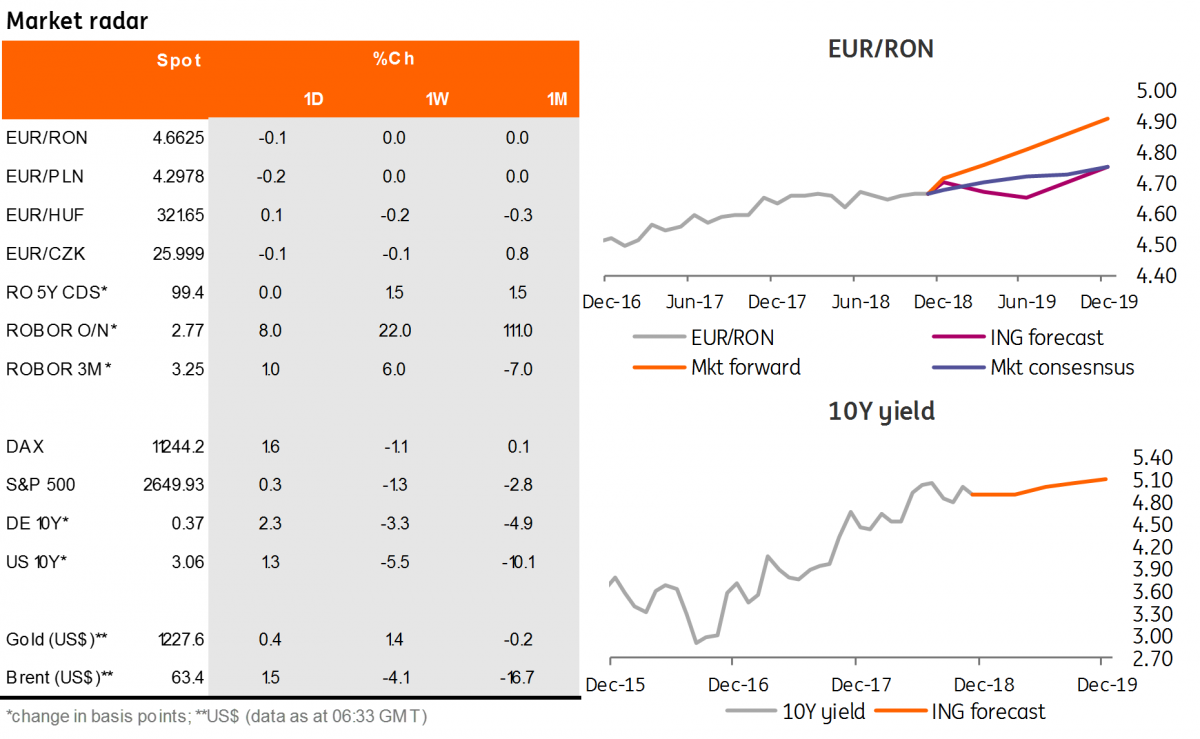

The spike in money market yields likely triggered some mild appreciation for the EUR/RON as the pair closed the day some 30 pips lower, around 4.6620. We see downside potential as fairly limited but a test below 4.6600 could occur, particularly if the central bank doesn't organise a repo on Monday.

Government bonds

The Ministry of Finance plans to sell RON300 million in February 2025 bonds. Given the small amount, we expect a good bid-to-cover ratio and cut-off yield around 4.60%. In general though, the market doesn’t appear to be following a clear trend right now. A budget revision is expected to be voted on, with the government sticking to its budget deficit target of 3.0% of GDP.

Money Market

The high volatility in front-end implied yields continues and will likely remain in place until banks get a clearer picture of their cash flows following budget payments. Hence, we could see rates covering the beginning of the next reserve period trading even higher than the current 4.20%.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap