The Commodities Feed

Your daily roundup of commodities news and ING views

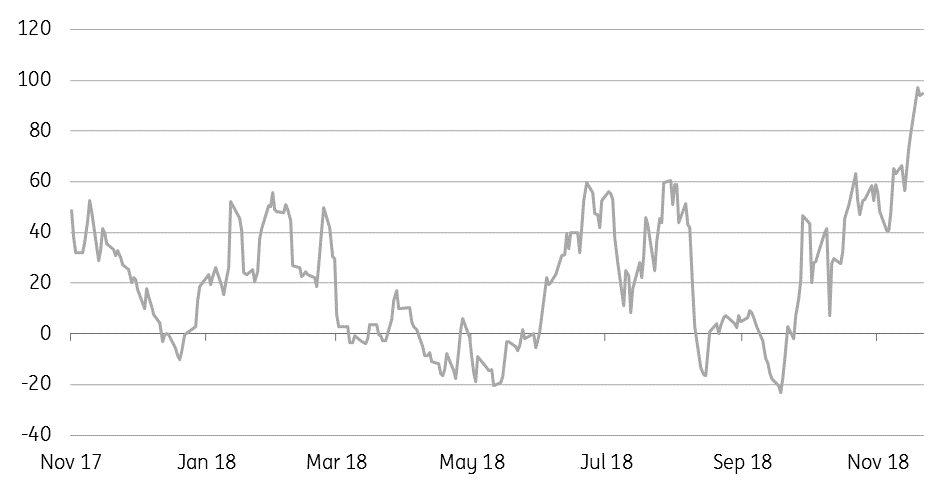

LME zinc cash/3m spread continues to strengthen (US$/t)

Energy

US crude oil inventories: The EIA has reported a larger than expected crude oil build over the last week, with inventories increasing by 4.85MMbbls, higher than the 3.45MMbbls the market was expecting, and very different to the 1.55MMbbls draw that the API reported the previous day. For a change, inventory numbers were a bit more constructive for gasoline and bearish for distillate fuel oil. Gasoline inventories declined by 1.3MMbbls, compared to expectations of a build, whilst distillate fuel oil saw a marginal draw of 77Mbbls, compared to expectations of a drawdown in excess of 2MMbbls. Refineries increased their run rates from 90.1% to 92.7% over the week, as refineries return from maintenance, a trend which is expected to continue in the coming weeks.

US natural gas storage: Due to Thanksgiving, the EIA also released its weekly gas inventory report yesterday, which was watched closely given the cold weather and volatility in prices that we have seen recently. The EIA reported that inventories in the country declined by 134Bcf- significantly more than the five-year average decline of 25Bcf, whilst it also exceeded market expectations of a 109Bcf draw. Moving ahead, the market will be nervous about any cold weather forecasts, with natural gas inventories almost 19% below the five-year average.

Metals

Copper stocks: LME copper stocks fell by 1,975 tonnes yesterday, taking total inventories to 143.3kt –stocks in LME exchange warehouses have fallen by c.37kt since 2 November. It is a similar trend with COMEX copper stocks, with 15.2kt of inventory being withdrawn since the start of the month. Meanwhile, physical copper premiums in the US are strengthening, reportedly standing at USc7.5/lb, up from USc7.25/lb in October. Global exchange copper stocks (including LME, COMEX and SHFE) now stand at more than a two-year low of 407kt. Increased refined copper imports from India (due to the closure of Vedanta’s 400kt pa Tuticorin smelter) and China continue to keep the physical market tight.

Zinc backwardation: Zinc cash contracts currently trade at a premium of US$94/t over the 3M forwards and have been as high as US$97/t earlier this week- the highest level in more than a decade. The physical spot market is clearly tight, with healthy demand for galvanizing metal, and exchange inventory levels near the five-year low. Moving forward though, with concentrate supply increasing, the refined balance should also start to become more comfortable over 2019.

Agriculture

Brazilian soybean cash values weaken: Cash values for Brazilian soybeans have continued to decline. After hitting a high of almost USc275/bu in October, values have fallen to below USc140/bu. Part of this weakness appears to reflect growing sentiment that the US and China could be moving towards a trade deal. The market will be watching developments at the G20 summit later this month very closely. Meanwhile, Bloomberg reports that the CME is looking at potentially launching a Brazilian soybean contract. Given the growing dominance of Brazil as a soybean supplier, such a move would make sense.

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

CommoditiesDownload

Download snap