Hungary: Budget worsens due to one-offs

The cash-flow based budget deficit deteriorated mainly due to one-offs including public sector wages and family allowances in October, while revenue from Brussels continue to increase

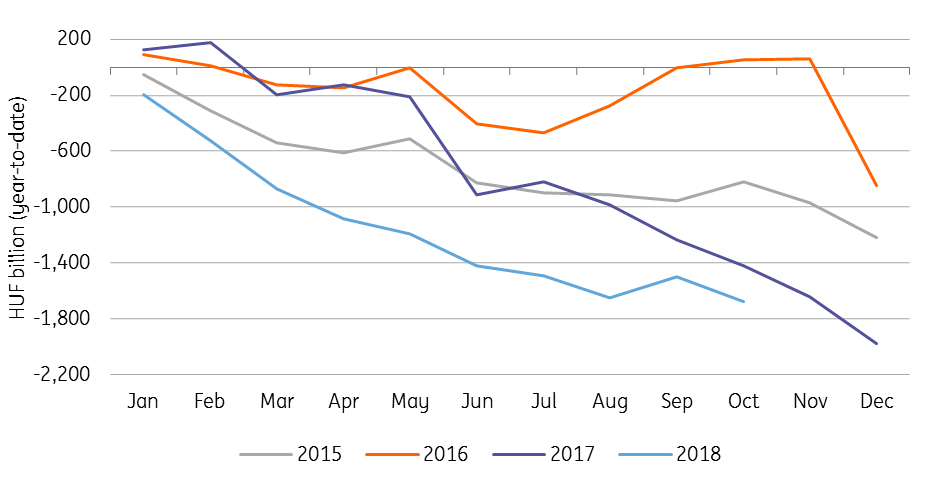

After last month’s improvement, the cash-flow based deficit returned to the deteriorating trend in October, posting a deficit of HUF 1,678 billion. On a monthly basis, the budget worsened by HUF 181.6bn, and if we compare it to the original target, the latest figures surpass it by 24%.

Cash-flow based year to date deficit

The details show the deterioration was mainly related to one-off disbursements and the continuation of pre-financed EU projects.

The government paid the public sector wages and the family allowances earlier than usual (in late October instead of early November) due to the four-day-long weekend at the start of November and are partly behind the HUF 130 billion deficit.

As for the EU projects, the government has continued to pre-finance them, although the exact amount is unknown as the government has stopped sharing information in the preliminary release.

What we do know is that HUF 131 billion of came from Brussels, translating into a total inflow of HUF 472 billion inflow in 2018 so far

Considering the inflow target by the government, it wants to see another HUF 500bn transferred before the remained of the year. The Ministry emphasised that revenues from Brussels “could rise significantly by year-end”.

Regarding the revenue side, the favourable underlying tendencies have remained with us. Compared to the same period last year, the robust labour market helped increase revenue from personal income and payroll taxes. Meanwhile, the even more significant household consumption led to higher VAT revenue. Looking forward, we do not see any factor to break the positive momentum.

Excluding the one-offs from the overall picture, the latest budget data was more or less in line with our expectations. As a larger amount of EU money might come in 4Q18, the pressure could weaken on the ÁKK to finance the government’s needs. Considering the strong economic activity and underlying budgetary situation, the 2.4% deficit-to-GDP target is still realistic.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap