BriefING Romania

EUR/RON testing 4.6700 again

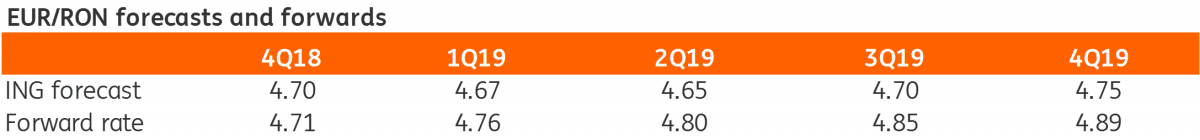

EUR/RON

The EUR/RON traded sideways around 4.6700 yesterday on below-average turnover. Early buying interest in EUR/RON, in line with regional currency pairs opening higher, suggest that we could see the scenario witnessed in the last few days repeating, with market attempts to break above 4.6700 meeting strong offers. The Romanian currency has outperformed regional peers so far this year and Romania is running trade deficits with most of its neighbours. Hence, a correction might be overdue. Still, the timing for a shift higher in the central bank (NBR) comfort range is difficult to call. Maybe, once inflation starts to fall on base effects into the year-end, the NBR could gradually become more flexible.

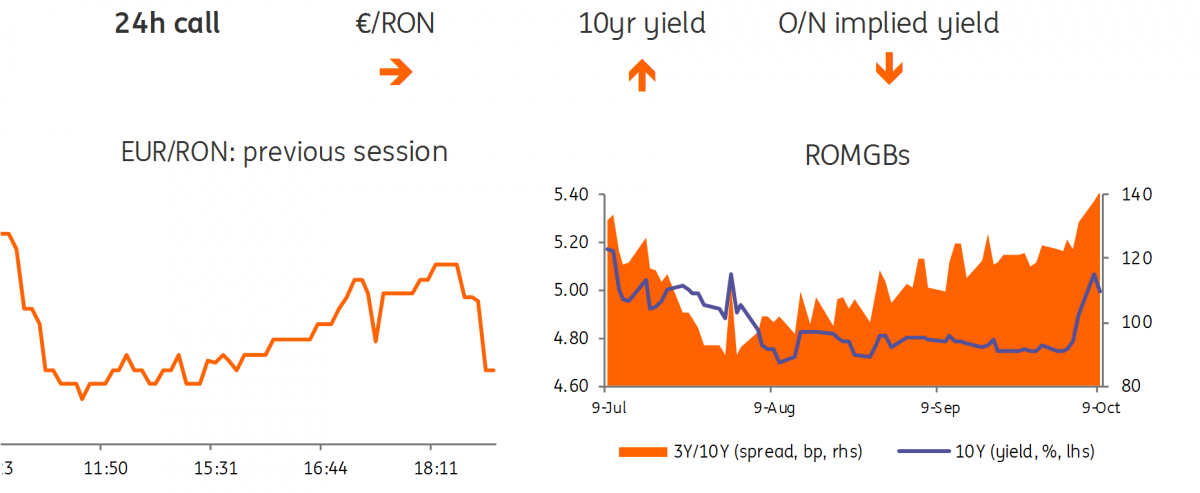

Government bonds

The ROMGBs sell-off continued yesterday with yields for papers around Jun-2023 bond auctioned by MinFin seeing the widest swings and closing c.20 basis points higher. MinFin sold RON600 million in Jun-2023 bonds, as planned, at an average/cut-off yield of 4.75%/4.79%, in line with the prevailing secondary market conditions. The auction met decent demand with the bid-to-cover ratio at 1.42x. The central bank announcement that it will not roll-over its repo injections amid market rates trading around the key rate level, likely created some concern among market players about higher carry rates, especially when this is considered in the context of depreciation pressures on the Romanian leu.

Money Market

The implied cash rates spiked c.50bps to around 3.00% after the NBR announcement that it will not roll-over its repo liquidity providing operation. Despite that the liquidity backdrop seemed comfortable, the lack of commitment from central bank on consistent open market operations and the price action in the FX market suggesting possible liquidity sterilisation by the NBR pushed the whole money market curve higher with maturities within the current reserve maintenance period seeing the sharpest rise in implied yields of c.60-70bps.