Hungary: Inflation hits five-year high

Headline CPI accelerated to 3.6% year-on-year amid higher unprocessed food, fuel and tobacco prices. As the core CPI has remained roughly stable, the central bank can still say its loose stance is justified

| 3.6% |

Headline inflation (YoY)Consensus (3.5%) / Previous (3.4%) |

| Higher than expected | |

Headline inflation came in at 3.6% YoY in September, in line with our forecast. The market was expecting an acceleration but not to this extent. Still, the reading didn't exactly catch the market off guard. While the headline reading is above the National Bank of Hungary's 3.5% forecast, we don’t see it as a game changer. The central bank emphasises that it wants to see inflation reach the target in a sustainable manner, which means as long as core inflation remains below the 3% target, it will consider its loose policy stance to be perfectly justified. Core inflation came in at 2.4% YoY in September.

Headline and core inflation measures (% YoY)

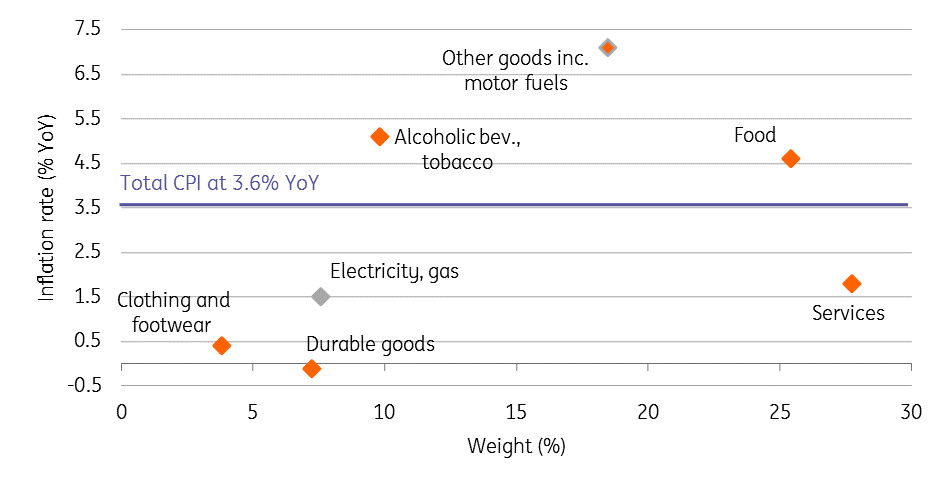

As we predicted, the main driver of the September headline CPI was the 14.9% year-on-year growth in fuel prices, showing a mild deceleration from the previous month due to base effects. Food prices – especially unprocessed ones like fruit and vegetables – increased an above-average 4.6% YoY. Imported inflation is still relatively low as prices of durables went down by 0.1% YoY. This was well counterbalanced by the marginal (0.1 percentage point) acceleration in service inflation to 1.8% YoY.

CPI by main groups in September

In 4Q18, we expect inflation to remain around recent levels, but the oil market presents huge uncertainty. Should oil prices stick to the 85 USD/barrel level, we see the base effect dragging down headline inflation to 3.3% YoY by year-end. If the increase in oil prices continues, Hungarian inflation will remain around 3.5%. In either of these scenarios, headline CPI will remain below 3% on average in 2018 as a whole. Our base case scenario is 2.8% YoY, while we forecast a jump to 3.3% on average in 2019.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap