Hungary: Industry’s roller coaster ride continues

Industrial production dropped on a monthly basis, and as the year-end holiday shutdown affected data, we expect an overall weak fourth-quarter performance

| 3.5% |

Industrial production (YoY wda)Previous (3.3%) |

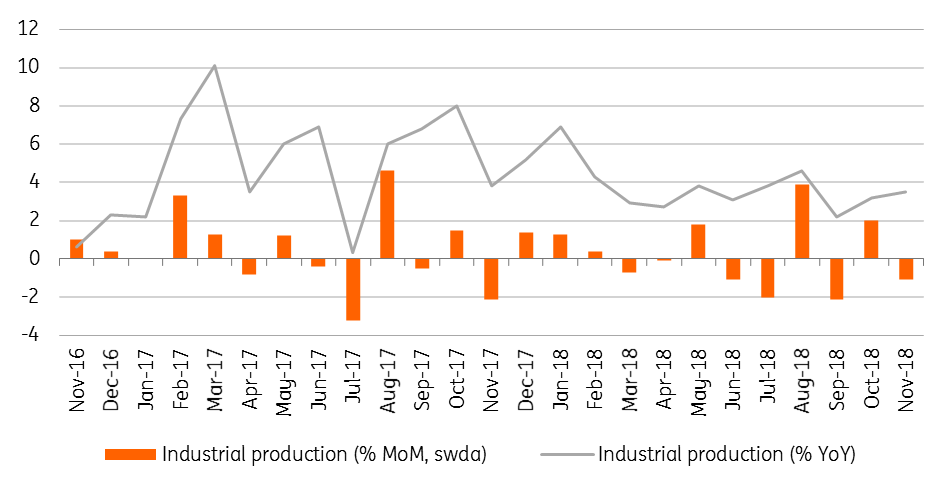

After rebounding in October, the volume of industrial production dropped again in November compared to the previous month, continuing its monthly roller coaster ride. Adjusted for calendar effects, production came in at a moderate 3.5% year-on-year, matching the average performance of January-November. Overall, the recent reading fits into the picture of a trend-like deceleration.

Performance of the Hungarian industry

The Statistical Office's commentary suggests that all of the main subsectors expanded on a yearly basis. However, it is quite clear that without a strong performance in any of the key subsectors (like car manufacturing, electronics and the food industry) an okay-ish expansion is not enough to provide strong overall industrial figures. Looking forward to December, the usual year-end shutdowns won’t help towards the overall 4Q performance, suggesting a weaker growth rate and thus a lower contribution to GDP growth. Our view is backed up by soft indicators, too.

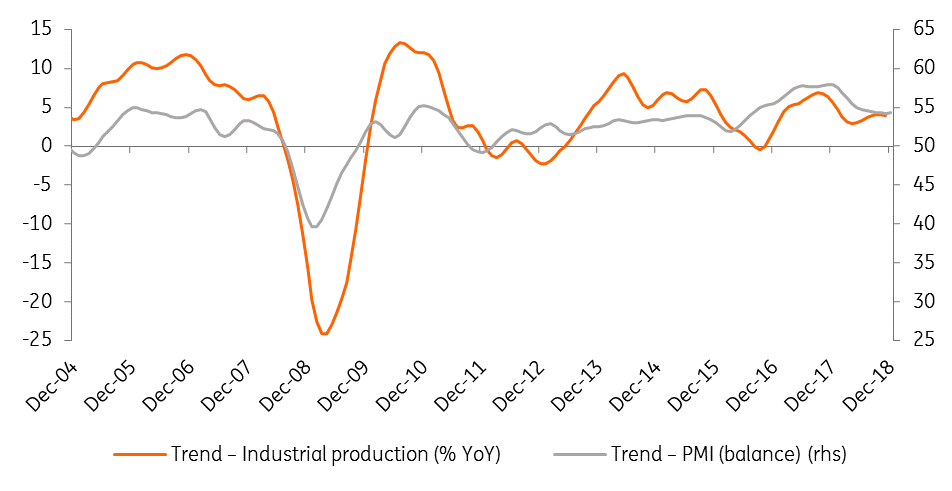

Manufacturing PMI and industrial production trends

We expect an average growth rate of 3.5% in industry in 2018, but the new year might bring slightly stronger performance with a growth rate of roughly 5% YoY on average on the back of newly built capacity. However, our forecast in 2019 is accompanied by downside risks mainly stemming from the gloomy eurozone outlook.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap