Briefing Romania

First MinFin auction in 2019

EUR/RON

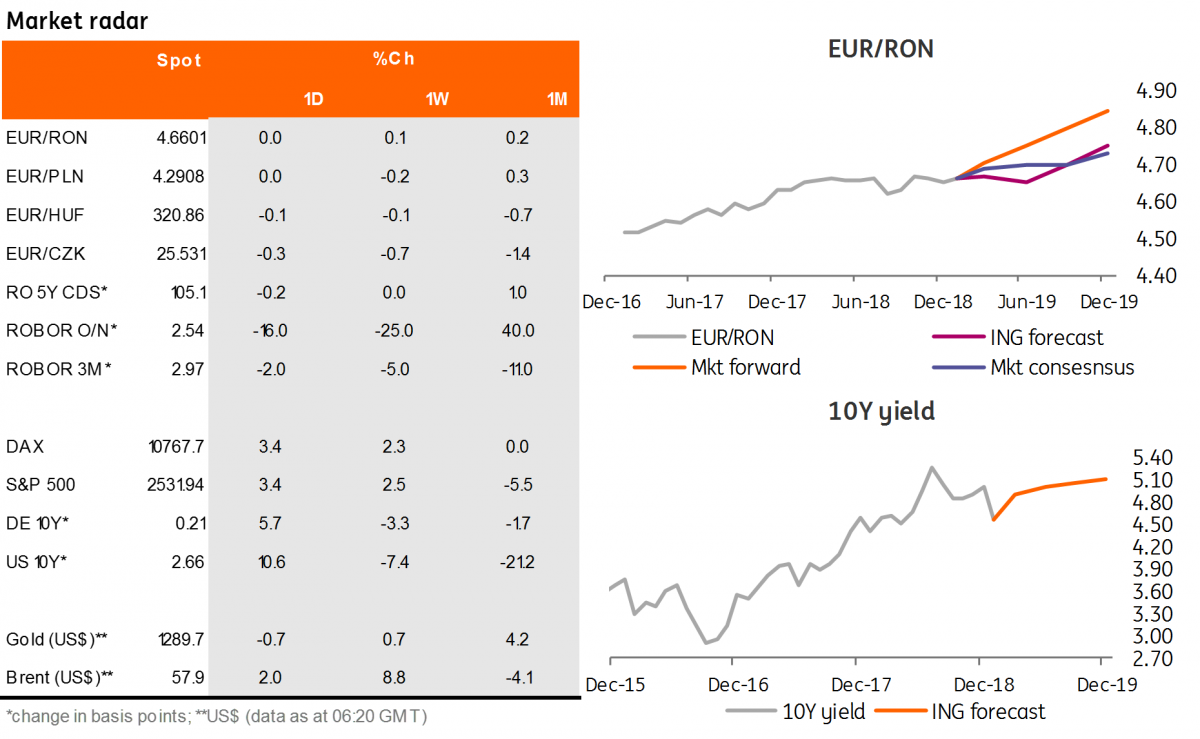

The EUR/RON seems to be consolidating above the 4.6600 mark, with the market eyeing tomorrow’s NBR Board meeting where Governor Mugur Isarescu is expected to make his first comments on the recent tax on bank financial assets. Hence we look for a quiet trading session today in the same 4.6600-4.6700 range.

Government bonds

It was another good day for Romanian government bonds as yields dropped 5-6 basis points in line with the general better sentiment towards risk assets. The Ministry of Finance begins its auction calendar for this year with RON400 million up for sale in October-2021. This is the first test for the market after the recent impressive rally we’ve had in ROMGB’s. The tenor is usually suitable for local ALM’s which most likely haven’t been driving the rally. Hence, while we expect decent demand, yields are unlikely to break through the current secondary market mid-levels of 4.03%.

Money Market

The better liquidity conditions are pushing implied yields lower across the curve. Cash rates dipped below the key rate and are now trading around 2.00%, with a proportionate transmission into longer tenors which inched lower between 10 and 20 basis points. These accommodative conditions should persist for at least the current reserve period, but any comments from Governor Isarescu will be closely followed in tomorrow’s press briefing.

The week ahead

The key event for the market will be comments from Federal Reserve officials. At the December FOMC meeting, they scaled back their expectations for monetary policy, suggesting two 25 basis point moves was the most likely scenario for 2019, down from the three hikes they had pencilled in back in September. We expect the bulk of Fed speakers to remain cautiously optimistic while soothing the concerns about an overly aggressive response from the central bank to any perceived inflation threat. In this regard, we expect December headline inflation to be pulled lower by energy price moves while core inflation remains at 2.2%. In the eurozone, look out for December's Economic Sentiment Indicator, which will probably be impacted by the Yellow Vest protest movement in France. The NBR meeting is likely to bring no change in policy stance, but the press briefing will be closely watched for hints about the outlook, including for a possible revision on the FX guidance. We see EUR/RON trading within 4.6550-4.6850 this week.