The Commodities Feed: All eyes on trade talks

Your daily roundup of commodities news and ING views

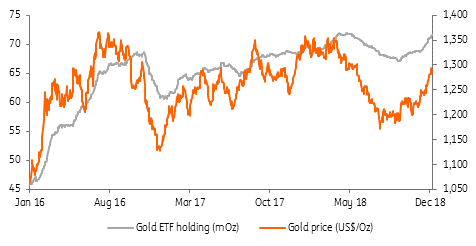

Gold ETF holdings continue to grow

Energy

ICE Brent speculative positioning: Latest exchange data shows that over the last reporting week, speculators reduced their net long in ICE Brent by 9,924 lots, leaving them with a net long of 152,325 lots as of 1 January. However, the strength in the market since the start of the year, along with a growing open interest, suggests that the speculative net long is likely to be somewhat higher currently. Meanwhile, as a result of the US government shutdown, no positioning data for NYMEX WTI is available, with the CFTC having suspended its Commitment of Traders report.

US crude oil inventories: The EIA released its weekly inventory report last Friday, which showed that US crude oil inventories increased by 7Mbbls over the week. Both gasoline and distillate fuel oil saw significant builds of 6.89MMbbls and 9.53MMbbls respectively, with refineries in the country increasing their utilisation rates from 95.1% to 97.2% over the week. Crude oil imports fell by 264Mbbls/d over the week to 7.39MMbbls/d. Imports from Saudi Arabia fell to 672Mbbls/d over the week, the lowest level seen since June 2018.

Metals

Beijing action supports metals: The People’s Bank of China (PBoC) announced on Friday that it will slash the reserve requirement ratio for Chinese banks by 1% (effective in two stages on 15 January and 25 January), in the hope that this would boost lending from banks. This comes after official data showed that Chinese manufacturing activity in December contracted for the first time since July 2016, with the manufacturing PMI coming in at 49.4 for December. The liquidity measure helped to push base metal prices higher, with LME copper trading almost 3.5% higher since Thursday’s settlement. Meanwhile, the market will be watching closely how US/China trade talks develop over the next two days.

Gold ETF holdings: Volatile equity markets, concerns over global growth and expectations of fewer rate hikes from the US Federal Reserve have seen investors returning to gold as a safe haven asset. Gold ETF holdings increased by around 0.6mOz over the first week of January, with total known holdings edging closer towards the five-year high of 72mOz made in May 2018. Given a number of uncertainties are likely to linger, we expect gold prices to remain fairly well supported moving forward.

Agriculture

EU sugar production: Latest estimates show that the European Commission is expecting that EU sugar production over the current 2018/19 season will total 18.2mt, down from 21.35mt last season. The decline in output is driven predominantly by lower yields, following the hot and dry summer seen across large parts of Europe. As a result of lower output, the Commission also expects that exports will fall significantly- from 3.35mt last season to 1.8mt in the current season.

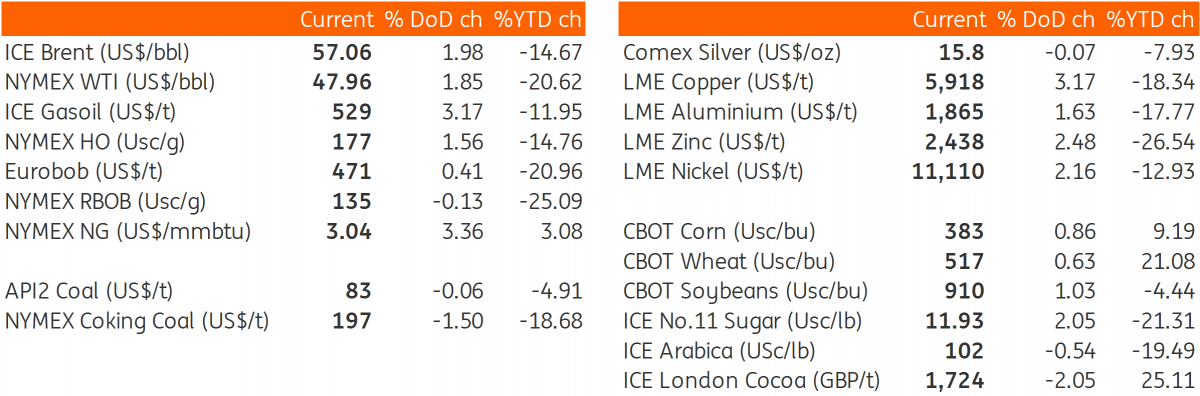

Daily price update

Download

Download snap