What’s going on in Latam? The same old Samba for rates…

Brazil has been doing its thing as of late, and it’s not been a happy samba. Here, we ask what’s next. We contrast Brazil with Mexico and the US, employing mean-reversion as our guide. We also bring Colombia and Chile into the conversation. Bottom line, Brazil still needs to hike. Mexico and Colombia can comfortably cut. Chile can too, but not comfortably

Banco Central do Brasil likely has to hike by another 175bp, and then we'll see

We noted some months back that Brazil had run out of a “comfort buffer”. See an example here. Its central bank's rate differential to the US had fallen to 5%. That sounds high. But 5% is some 3.5% below the average of the past decade and a half. That can be fine if fundamentals are fine, but they’ve clearly not been. Since then, Banco Central do Brasil (BCB) has hiked by 175bp, partly to mute a collapsing real. So, where now?

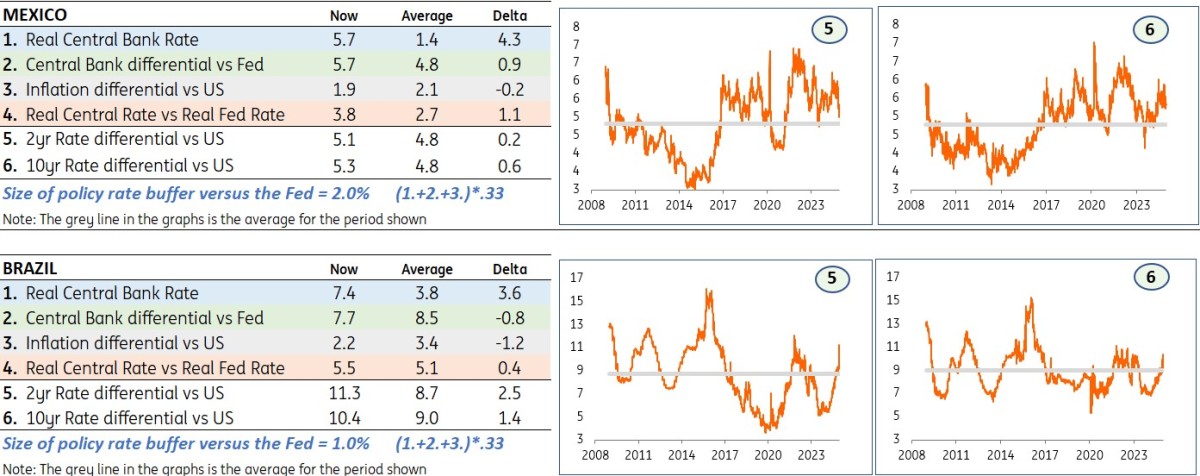

First some context. Both Mexico and Colombia have a near 1% positive buffer in terms of their respective average central bank policy rate differentials versus the Federal Reserve. In contrast, Brazil has a near 1% negative buffer on this measure. Ideally, it will need to close this up to zero, and likely will need to generate a positive buffer, probably in the region of 1%. That equates to another 175bp in rate hikes, based on this metric alone.

That would in fact likely prove to be an overshoot to the upside, as other metrics are far more comfortable. The domestic real rate differential is at 7.4%, some 3.6% above the historical average. More rate hikes would directly add to this, helping to contain inflation risks now being amplified by peso weakness, but with a significant risk of harm to the economy. There will be subsequent talk of rate cuts should such extreme easing need to be delivered.

Market rates are already trading at quite concessional levels, currently at comfortable double-digit spreads versus the US. Versus historical averages, there’s now a cushion of 2.5% in the 2yr and 1.4% in the 10yr. Likely there is still pressure for these spreads to widen some more, but at the same time quite some concession has already been priced. These positive deltas in the 2yr and 10yr versus the US contrast with a negative delta of -0.8% on the policy rate. It’s the latter that requires adjusting higher.

Key differentials versus the US for Brazil and Mexico and the rate buffer calculation

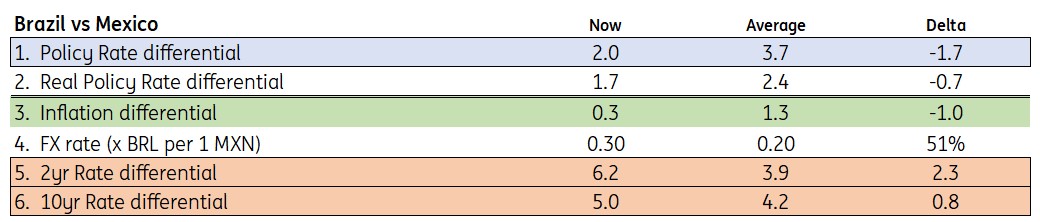

There is similar gap between Brazil and Mexico, which can be closed from both sides

We see something similar when we contrast Brazil with Mexico. The 2yr spread to Mexico is at 6.2%, which is some 2.3% above average, and the equivalent delta in the 10yr is 0.8%. In contrast there is a negative delta in the policy rate differential versus average. Currently, the BCP rate is 2% above Banxico's. The historical average is 3.7%. That’s a negative delta of -170bp. The BCP needs to hike (and/or Banxico to cut) in order to close that. And that only gets us back to a type of neutrality, which implies that more likely still needs to be done should macro pressures (and FX) persist in Brazil.

As for Mexico, at the moment, Banxico has a 2% buffer based off a combination of the nominal rate differential vs US (table above), the real rate differential vs US and the domestic real rate. If we look at just the nominal and real rate differentials vs US, there is a 1% buffer. Either way, Banxico has room to move back towards long term averages, and at the very least it can therefore match the Fed and cut by 25bp. It has room for more if it so chooses.

Brazil versus Mexico - key spreads

The respective pressures opens opportunity in relative rates

A notable difference between Brazil and Mexico is the performance of respective currencies. Yes, the Mexican peso has had a weakening tendency since the election outcome that coalesced on the judicial reform issue. But that merely took the peso away from a very rich valuation towards a more neutral one. In contrast, the Brazilian real has gone a tad off the rails, and has shot into material weakness territory versus fair value. The messaging there is poor for Brazil in relative terms. This is not a huge surprise to us. Mexico is far from a perfect story, but relative to Brazil, it looked like a much better one. See more here and here.

At some point, Brazil will begin to offer value and we’ll go the other way on this trade. That likely requires another round of big BCB rate cuts first, while delivery of a couple of Banxico rate cuts can build that concession from the other side. Watch this space. The 2yr spread is now 6.2% and the 10yr is at 5%. Entry points at 7.5% and 6% respectively would be more than enough concession. Even 50bp off these are worth a look. We don't necessarilly have to get to the extremes for the policy rate as currently discounted before getting back in.

Colombia is in the same camp as Mexico, but Chile has less room for manoeuvre

Separately, we note that the market is discounting a 25bp cut from Banco Central de Chile (BCC) and a 50bp cut from Banco de la República de Colombia (BanRep). Our analysis identifies a vulnerability to the BCC move, as we have a negative buffer in play, which can pose FX risks if pushed too far. It’s been in the “dodgy zone” for some time. See more here. In contrast, for BanRep we identify a positive buffer of 1.7%, signalling room to cut, and there's therefore no issue with the cutting agenda there. See our previous note on that here.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download opinion

Padhraic Garvey, CFA

Padhraic Garvey is the Regional Head of Research, Americas. He's based in New York. His brief spans both developed and emerging markets and he specialises in global rates and macro relative value. He worked for Cambridge Econometrics and ABN Amro before joining ING. He holds a Masters degree in Economics from University College Dublin and is a CFA charterholder.

Padhraic Garvey, CFA