The next Minsky Moment

Financial markets remain buoyant but some imbalances that led to the crisis are building up again. Volatility and risk might pick up slightly next year but 2019 might get even trickier. Will it be different this time?

The Goldilocks economy

The world economy seems to be doing fine. All the 45 countries, the OECD follows are expected to show two consecutive years of positive growth in 2017-18. The last time we saw such a phase of synchronised positive growth was ten years ago. However, contrary to then, inflation is hardly on the rise and remains remarkably subdued across the board. So there is really no need for rapid monetary tightening, resulting in relatively low-interest rates.

Market participants like to call this the "Goldilocks economy", with the economic environment neither too hot, nor too cold, but just about right. In such circumstances, it's hardly a surprise that stock market volatility has fallen back to historically low levels, while credit spreads are also increasingly tight, a result of the search for yield.

Are we having a 'Wile E. Coyote' moment?

While our base scenario anticipates the recovery to continue at a healthy pace over the next few years, which is market supportive, one should not be blind to the possibility of a less benign outcome. Growth disappointments or less generous financing conditions can shake financial markets. It is, therefore, worthwhile to refer to the research of Hyman Minsky, an economist whose work was rediscovered with the outbreak of the banking crisis in 2007.

The Minsky moment is comparable to the Looney Tunes character Wile E. Coyote who, in his zeal to catch the Road Runner, sometimes runs off a cliff, but only realises he's standing on thin air when he looks down

In short, Minsky’s thesis, aka the financial instability hypothesis, puts forward the idea that long periods of stability encourage companies and households to take on more leverage, which ultimately makes the system very vulnerable. In those circumstances, central bank tightening on the back of higher inflation could put the more indebted parts of the economy in trouble, ultimately leading to a financial market correction, sometimes referred to as “a Minsky moment”.

One could compare it to the slapstick Looney Tunes character Wile E. Coyote who, in his zeal to catch the Road Runner, sometimes runs off a cliff, but only plunges after having looked down and realising he’s standing on thin air.

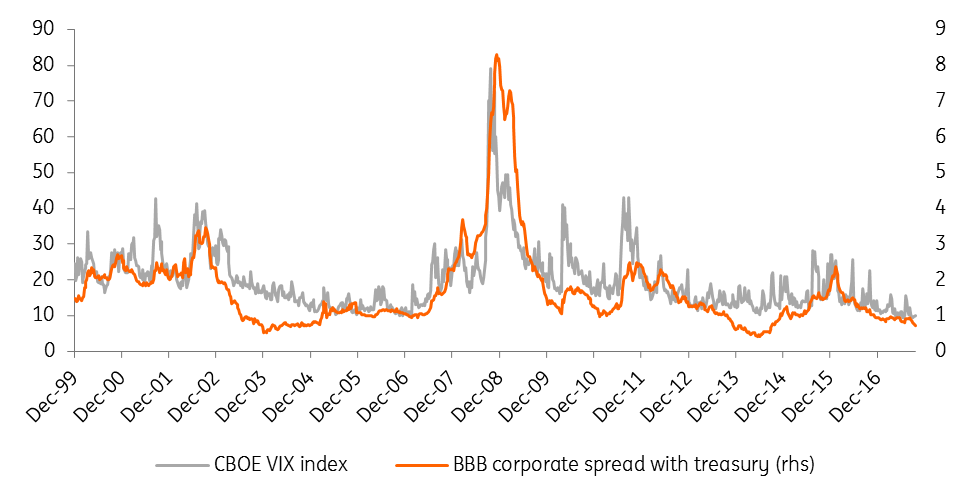

Stock market volatility and corporate spreads

Both stock market volatility and credit spreads are at very low levels.

It's easy to cry wolf!

In its recent financial stability report, the IMF highlighted the increase in both public and private indebtedness, with total debt levels in most big economies now even higher than 2006, in terms of GDP.

To be sure, this is mostly due to a sharp increase in public debt, while private debt has not yet reached the levels we saw back then. US consumers still have less debt, but US companies have higher leverage than they did in 2006. This seems to suggest private debt ratios might still have to climb a bit further before trouble sets in.

Admittedly, we are not the only ones feeling a bit uneasy in these circumstances questioning the multiplying financial markets buoyancy. Even the Chinese central bank governor has been warning of a Minsky moment in China. But it's easy to cry wolf and a lot more challenging to get the timing of a trend reversal right.

Remember, Alan Greenspan spoke of irrational exuberance many years before the stock market actually tanked. Likewise, reports on the unsustainable boom on the US real estate markets began to crop up in 2005, but it still took nearly two years before the first stress on financial markets actually appeared.

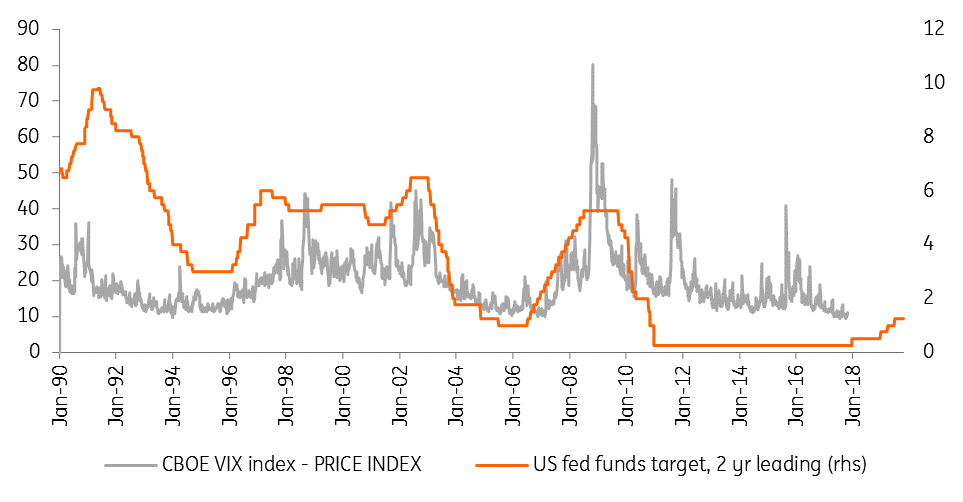

Volatility lags monetary policy

Too early to panic: 2018 might still be OK

Historically volatility has been a lagging indicator, mimicking short-term interest rates with an approximately two years lag. In other words, interest rate hikes today might lead to more volatility in two years’ time.

To be sure, the European Central Bank or the Bank of Japan is not even thinking of a rate hike, meaning central banks are not yet tightening across the board. This reduces the risk of significant market corrections in the short run. On top of that, the ECB will still be buying plenty of corporate bonds until at least September 2018, which all but limits the risk of notable spread widening. That said, in the past increasing volatility and rising risk premia in the US have often spread across the globe.

Even on that count, it still looks a bit early to panic. Looking at monetary policy in the US, historical evidence would suggest that 2018 could see at most a slight increase in volatility and risk premia, but that 2019 might be a lot more tricky in this regard. But of course, as we have heard before, this time it might be different.

Peter Vanden Houte

Peter Vanden Houte is Chief Economist, Belgium, Luxembourg. He has has been working with ING in various research functions for more than 20 years. He is also vice-chairman of the “economic commission” at the Belgian Employers Federation.

Peter Vanden Houte

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more