Bundles7 June 2019

In case you missed it: Dovishness all over again

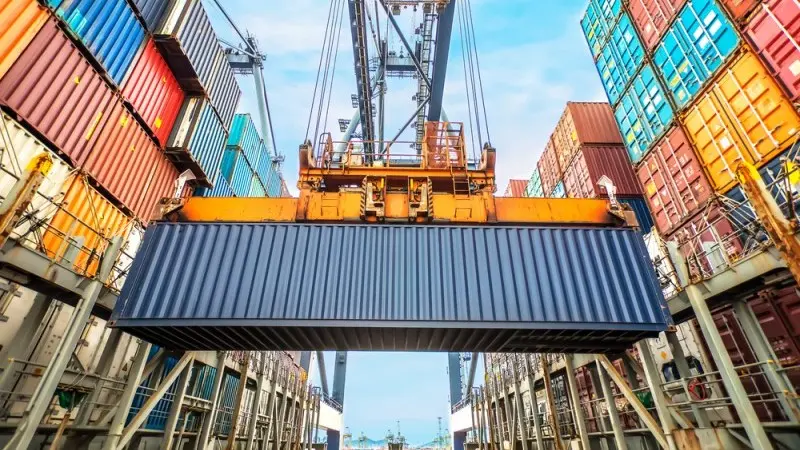

US jobs miss forecasts cementing market expectations of a slowdown, and if the Fed cuts rates, the ECB will probably follow suits as it is a smidge away itself. Elsewhere, we've revised our yuan forecast lower amidst President Trump's trade crusade as the damage from the trade war is set to make 2019 the worst year for trade since the financial crisis