US: The twists and turns ahead

A strong start to 2019 gave way to fears of recession only for an easing in trade tensions and three Fed rate cuts to turn sentiment around again. 2020 could prove more unsettling with geopolitical tensions spreading to the Middle East and domestic politics remaining fraught. With limited opportunity for stimulus, we see growth risks skewed to the downside

2019: Out on a high

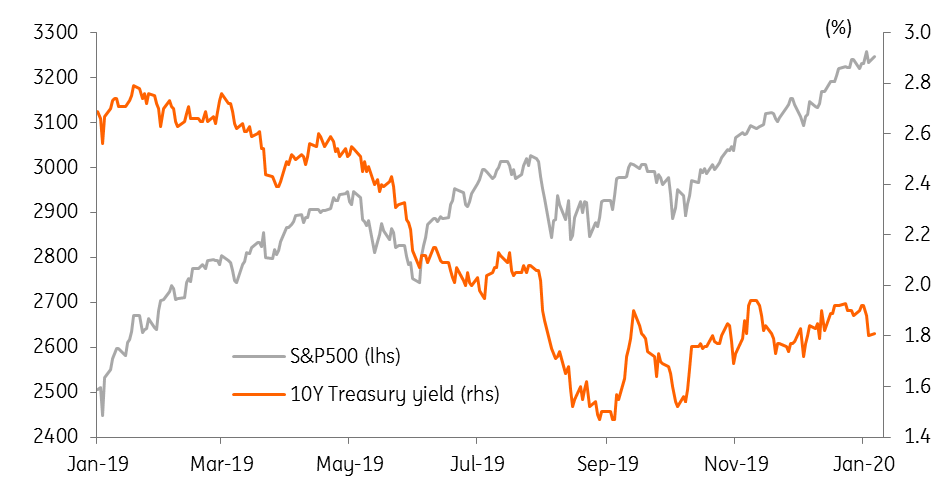

Looking back to the beginning of 2019, we predicted the economy would grow 2.3% and that looks almost spot on. However, a more aggressive Federal Reserve response than we predicted was needed to achieve it. Trade tensions were a key theme of 2019 as protectionist measures raised costs, hurt supply chains and damaged corporate profitability while weak global demand and a strong dollar compounded the problems. During the summer, there were real fears of recession with the Treasury yield curve inverting and equities selling off. However, the combination of three 25 basis point interest rate cuts and President Trump announcing a 'phase one' deal on trade with China was enough to reinvigorate confidence such that the S&P 500 ended the year up 30% while 10-year Treasury yields ended 2019 90 basis points lower.

US 10Y Treasury yields versus S&P500 equity index

2020: Political warfare

2020 has not started quite so rosily. Tensions with the Middle East took a dramatic turn for the worse following the assassination of Iranian military leader Qasem Soleimani. And while hostilities appear to have subsided somewhat, market sentiment remains vulnerable.

Domestic politics also remains a source of uncertainty. Arguments over the trial rules are holding up President Trump’s impeachment, with a growing risk that the verdict is not reached until March. This could have implications for the selection of the Democrat Presidential candidate, given that Senators Bernie Sanders and Elizabeth Warren from the more populist wing of the party will be tied up in the Senate trial proceedings rather than on the campaign trail while current front runner Joe Biden risks being tarnished due to his son’s ties to Ukraine, which is central to the trial. Moreover, Joe Biden may be required to testify.

With the Iowa and New Hampshire caucuses scheduled for 3 and 11 February, respectively, this has the potential to open the door for alternative centrist Democrats to make advances such as Pete Buttigieg and the big spending Michael Bloomberg.

Ultimately, polarised partisanship in the present Congress means that President Trump, having been impeached by the Democrat-controlled House, will be acquitted by the Senate, as the entire Democratic caucus, every Independent, and 20 Republican Senators would need to vote against the president for him to be convicted.

Nonetheless, it could still prove to be damaging for President Trump, especially if more revelations emerge, so the best we can say is that the outcome of the November election remains highly uncertain. The range of possible economic and regulatory implications from the varying candidates is broad, as we outlined in our latest US Politics Watch. Consequently this could be a factor that keeps businesses cautious and reluctant to put money to work in a meaningful way this year.

US Presidential timeline

Good and bad

More positively, the phase one trade deal between the US and China is scheduled to be signed on 15 January and this will hopefully draw a line under the tit-for-tat escalation in tariffs experienced over the past two years. However, there is little sign of this positive news feeding through into improvements in the US manufacturing sector just yet.

Regional manufacturing surveys remained weak in December and the national ISM measure hit new lows, led by weakness in new orders. Durable goods orders and shipments continue to look soft, pointing to ongoing weak investment spending. The squeeze in corporate profits, political uncertainty due to the upcoming Presidential election and the latest ratcheting up in geopolitical tensions, further diminish the chances of a major rebound in this key component of GDP.

Additionally, the Boeing 737 Max production halt could have significant implications for first quarter GDP, largely through inventories not increasing as rapidly – there have been no deliveries of the jet so this is where they have been showing up in recent months. It could also result in job losses at suppliers (there are more than 600 companies involved in production). Later in 2020, assuming 737 Max sales are eventually allowed, it should result in a boost to exports and investment with inventories being run down.

Nonetheless, the jobs market remains firm, which should underpin consumer spending while the housing market looks to be a decent source of growth in 2020. Mortgage rates are much lower than 12 months ago and this has led to a pick-up in demand with home builder confidence at record highs. This bodes well for residential investment and is a key reason why we have revised up our 2020 GDP forecast to 1.7%.

ISM business surveys and the National Association of Home Builders sentiment index

The Fed’s steadying hand

The stabilising effect of the Fed’s rate cuts and the US-China trade deal means that while not particularly strong, growth looks durable, with little near-term prospect of recession. With the Fed suggesting it needs to see a “material” change in the outlook for it to consider another policy change, the prospect of near-term rate cuts looks minimal. Should trade and geopolitical risks subside further then the likelihood is we will see the Federal Reserve on hold through 2020.

Unfortunately, our confidence that politics will provide a benign backdrop is low given the upcoming impeachment trial and the prospect of a brutal presidential election battle. There is a sense too that President Trump could attempt to make political capital by striking out at perceived injustices with other nations as he seeks re-election. In this regard, US-EU trade tensions remain a threat for 2020 given the lingering topic of un-level auto tariffs and US unhappiness over some EU countries imposing taxes on US tech company revenues.

Erring on the side of caution

With global growth remaining subdued, the Fed seemingly reluctant to provide more fuel with rate cuts, and little prospect of any additional fiscal support – note the 2020 FY budget will result in spending increasing by just $50 billion – we continue to err on the side of caution when it comes to growth. Inflation is also likely to remain benign, with the core PCE deflator still running at just 1.6% year-on-year, wage growth at barely 3% and the University of Michigan reporting that consumer inflation expectations five years ahead hit a new historical low in December.

So while the US backdrop is looking better than we were thinking just a couple of months ago, we remain wary and suggest the US will modestly underperform market expectations. Given this prognosis, the risks appear skewed towards a modest additional policy ease from the Fed and Treasury yields dropping towards a 1.75-1.5% range by mid-2020.

Download

Download article

10 January 2020

January Economic Update: Turbulent twenties This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more