Our first thoughts on the US election and the potential impact on Europe and markets

The US election is fast approaching and while we know Joe Biden and Donald Trump will surely be slugging it out once again, we’re lacking clear manifestos. So what are the broad policy intentions, and what will they mean for the world? Not forgetting, of course, how far and fast they go will be determined by the outcome of the Congressional elections

Biden vs. Trump on key issues

Biden promises more of the same with social spending funded by tax hikes

President Biden has repeatedly stated that his intention for a second term is to “finish the job”. The social policy thrust will likely centre on abortion rights and improving access to education and childcare accompanied by renewed efforts on substantial student debt relief. ESG will also remain a key theme for his administration, with support for clean energy, environmental protection, and continuing climate change mitigation. Improved relations with allies and trade partners will be maintained despite somewhat more protectionism, as illustrated by the US Steel takeover intervention and the failed negotiations to include European carmakers in the Inflation Reduction Act’s support for electric vehicles. China and Russia will continue to be viewed with distrust, while support for Ukraine and Taiwan will continue.

“Bidenomics” has focused on the creation of middle-class jobs and de-risking supply chains through incentivising investment in the US economy (Chips and Science Act, Inflation Reduction Act, Infrastructure Investment and Jobs Act). These measures will receive continued support. Biden is likely to launch another attempt at raising taxes on the wealthiest Americans and large corporates to fund social services and cut the deficit. As a minimum, we would expect him to allow the Trump tax cuts (2017 Tax Cuts and Jobs Act) on wealthy individuals and corporations to expire as planned in 2025.

We expect he will also seek more funding for the Internal Revenue Service (IRS) to ensure tax payment compliance and also potentially watch for an expansion of the Supreme Court with more judges added to nullify the effect of President Trump’s appointments.

Trump opts for tariffs and domestic tax cuts

Should Donald Trump win the election, he too has promised to finish the job he started during his first term while also vowing “retribution” for political enemies, which risks stoking political division and could lead to a potentially turbulent initial transition period.

His main policy thrust will see a return to the America First transactional approach to diplomacy that involves a general disregard for the concerns of allied partners, international law and the green agenda. Geopolitically, support for Ukraine could falter and the US’ willingness to stand up in support for Taiwan’s independence could wane. Hardline rhetoric against undocumented immigrants will see further restrictions at borders with the prospect of forced removals.

Trump has repeatedly spoken of his belief in using tariffs to raise tax revenue while incentivising the reshoring of economic activity back to the US. He has mentioned 60% tariffs on imports from China while clamping down on the ability of China to export via third-party countries. He has proposed introducing 10% tariffs on all other countries with money used to fund modest tax cuts for higher income households and corporates and helping to shrink the deficit. He will certainly look to extend and potentially make the tax cuts from the 2017 Tax Cuts and Jobs Act permanent. However, this policy mix is vulnerable to the risk of retaliatory tariffs, heightened geopolitical tensions and higher inflation.

Meaningful improvements in fiscal deficit are unlikely

From a financial market perspective, it is encouraging that both candidates acknowledge the need to rein in fiscal deficits, but implementation will be challenging. Mandatory spending accounts for two-thirds of government expenditure and there appears to be little desire from President Biden to tackle the ongoing upward pressure from demographic shifts on social security, Medicare and Medicaid expenditure. President Trump has spoken of curbing access, but this would merely slow, not reverse, the increase in spending.

Discretionary spending, half of which is defence, accounts for just over a quarter of government expenditure. It is already close to historical lows at 6.4% of GDP, and it is hard to imagine that there will be meaningful enough real-term cuts to spending on the judiciary, transport, education and social services that will move the needle on the deficit. We imagine President Trump would be more willing to make large cuts to discretionary spending than President Biden. However, any savings made here will likely be swallowed up by rising interest expense on the national debt, which accounts for the remaining 10% of government expenditure.

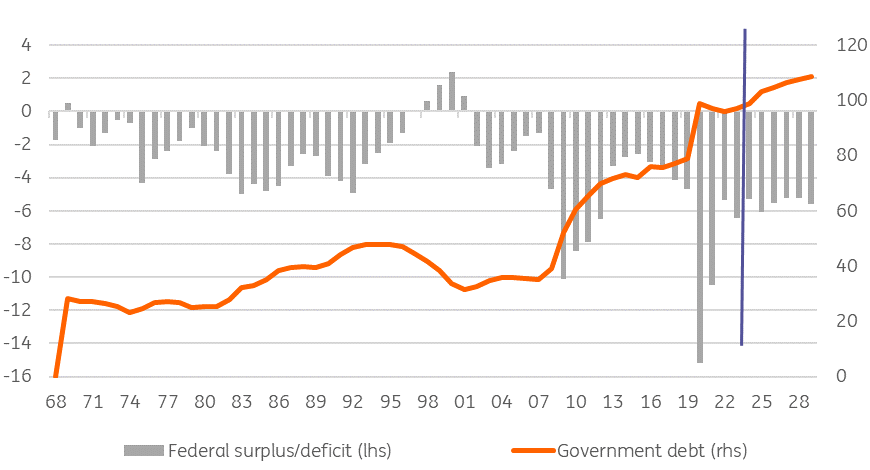

This means that for the deficit to shrink significantly, we need to see taxes take a larger share of GDP and for GDP to continue growing strongly. While deficits could improve under both scenarios, this improvement will only be marginal. Remember that in 2023, the US recorded a fiscal deficit of 6% of GDP despite the economy growing 2.5% and unemployment averaging 3.6%. The economy posted a similarly robust performance in 2000-01, yet the US recorded a fiscal surplus of 2% of GDP. There has been a clear structural deterioration in the nation’s fiscal position and should activity disappoint, deficits could widen markedly.

Under either scenario, we may only see the deficit trend down towards 5% of GDP through the Presidential term while government debt levels rise above 105% of GDP. Under Trump, there may be slower government spending growth relative to Biden, but a Biden presidency would probably see more domestic taxation on income and corporate profits. There is uncertainty over how much revenue Trump tariffs would generate. A 10% tariff on $3tn of trade raises $300bn – equivalent to just under 1% of GDP, but retaliation and trade barriers are a hindrance to growth, and revenues could be weaker from other taxes.

Fed policy rates may need to be tighter given the policy mixes

The implication for the Federal Reserve is that if loose government fiscal policy continues, whereby the government pumps more money into the economy than it is taking out via taxes to the tune of 5% of GDP, then there is perhaps the case for monetary policy to be somewhat more restrictive. We are already seeing this translate into expectations of the neutral rate for Fed funds creeping upwards. The Fed says that it is 2.6%, but we believe that high deficits and structural changes in the economy, such as making supply chains more resilient as well as higher fiscal deficits, argue in favour of the neutral rate ending up closer to 3%.

At the margin, the neutral rate may end up being slightly higher in a Trump Presidency due to lower domestic taxes supporting consumer activity and tariffs being inflationary. If Trump is successful in implementing stricter border controls, lower immigration and a smaller potential workforce could add to medium-term inflation pressures.

In terms of the structure of the Federal Reserve, Donald Trump has suggested that he would seek to replace Jerome Powell when his term ends as Fed Chair in 2026. This runs the risk of a politicisation of the Fed that could cause some concern in financial markets.

Government deficits & debt with Congressional Budget office projections 2024-2029 (% of GDP)

Implications for Europe

Arguably, while politically and socially, the elections are of high importance for the US, the economic implications could be more important for Europe than for America. It's not only economic implications stemming from trade or fiscal policies but also security policies that could severely affect the contenent.

Biden wins: The recently failed negotiations to open the Inflation Reduction Act for European carmakers show that a second Biden administration will continue an America First, Europe second approach. As a result, the gradual relocation of European investments to the US could continue, further weakening European industry. At the same time, there wouldn’t be any doubts about US-NATO membership and support. Still, with fading electorate support for Ukraine, the US could push for negotiations and a truce, increasing chances the country could be split and the security risk for Europe would remain.

Trump wins: Judging from comments so far, the risk is high that a President Trump would initially cast doubts about US NATO membership. We don’t think that eventually Trump would leave NATO as it would require a majority in Congress and the US would not risk creating global turmoil or a split Europe. However, the pure speculation about such a scenario brings new (economic) uncertainty to Europe. Trump also said that he would end the war in Ukraine within 24 hours. We doubt it, but any deal with Putin without considering European interests would likely bring political turmoil to Europe. In any of these scenarios, Europe will have to step up military expenditures far above the current target of 2% of GDP.

As for economic and trade policies, Trump could change the nature of the IRA, which could actually help Europe as it would end the current subsidy competition for green investments. At the same time, the global fight against climate change would take a hit, and Europe would be forced to rethink the balance between economic interests and climate even more. It could be an investment opportunity for Europe, at least in the case of more accommodative fiscal policies.

Any expected increase in tariffs would hurt the European export sector at a time when the US had again become the most important trading partner. Expected retaliation measures from the EU would add to inflationary pressures in Europe.

In short, with the increased security risks combined with new tariffs, a new term in office for Donald Trump would bring stagflationary risks to Europe.

Implications for the ECB

Biden wins: As this would be mainly more of the same, and the eurozone would see a gradual cyclical recovery with only slow structural improvement and continued supply-side constraints, the ECB will only cautiously continue cutting rates in 2025.

Trump wins: The stagflationary impact of a Trump victory would be more challenging for the ECB to deal with. So far, the ECB’s reaction function has put more emphasis on inflation than during the Mario Draghi era. However, the severe security and economic risks of a second Trump term could force the ECB ultimately to rebalance growth and inflation again and cut rates more significantly than in our base case, especially if a lasting stagnation would lead to new tensions within the monetary union.

Only one way to go for Treasury yields if the deficit isn't prioritised

So far, the market has not baulked at the massive issuance requirements being thrown at it to help finance the fiscal deficit. While the long-anticipated Fed rate cut cycle is likely to drive yields lower when it finally comes to fruition, we don’t believe it will be long before there is a more bearish impulse for bonds. Given the lack of material difference between a Trump and Biden administration in terms of effect on the cash deficit, the bond market won’t really care who is at the tiller when it decides it has had enough. In that narrow pure-ability-to-slash sense, the bond market might be more comfortable with a Trump administration, but not by much, as we’re still left with huge issuance requirements and a rating downgrade risk from poor debt dynamics.

Is there a Trump versus Biden difference? Not much. Maybe a back-of-the-envelope 50bp difference based on what we know on 10Y yields (Trump below Biden). But the bond market won’t mind which one of them does the chopping job. It just needs to get done.

Implications for FX markets

The working assumption in FX markets is that a Trump administration would be worse for global trade and negative for currencies such as the renminbi and the euro. Trump’s trade war, particularly in the 2018-19 period, saw EUR/USD drop by more than 10%. However, It must be remembered that Trump’s aggressive protectionism was enabled by the fiscal stimulus of the TCJA tax cut, passed in late 2017. The make-up of Congress and the ability to pass fiscal stimulus will have a big say in whether the dollar can rally.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more