Trade war: Where is Trump heading?

President Trump has threatened to rip apart the US-China trade deal and has not ruled out tariff hikes, if non-Chinese experts are unable to participate in the search for the origin of Covid-19. Although we think that Trump prefers verbal pressure for now, the risk of new measures is definitely rising

Return of the threats

The possibility of another trade war is back. President Trump has said he will terminate the phase one deal if China does not live up to the goal of increasing imports from the US by a total of US$200 billion the end of 2021. Once again we have witnessed that Trump is willing to apply tariff hikes (or at least threaten their use) to other policy areas than just trade. He called tariff hikes ‘the ultimate punishment’ if China does not allow non-Chinese experts to be involved in the search for the origin of Covid-19.

Trade secretary Wilbur Ross has also ramped up trade tensions by initiating a national security section 232 investigation into imports of (parts of) transformers and transformer regulators.

Non-tariff measures

As well as tariffs, the US government is eyeing other ways of piling on the pressure. The latest idea at Capitol Hill is to hurt China by ordering the main US federal pension fund not to invest in China's financial assets. Last year a similar idea was floated when the US government threatened to close US financial markets to Chinese companies to complicate their funding.

Incentives to discourage American companies from making direct investments in China and restrictions on Chinese direct investments in the US are other options to put economic pressure on China.

The ‘nuclear’ option of defaulting on US government debt, of which China is the world's largest holder, is sometimes brought up in the public discussion as well. This seems unlikely because it could have significant repercussions for the credit rating of the US and thereby the funding costs of its increasing government debt.

Bark or bite as well?

The million dollar question is whether President Trump will stick to verbal pressure or follow up and hike tariffs again or effectuate alternative protectionist measures.

Regarding Chinese compliance with the phase one deal, we don’t expect the President to move in the short run. Although the call for a renegotiation of the trade deal is apparent in Chinese newspapers, so far the Chinese government has not asked for this. After a call last week between Vice Premier Liu He and the US trade representative Robert Lighthizer, the Chinese Ministry of Commerce confirmed it is continuing to work on implementing the deal.

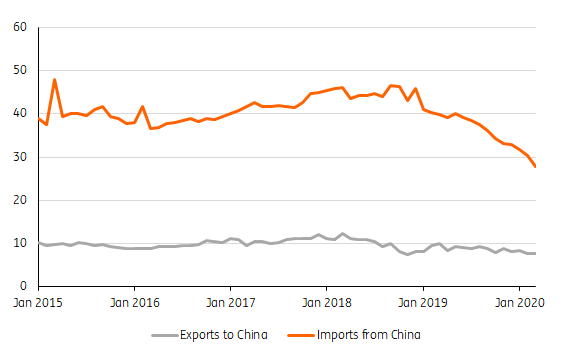

Chinese imports from the US (and other countries) have crashed this year as a consequence of plunging Chinese demand due to the Covid-19 pandemic (see chart 1). The crisis seems to qualify for calling upon the clause in the phase one deal that states, ‘in the event that a natural disaster or other unforeseeable event outside the control of parties, delays a party from timely complying with its obligations...the parties shall consult with each other’.

The fact that Chinese authorities have not brought up this point to publicly pressure the US to renegotiate could be seen as a sign of good intentions. Together with the positive tone from US negotiators Lighthizer and Treasury Secretary Steven Mnuchin after their call with Liu He, there is no indication that China is deliberately trying to shy away from the deal.

Having said that, it is clear that it is simply unrealistic to expect, in the midst of the deepest recession since the 1930s, that China could prop up it imports by $US200 billion in two years. So, it would be no more than reasonable for the US to give China some leeway, for example by lowering the target for this year ($US76 bn) and agreeing that the cumulative target of $US200 bn of extra imports from the US can be reached at a later point in time.

Besides, while China is not importing as much from the US as originally targeted, China is not exporting anywhere near as much to the US given that the year to date goods deficit with China is 33% lower than in 2019. This has caused a further significant decline in the bilateral trade deficit of the US with China. The improvement in the bilateral trade balance already started last year before the pandemic hit the world economy. It is partly the result of Trump's tariffs. So he can use that to claim that his war on trade with China has been successful, which should give him some space not to demand the impossible in these extraordinary times.

Last Wednesday, however, Trump said he is not ‘interested in renegotiating’ the deal. Does that mean that a tariff hike or other measures to inflict pain on China are in the offing? Not immediately, in our view.

Chart 1: US - China - Bilateral trade USD, bn per month

Blame for the economic crisis

Last year, Trump could shrug off critics who said his tariff hikes hurt the stock market and caused a recession in manufacturing by pointing to all time highs for stock market indices and record low unemployment rates. But this time, the overall economy is in a devastated state.

So from an economic point of view, it would be very risky for Trump to take measures that are not welcomed by most American businesses and consumers. He would have little defence if he were to be accused of driving the economy into an even deeper hole.

We therefore expect Trump to wait a little more to see whether his verbal pressure on China works so that he can continue to claim he has cut a ‘fantastic deal’ with China.

Chart 2: Selected bilateral trade balances and total US trade deficit USD, bn per month

Other reasons for hiking tariffs

Nevertheless, the risk of Trump taking new protectionist measures has definitely increased. Trump is currently not doing very well in the polls. As the economy is in a terrible state and will still be far from healthy at election day, Trump could give preference to non- economic considerations.

If the President thinks that China offers a scapegoat for the current crisis and could potentially boost his re-election chances, an announcement of new protectionist measures is a serious option, particularly if the conflict with China about the search for the origin of the Covid-19 virus escalates. If Trump feels a sense of injustice in China’s behaviour and can bring other countries on board to take action, he might well go for another round of tariff hikes. Trump could then portray himself as a global leader.

Download

Download article15 May 2020

Covid-19: What you need to know This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).