Three UK net-zero challenges ahead of COP26

The UK government's new net-zero strategy is encouragingly comprehensive. But addressing the shortfall in tax revenues brought about by more electric vehicles, successfully greening the UK's buildings stock and shielding consumers against increasingly volatile power prices all present tough economic challenges for the government

The UK's net-zero challenge

There’s no doubting the UK’s ambition on climate change ahead of the COP26 climate change summit in Glasgow which starts on 31 October. Britain has achieved the fastest decline in carbon emissions in the G7 since 1990. And its long-awaited net-zero strategy unveiled last week is a commendably comprehensive look at what the country needs to do to achieve the full 78% fall in carbon emissions on 1990 levels, by 2035. It endorses the vast majority of the recommendations offered by the independent Climate Change Committee last year, as we show in the chart below.

Yet the scale of the UK’s challenge cannot be understated. Emissions have already fallen by around half of what is needed by 2050 under the government’s target. But the easier gains have been banked, and the remaining emissions' reductions are going to be considerably harder to unlock. Here, we look at three challenges with particular relevance for the UK economy.

What needs to happen to achieve net-zero

Required emissions' cuts are based on historical data and 'balanced pathway' projections from the Climate Change Committee's Sixth Carbon Budget

Plugging the government's fiscal hole sparked by electric vehicles

Transport has so far been a poor performer in the UK’s net-zero journey. Emissions' levels, of which cars are a key contributor, have barely changed since 1990. Increased car ownership and fleet expansions have offset improvements in fuel efficiency. Admittedly this is not a trend that’s unique to the UK, but it does pile on the pressure to achieve the roughly 70% fall in emissions by the middle of the next decade.

That said, this looks like one of the easier areas of the net-zero strategy to achieve. Unlike other decarbonisation efforts, the technology is largely there and continues to improve, while average prices are expected to fall.

Britain plans to ban sales of fossil fuel-powered vehicles from 2030, and allow only 100% electric from 2035. Encouragingly, usage of electric vehicles is already increasing rapidly. Full-electric cars made up almost 10% of sales in the first three quarters of 2021, up from 5% a year earlier.

Battery electric vehicles were almost 10% of sales in the first three quarters of 2021

That’s despite UK consumer subsidies for electric cars being considerably less generous than in other parts of Western Europe. Both Germany and France have introduced hefty grants for electric vehicles – up to €9000 and €6000 respectively – while the latter also offers bonuses for converting old cars. The UK, by contrast, offers new buyers 35% of the value of a new electric vehicle, with a cap of £2,500.

Greater consumer interest and affordability means that further adoption now relies more heavily on improving charging infrastructure. Growth is speedy, and the UK is doing comparatively well on rapid chargers, which are consistently posting 10% quarterly increases.

Still, there are challenges to overcome. For one, policymakers will have to make sure that chargers are concentrated in the right places to ensure car users are incentivised to charge when local electricity supply is higher (ie when it’s windy). As we highlight later, EV batteries present a great opportunity to help balance local power grids given the inherent volatility in renewables generation.

The UK scores well on fast-chargers

But the government’s bigger issues are economic. Much has been made of the black hole the switch to electric vehicles is set to create in the public finances. Pre-pandemic, the UK Treasury collected just under £30bn annually in fuel duty or 3.3% of total receipts. This is set to fall gradually as EVs become more prevalent, and the Office for Budget Responsibility reckons this is likely to be the largest cost associated with the net-zero transition. Unsurprisingly, the drop in fuel duties will accelerate in the second half of this decade.

Transport looks like one of the easier areas of the net-zero strategy to achieve

That this gap will be filled is inevitable. But doing so in a way that keeps the EV transition on track, while ensuring lower-income households don’t get disproportionately hit, will be a challenge. Simply raising taxes on fuel or fossil fuel-powered vehicles will increasingly hit lower earners, who are much less likely to buy an electric vehicle at this point, or indeed have somewhere to charge it. Roughly half of those in the lowest income quintile have off-street parking, compared to over three-quarters in the highest.

Some form of road pricing seems likely (eventually), and probably one that goes beyond the city-focused congestion charging zones that are gradually becoming more prevalent. Arguably it’s the only effective way to also restrict the anticipated rise in congestion. The Climate Change Committee has predicted that car miles driven will need to fall by 9% by 2035 as part of its 'balanced pathway'.

All of this is, inevitably, going to be contentious. It may well be after the next election in 2024 before these challenges are fully addressed.

Making the UK’s ageing housing stock greener

Making UK real estate green is likely to prove to be one of the hardest nuts to crack in the net-zero journey for three reasons.

Firstly, the UK is starting from a comparatively challenging base. At over a third, Britain has the highest share of residential buildings built before 1945 in Europe. The UK is also among the most reliant in Europe on gas central heating – and lags considerably behind France and Germany on heat pump numbers. Buildings-related emissions per capita are higher than many in Europe, and they need to halve by 2035 under the Climate Change Committee's ‘balanced pathway’.

Secondly, bringing both residential and commercial property up to standard is likely to be the area where the most direct public investment will be required, at least in the short term. By combining estimates from the OBR and the CCC, the government may need to have invested £14bn between 2020 and 2025 inclusive on buildings. That’s quite a lot more than on energy or transport, even though both require considerably higher injections of private sector money in the short term.

Greening real estate requires more near-term public investment than transport or energy

Thirdly, it’s politically contentious. Unlikely electric cars, housing investments are less likely to generate large operational savings. The CCC estimates that the ‘average abatement cost’ – the net cost per unit of emissions prevented – is easily the highest for residential buildings. Energy efficiency measures are estimated to cost £381/tonne of C02 emissions reduced between now and 2050, compared to a net saving of £72 with electric cars.

The UK risks slipping behind other parts of Europe on investments in greener buildings

Encouragingly, the UK has now released its Heat and Buildings Strategy, setting out what needs to happen to green the UK’s housing stock. The government will increase the incentive for households to switch to heat pumps. Grants of £5,000 per household will be available from April.

Interestingly, the UK government's strategy sets out an even more ambitious emissions reduction target for buildings than the Climate Change Committee had advised. But for that to be realised, more concrete policies are needed. For now, the UK risks slipping behind other parts of Europe on investments in greener buildings.

France’s MaPrimeRenov scheme offers generous grants (circa 30% of renovation costs), and interest-free loans to help households finance the work. Germany has something similar, though it's more loan-oriented, while Spain is allocating almost €8 billion on energy efficiency from its EU recovery fund allocation.

By contrast, the UK currently has no subsidy or loan scheme for insulation. A replacement for the previous Green Homes Grant, which offered up to £5,000 for green renovations (and more for lower-income families), was scrapped after only a few thousand vouchers were spent.

The net cost of reducing buildings' emissions is comparatively high

With COP26 around the corner, there is mounting pressure on a replacement scheme. And this does bring potential opportunity. The UK jobs market is currently in the midst of a mismatch, with shortages in some areas counterbalanced by slack elsewhere. Over 5% of construction workers were still fully furloughed as of August, despite economic activity having returned to roughly pre-virus levels months before.

The transition to net-zero presents an opportunity to retrain workers. And unlike energy and other large infrastructure projects, which will come on stream gradually over a few years, building renovations are quick to implement and are a good candidate for relatively swift economic stimulus.

Shielding consumers against higher power prices and volatile renewables' generation

The recent volatility in UK power prices has come at an inopportune moment for the UK government ahead of COP26. Higher electricity prices, while partly down to bad luck, have exposed the UK’s reliance on natural gas and variable renewables, notably wind and solar.

The UK will have to adapt to more volatility in power prices over the next few years

2021 has been a particularly bad year for UK windspeeds. Both July and August saw the lowest speeds for well over a decade. At the same time, natural gas – in effect Britain’s ‘back-up’ energy source for times of poor renewables output – has been under global supply pressure. The UK also has comparatively very low levels of gas in storage.

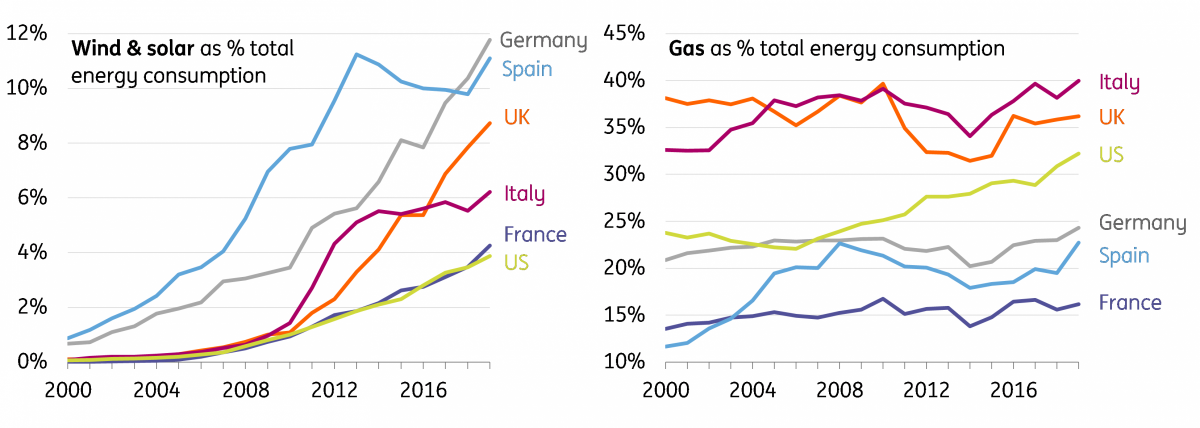

Natural gas and increased renewables' output has helped the UK decarbonise faster than most. But it also means that the UK is vulnerable to increased volatility in power prices over coming years.

We wrote about this issue in more detail recently, and our conclusion was that there are no obvious short-term mitigations, bar direct government support to households and businesses. Hydrogen, which offers a possible long-term solution for storing energy, relies on technology gains. The UK government is hoping to use contract-for-difference auctions to help unlock 5GW of capacity by 2030.

Finding better ways of balancing local power grids is also going to be key, given wind farms and solar sources are often dislocated from areas of stronger demand. Electric vehicles offer a novel solution, effectively providing the grid with a network of batteries across the country, and an opportunity to balance local grids. Still, large investment in grid infrastructure will also be needed, which potentially could translate into higher energy bills.

The net-zero strategy also hinted at a pivot towards more nuclear energy, and the government is looking to make a final decision on at least one more nuclear site during this parliament.

In the meantime, however, the UK will have to adapt to more volatility in power prices over the next few years. This is unlikely to be the last time that power prices spike on unseasonal weather or indeed volatility in gas supply.

UK reliant on variable renewables and natural gas

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more