UK power price spike exposes the challenges of net zero electricity

UK power price volatility is unlikely to go away as the country transitions towards more wind and solar reliance. Hydrogen, grid investment and power pricing tweaks offer possible long-term mitigations. But before then, volatile prices pose both an economic and political challenge, not least maintaining current high levels of public net zero support

The recent surge in UK power prices could hardly have come at more awkward time for the British government, with a little more than a month to go until the county hosts the COP26 global climate summit in Glasgow.

True, the UK is not alone, and to varying extents the whole of Europe is grappling with higher energy costs. But the situation in Britain has become particularly acute. The one-month baseload forward, a gauge of wholesale electricity pricing, currently sits at more than double the level it has been at any point in the past decade.

In this piece we’ll look at why this is happening, the economic impact, but also some potential solutions. But the simple conclusion is that we should expect some ongoing volatility in power prices as the country begins its necessary journey towards green electricity and heating – albeit hopefully not quite to the same extent as recent weeks.

UK power prices have surged through September

The power price spike has revealed two key vulnerabilities in the UK’s energy system

The sharp spike in UK electricity prices through September owes a fair amount to bad luck. That was epitomised by a recent fire at the point where a key power cable enters England from France. The UK’s exit from the EU, and with it the internal energy market, has possibly also contributed at the margin.

But the UK is also a victim of its own progress on lowering emissions, and it’s revealed two key vulnerabilities as the country transitions to net zero.

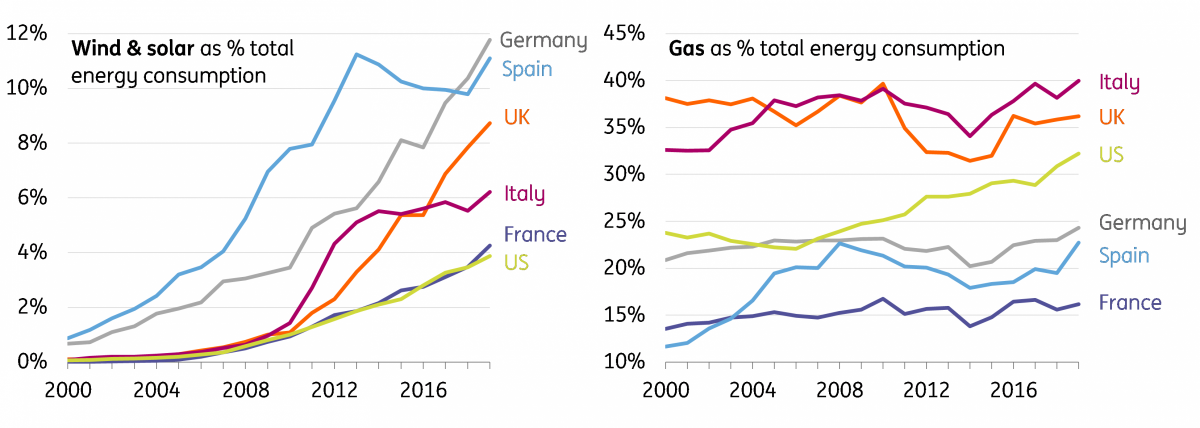

The first is that the UK has become particularly reliant on natural gas. This has coincided with one of the starkest falls in coal generation in Europe over recent years. Indeed, this is a key reason why the UK scores comparatively well on recent reductions in C02 output. Emissions have already fallen by around half of what is needed by 2050 under the government’s target, according to data from the Climate Change Committee. The percentage reduction in total carbon emissions has been the largest in the G7, and electricity accounts for almost half the decline since 1990.

UK power generation by source (% total)

The second vulnerability relates to the UK’s increasing reliance on ‘variable renewables' – that’s solar and to a greater extent, wind. The latter, in particular, is a key focus of the UK’s efforts to decarbonise electricity. It already accounted for 7.5% of energy consumption in 2019, and became significantly more prevalent during the pandemic when power demand fell, taking fossil fuel generation down with it. The government is planning for 40GW of offshore capacity by the end of the decade.

This is clearly a key part of the UK’s net-zero journey, but the transition also brings with it some major challenges.

July comfortably saw the lowest wind speed for that month this century

Admittedly, money isn’t one of them, given the price of offshore wind has effectively fallen by two-thirds since 2015. Private-sector involvement is incentivised by the government’s contract-for-difference auctions, which guarantee a minimum price for the supplier. From a public financing perspective, the costs are more minimal than for other areas of the net-zero transition. It’s likely to be energy efficiency in buildings that will require the largest near-term investment from the government.

Part of the challenge instead lies in getting renewables projects through various approval stages. The government is under pressure to streamline the planning process to help increase the flow of new projects.

But the more immediate hurdle is the volatility in how much renewable electricity is generated. Recent shortages in natural gas – which our commodities team link to a colder April/May, a redirection of LNG supplies to Asia, and less supply from Norway & Russia - have coincided with a particularly poor few months for UK wind. The latest data covering July shows comfortably the lowest wind speed for that month this century.

2021 has not been good for strong winds

No easy short-term solution to the UK’s power price challenge

In the short-term, escalating power prices are somewhat beyond the government’s control. As our commodities team notes, a fall in gas prices will rely heavily on winter temperatures.

Further power price pressure may well require the UK government to repeatedly step in to support heavy industry, as it has done recently with C02 production. And as the likes of France, Spain and Italy are already starting to do, the UK will be under pressure to directly support consumers. The cap on household energy costs is already set to rise by 12% in October, and a further double-digit rise next April seems increasingly likely, too.

We expect this to contribute over one percentage point to inflation by the second quarter of next year. This coincides with a tightening of fiscal policy via reduced welfare benefits and a forthcoming rise in taxes. The hit to the cost of living is one of the factors why we think the Bank of England will leave it until later in 2022 before hiking interest rates. Consumer confidence has already fallen fairly sharply in September.

Hydrogen offers one long-term option to minimising price volatility

It’s these short-term issues that will inevitably frame the debate heading into COP26, but there are some interesting longer term lessons too. Indeed the events of recent weeks are a reminder that price volatility is going to remain a common feature as the UK transitions to zero-carbon electricity, particularly from wind and solar.

The good news, for now, is that the arrival of autumnal weather appears to be heralding the return of stronger winds. But a key lesson of the past few weeks is that the UK’s progress on decommissioning coal power, while clearly a long-term success, has also left the UK with fewer ways to substitute for poor wind and solar generation.

Incidentally, this is a problem that many countries are likely to encounter over coming years. One of the conclusions of our team’s global energy transition scenarios published last year, was that gas demand globally is unlikely to peak until the next decade as countries seek a ‘backup’ for variable renewables. In terms of impact, our team has looked at the challenge of price volatility in detail and estimates that a 50% short-term increase in UK wind generation (eg as wind speeds change) lowers British electricity prices by 6.6%, and similar vice-versa.

UK reliant on variable renewables and natural gas

This means that finding effective ways of storing renewable energy is going to be particularly important for Britain – not least because capacity for storing natural gas has shrunk considerably in the past couple of years, following the closure of a site that housed 70% of the UK’s gas stocks up until that point.

Hydrogen is clearly one option, though as our US team noted in their write-up of New York Climate Week, technology remains an obvious barrier and for now it’s an expensive option. The UK released its strategy on this during August, with a goal of enabling 5GW of production by 2030.

Hydrogen may actually increase the UK’s dependency of gas in the short-term

Industry is now awaiting details on how contract-for-difference auctions, like those used for wind power to guarantee producers a minimum price for generation, could be structured to help unlock the £4bn private investment the government is looking for. The UK hopes to use this both for industrial power, but also potentially to replace gas in the country’s existing heating systems.

But as in many other countries, the compromise of quick hydrogen deployment may well be that not all of it is generated with green renewables. The alternative - so-called ‘blue hydrogen’ - is produced from gas, with the resulting emissions captured and stored.

In other words, hydrogen may actually increase the UK’s dependency on gas in the short-term, even if in the longer-term it offers a way of smoothing the UK’s volatility in renewables production and thus acts as a key component in the net zero journey.

The blue hydrogen approach also relies on further technological advances in storing emissions, though the UK is arguably at a more advanced stage than most in preparations for the first carbon capture and storage (CCS) clusters. This infrastructure enables emissions from various industries in close proximity to be captured and piped offshore.

Local power pricing and changes to grid design will help mitigate volatility wind

The final piece of the jigsaw is the electricity network itself. While the cost of wind and solar has fallen dramatically, it’s been replaced by other costs to account for the increased volatility that both renewables bring. 35% of the UK’s wind power is generated in Scotland, and there’s only so much grid capacity to move that electricity around the wider United Kingdom when supply exceeds Scotland's local demand.

Suppliers are frequently paid so-called constraint payments to turn-off the turbines on windier days to stop the system overloading. The tilt towards offshore over onshore wind over coming years will probably only amplify the constraints of the existing electricity grid.

The obvious solution to these challenges – adding more interconnectors to enable more power to flow around the country – is clearly expensive. Ensuring that new sources of wind and solar are spread evenly around the country, unsurprisingly, also offers part of the solution, in so far as regional weather allows.

But as a Policy Exchange paper proposed earlier in the year, local power pricing could also ultimately play a role. After all, rapidly rising sales of electric cars effectively provides the grid with a network of batteries across the country, and an opportunity to balance local grids. The UK’s current national electricity pricing offers few incentives for consumers to charge at times of lower local demand/higher supply – though dynamic (national) tariffs with cheaper overnight costs are becoming more prevalent.

Finding an effective, perhaps technology-based, method of incentivising consumers to charge their cars when it's windy or sunny locally may offer a helpful way of balancing the electricity network.

UK consumers more concerned about price spikes than renewables investment

The challenge of price volatility isn’t going away

The common theme running through all of this is that it’s going to take time. And much of it – not least hydrogen power – will rely on technological gains as much as capital investment. While the UK’s plans for net zero energy are clearly essential both for climate and long-term economic health, the transition process means the UK – like other parts of Europe – will have to adapt to more volatility in power prices over the next few years.

This is unlikely to be the last time that power prices spike on unseasonal weather or indeed volatility in gas supply – and indeed both hold the key to how serious the situation becomes this winter. Cost of living spikes will be a recurring risk – though it goes without saying that the longer-term impact of not taking action would be much greater than the near-term costs of the energy transition.

But there’s also a growing risk that the public becomes more disenfranchised with net zero, as some near-term costs become more visible. The good news is that around 80% of the public support the use of renewable energy. Keeping it at that level will be a key challenge for the government over the next few years.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article

29 September 2021

Sustainability: here comes the hard part This bundle contains 8 Articles