Thailand’s growth ends 2017 on a weak note

Persistent weak domestic demand undermines official optimism on 2018 growth outlook

| 4% |

4Q17 GDP growthYoY |

| Worse than expected | |

GDP growth slows in 4Q17

Consistent with our forecast, Thailand joined the majority of Asian economies in posting an economic slowdown in the final quarter of 2017. At 4.0% year-on-year in 4Q17, GDP growth came in below the consensus forecast, which was centred on an unchanged pace of 4.3% posted in 3Q17 (ING forecast 3.9%). A moderation of both exports and industrial production growth, as well as persistent weak domestic spending, were behind our below-consensus 3.9% forecast.

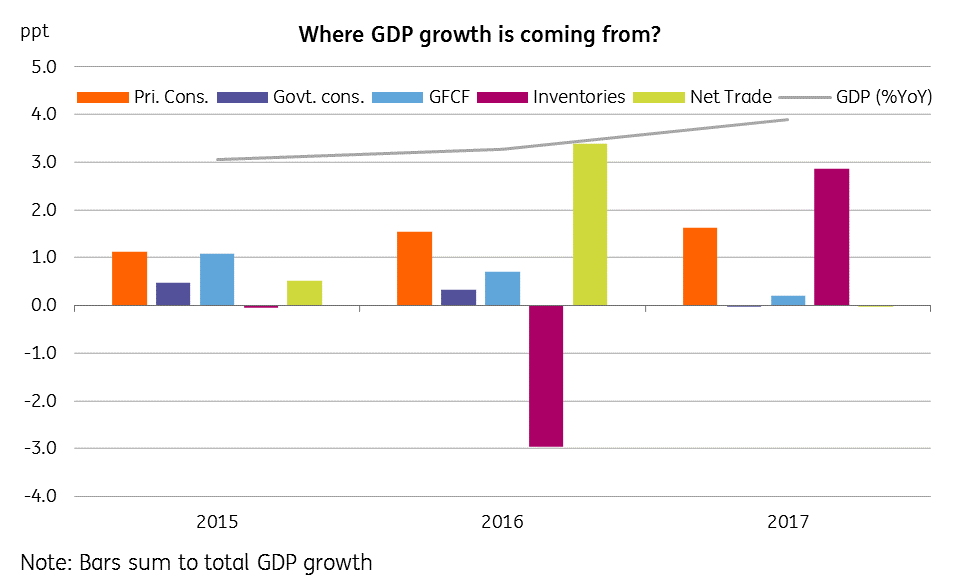

The slowdown from 3Q17 was broad-based. The contribution of all main domestic spending components – private consumption, government consumption and gross fixed capital formation – to headline GDP growth narrowed. The same was true for net exports despite an acceleration in trade growth. Inventories remained the main expenditure-side driver of GDP growth, accounting for more than half of the GDP growth in the last quarter. On the industry side, agriculture and manufacturing were the main drags.

What's driving GDP growth?

Outlook for 2018

This puts the full-year 2017 GDP growth at 3.9%, an acceleration from 3.3% in the previous year (revised up from 3.2%). The pick up in growth in the last year was mostly an inventory story rather than improvement in underlying economic fundamentals (see chart). Thailand’s National Economic and Social Development Board (NESDB), the agency responsible for national accounts statistics, forecasts 2018 GDP growth in a 3.6-4.6% range. The Bank of Thailand (BoT), the central bank, forecasts it at 3.8%. We are again below consensus with our 3.5% growth forecast for this year (consensus 3.9%).

We consider the official optimism on growth unfounded unless it receives support from a recovery in domestic spending, while de-stocking will likely weigh on growth. This means the economy will need further support from exports. However, the Thai baht’s (THB) appreciation works to dampen external demand. We do not think the BoT will want to complicate matters by joining the global tightening cycle, while weak domestic demand and low inflation warrant no BoT tightening anytime soon.

What's driving THB appreciation?

There has been no let-up in the THB uptrend coming into 2018, with 4.2% year-to-date appreciation already against the USD. The key force behind the THB strength is the high current account surplus. At about 11% of GDP in 2017, the surplus was barely changed from 2016. The large current account surplus is the result of weak domestic demand. The textbook remedy for such an imbalance is demand-boosting economic policies. With no scope for monetary easing, more needs to come from the fiscal side. Without this, a repeat of 2017's THB performance looks difficult this year. The NESDB forecasts THB averaging somewhere between 31.5-32.5 per USD in 2018 (spot 31.3). We are reviewing our end-2018 forecast of 30.6 for upward revision (consensus 31.3).

Download

Download article

20 February 2018

Good MornING Asia - 20 February 2018 This bundle contains {bundle_entries}{/bundle_entries} articles"THINK Outside" is a collection of specially commissioned content from third-party sources, such as economic think-tanks and academic institutions, that ING deems reliable and from non-research departments within ING. ING Bank N.V. ("ING") uses these sources to expand the range of opinions you can find on the THINK website. Some of these sources are not the property of or managed by ING, and therefore ING cannot always guarantee the correctness, completeness, actuality and quality of such sources, nor the availability at any given time of the data and information provided, and ING cannot accept any liability in this respect, insofar as this is permissible pursuant to the applicable laws and regulations.

This publication does not necessarily reflect the ING house view. This publication has been prepared solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. The information in the publication is not an investment recommendation and it is not investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Reasonable care has been taken to ensure that this publication is not untrue or misleading when published, but ING does not represent that it is accurate or complete. ING does not accept any liability for any direct, indirect or consequential loss arising from any use of this publication. Unless otherwise stated, any views, forecasts, or estimates are solely those of the author(s), as of the date of the publication and are subject to change without notice.

The distribution of this publication may be restricted by law or regulation in different jurisdictions and persons into whose possession this publication comes should inform themselves about, and observe, such restrictions.

Copyright and database rights protection exists in this report and it may not be reproduced, distributed or published by any person for any purpose without the prior express consent of ING. All rights are reserved.

ING Bank N.V. is authorised by the Dutch Central Bank and supervised by the European Central Bank (ECB), the Dutch Central Bank (DNB) and the Dutch Authority for the Financial Markets (AFM). ING Bank N.V. is incorporated in the Netherlands (Trade Register no. 33031431 Amsterdam).