Rates Outlook: The eurozone still has a long way to go

2022 is the year EUR rates wake up and smell the coffee. Monetary easing will stop, and tightening is around the corner. This should prove to be a rude awakening with higher rates, wider spreads, and curve movements increasingly dictated by rate hike expectations

EUR direction: Wake up and smell the coffee

|

Current value

|

Year ahead | 4Q21 | 1Q22 | 2Q22 | 3Q22 | 4Q22 |

|---|---|---|---|---|---|---|

|

10Y EUR swap

0.1%

|

Higher | 0.15% | 0.3% | 0.45% | 0.55% | 0.65% |

EUR rates face a long road to adjusting to a world of tighter monetary policy. It is hard to blame them, coming out of a decade of below-target inflation, relentless monetary easing, and lower-for-longer interest rates. No more. Our economics team forecasts inflation hovering around the 2% target, admittedly slightly below that level, for the years to come.

EUR rates face the longest road to adjusting to a world of tighter monetary policy

Notably, we expect 2023 to start with zero European Central Bank net bond purchases, and with the prospect of a 25bp hike within three months. As this prospect is roughly a year away, it has allowed EUR interest rates to take a more sanguine view of the global inflation groundswell. Some of it is justified by slower price dynamics than in the rest of the world, but tightening steps by other central banks, in particular the Federal Reserve, have the potential to focus minds in EUR markets.

The trajectory we envision for EUR rates is gradually higher, but with the risk of an acceleration when the ECB starts to officially discuss the prospect of rate hikes. The likely tail end of the current Covid-19 wave makes that discussion difficult in 1Q and potentially 2Q, but an early Fed hike would start the countdown to the ECB. The ECB also has to go through a tapering of its own. This is complicated by the fact that much of the fixed income market valuation rides on its purchases.

We see ECB hikes as a more potent driver for higher interest rates than tapering

Even if tapering is concluded by the end of 2022 as we expect, it will not immediately bring an end to bond scarcity, the fundamental reason for persistently low EUR interest rates. For this reason, and as ECB purchases will, conveniently, only be reduced once the bulk of supply activity is done in 2022, we see ECB hikes as a more potent driver for higher interest rates than tapering.

This should allow 10Y EUR swaps (against 6M Euribor) to climb by roughly 50bp over the course of 2022. This is a non-negligible rise, and it is possible that the first quarter of the year makes this target appear ambitious. We would still think risks are tilted to the upside towards the end of 2022, however, owing to the imminent start of the ECB hiking cycle we’re expecting for 2023.

EUR rates have a long way to normalise

EUR slope: One or two quarters before flipping

|

Current value

|

Year ahead | 4Q21 | 1Q22 | 2Q22 | 3Q22 | 4Q22 |

|---|---|---|---|---|---|---|

|

EUR 2s10s slope

45bp

|

Steeper | 50bp | 60bp | 70bp | 75bp | 80bp |

We think EUR curve developments stand a chance to escape the monetary tightening steamroller for one more quarter, two at best. This is because the focus in the first months of 2022 is more likely to be on assessing the economic consequences of the winter Covid-19 wave. Instead, primary market activity in bonds and borrowers' rate hedging behaviour should be the dominant drivers. This offers a chance for the EUR curve to continue steepening as borrowers move to take advantage of still low costs at long tenors.

Primary market activity in bonds and borrowers' rate hedging behaviour should be the dominant curve drivers

That state of play will persist as long as EUR markets manage to keep their mind off the possibility of imminent ECB hikes. We don’t think this will be long, a quarter or two at most. After that, front-end volatility will pick up and the odds of curve flattening will increase.

For an example of what this could look like, look no further than late October/early November 2021. At that time, the EUR OIS curve priced a whole 25bp hike within one year. It is possible that back then the reaction was magnified by the surprise, but the effect was a sharp flattening of the 2s10s and 10s30s segments. When markets wake up to the possibility of near-term hikes, and remember we expect it to take place in 1Q 2023, then flattening is likely to occur at longer maturities. In our forecast, this translates into 2s10s peaking around 80bp in 2022, before flattening back afterwards.

Meanwhile, the approaching tightening is going to translate into steepening pressure on shorter segments of the curve, for instance on 2s5s. The regime we expect the EUR curve to follow in the second part of 2022 should closely resemble that of the USD curve in most of 2021: with the 5Y sector seeing the most volatility, and with the curve flattening on rates sell-offs beyond that point.

5Y will become the most volatile part of the curve in 2022

EUR money markets: dealing with tail risks

|

Current value

|

Year ahead | 4Q21 | 1Q22 | 2Q22 | 3Q22 | 4Q22 |

|---|---|---|---|---|---|---|

|

3M Euribor

-0.55%

|

Higher | -0.55% | -0.55% | -0.55% | -0.55% | -0.50% |

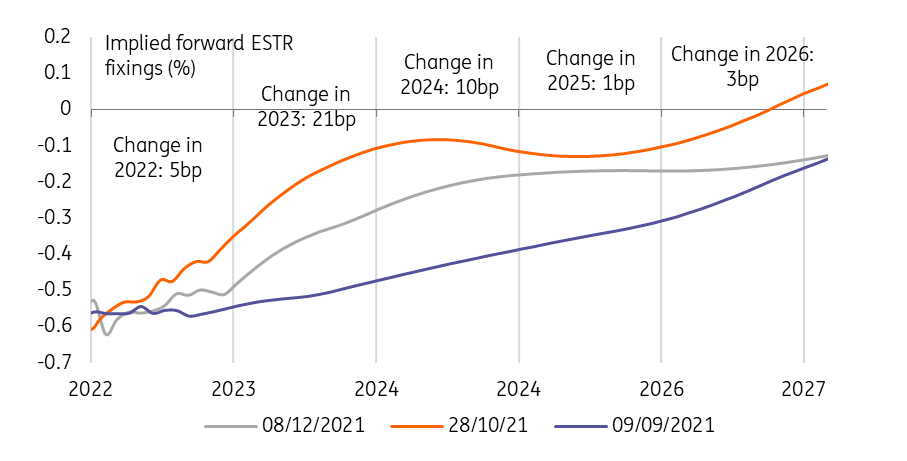

Currently, a mix of risk-off sentiment and year-end related factors has pulled front-end rates back from their recent highs. But with the ECB acknowledging the rising risk of inflation being stickier than anticipated, markets could price in the tail risk of higher key rates by the end of next year. Our view is that interest rates will only be raised in 2023, also because of the sequencing that the ECB has to go through when winding down its extraordinary policy support, ending asset purchases first. Yet while we think any ECB hikes priced at the very front-end are unlikely to materialise, rates further out are underestimating the extent and speed of the ECB’s adjustment once it decides to alter course.

Pricing of higher rates in 2022 is likely to prove sticky

The expiry of preferential terms in mid-2022 under which the ECB provided liquidity to banks via the Targeted Long-Term Refinancing Operations (TLTROs) adds another layer of uncertainty to short term rates. The risk is that banks choose to repay large portions of their drawn amounts, currently more than €2.2t, especially as the TLTROs then no longer mitigate the negative rate costs imposed on banks by the excess liquidity created via the ECB’s asset purchases.

The expiry of preferential TLTRO terms in mid-2022 adds to the uncertainty

Banks repaying the TLTROs would reduce the amount of excess liquidity, halving it in an extreme scenario, but it would still leave more than €2t sloshing around in the banking system. That should still put enough pressure on the €STR rate to keep it below the deposit facility rate of -0.50%. Nonetheless, banks could be seen to rely more on market funding which could widen funding spreads. In part, that scenario is already reflected in wider forward Euribor-OIS spreads.

That event is still some time off, so the ECB can still afford to wait before addressing the issue. And there are multiple ways the ECB could handle this. One could of course extend the favourable conditions, but further stimulating credit creation when inflationary risks are already increasing is questionable. That leaves the choice of addressing the negative rate costs more directly, via the deposit tiering. The ECB could increase the multiple of required reserves that are exempt from negative rates from currently 6 to 15, a value that would bring the costs to banks down to where they were when the tiered deposit system was first introduced in late 2019.

2022 hike may not materialise, but markets underestimate what comes after

Download

Download article

9 December 2021

Rates Outlook 2022: The liquidity overflow recedes This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more