Poland: A cautious MPC is in no hurry to hike rates

The post-meeting statement suggests the Council majority is confident that the current level of rates is appropriate for now; the MPC sees investment recovery but underlines fading wage pressures

Poland's Monetary Policy Committee left rates flat as was widely anticipated, but investors expect the Council to turn more hawkish following strong GDP and CPI figures. Both the post-meeting statement and later comments from MPC members suggest the Council sees risks to price stability as very limited. Particularly a statement from centrist R.Sura suggests he is unwilling to support a hike anytime soon. Chairman A.Glapiński even added that the data hardened his hike-averse stance and repeated he expects no hikes before 2019.

So a neutral stance has been reinforced. The post-meeting comments underline that GDP growth is likely to moderate in the medium to long run. According to NBP estimates, investments excluding mining rose by 6.9%YoY in 3Q17 as public outlays improved. The Chairman underlined that wage pressures faded lately (as unit labour costs decreased), while PLN appreciation already resulted in a significant monetary condition tightening. Also, the Council acknowledges the recent rise in CPI was largely driven by above-seasonal food prices.

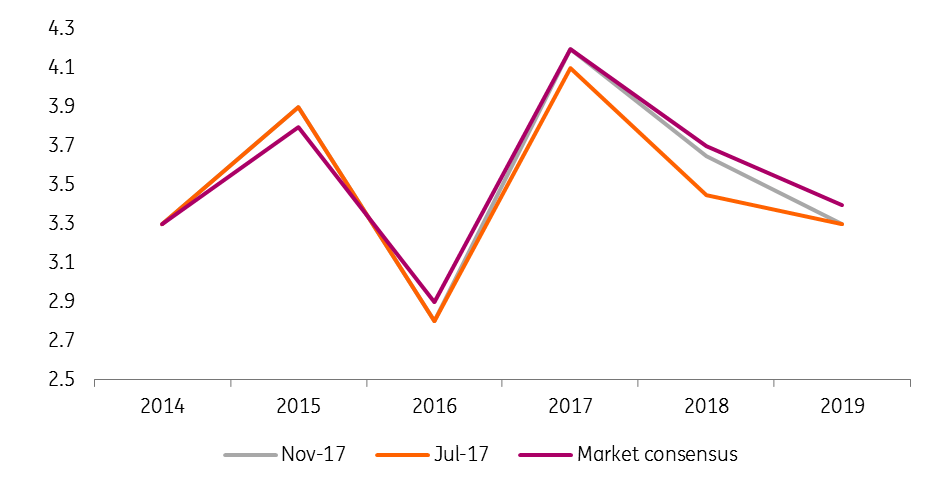

GDP - NBP projections vs market consensus

Consistently, we see only four members (E.Gatnar, Ł.Hardt, K.Zubelewicz and J.Osiatynski) who seem ready to deliver monetary tightening somewhere in 2018. Passing a hike against the Chairman would require the support of two out of three Council centrists (J.Kropiwnicki, G.Ancyparowicz and R.Sura). The recent comments of both G.Ancyparowicz and R.Sura suggest that is less likely to happen. We stick to our call for a first hike in 4Q18, and odds of an earlier hike have decreased.

The MPC decided to cut interest rates on mandatory reserves (from 1.35% to 0.5%), which is a limited burden for commercial banks and should boosts NBP profit marginally by PLN0.4bn (out of PLN9.2bn, an extraordinary high profit reached last year).

CPI - NBP projections vs market consensus

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more