Monitoring Hungary: The tough part is yet to come

In our latest update, we review our forecasts as Hungary inches closer to recession. Inflation is set to move higher, though the central bank has ended its rate hike cycle, as the economy faces local and global pressures. The key challenges ahead remain the EU deal and the energy crisis

Hungary: At a glance

- Big data and short-term risks are pointing towards a technical recession in the second half of the year.

- As price caps were extended into the year-end, it probably pushes the inflation peak into early 2023, when we expect a higher average inflation than in this year.

- The central bank ended its rate hike cycle at a 13% base rate and is now focusing on draining excess liquidity. So, hiking cycle ended, but tightening cycle continues.

- Volatility and high prices are characterising energy markets, which elevates the pressure on the country’s external balance and net external financing needs.

- Government spent an extra 1.2% of GDP to fill gas reserves, which comes on top of the planned 4.9% deficit, translating into a revised deficit goal of 6.1% in 2022.

- Moody's decided not to review Hungary due to mounting uncertainties, while Fitch noted that failing to secure an EU deal could result in an outright downgrade.

- The forint is still sitting on a roller coaster, remaining in the grips of energy price shocks, global risk aversion and local financing risk stemming from the EU debate.

- The fight against inflation continues through a new set of tools (managing liquidity and not rates), which resulted in an instant steepening of the yield curve.

Quarterly forecasts

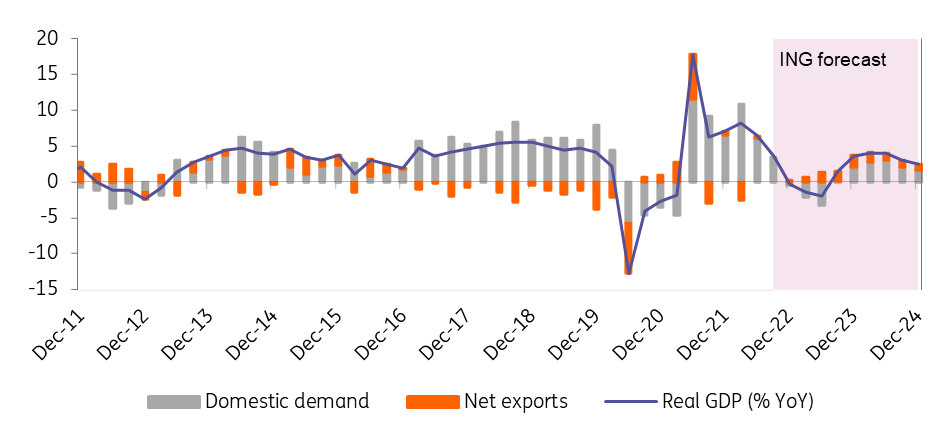

Technical recession is on the doorstep

After a sound second quarter performance (6.5% year-on-year GDP growth) incoming high frequency data regarding the third quarter economic activity haven’t looking tragic, yet. In contrast, big data like road usage, energy consumption and online cash registers are suggesting a marked slowdown during the third quarter. Monetary tightening, fiscal austerity measures, the rising cost of living are more in line with what big data suggests. In this regard, we downgrade our 2022 GDP outlook to 4.5% and cut next year’s forecast to 0.4% on average, seeing a technical recession during the second half of this year. With Europe facing rising recession risks due to the energy crisis, Hungary’s growth outlook is surrounded by significant downside risks.

Real GDP (% YoY) and contributions (ppt)

Key sectors still support Hungarian industry

The volume of industrial production rose by 6.6% year-on-year adjusted for working-day effects. Industry has been on an upward trend since April, as manufacturers are increasingly able to deal with problems arising from supply chain issues. All three major sectors of the local industry (auto, electronics, and food industry) performed well in July, while smaller ones have begun to adapt to the rising costs and lowering aggregate demand. Looking ahead, we see an extreme degree of uncertainty in forecasting industrial production. And although the manufacturing PMI in Hungary is still pointing to continued industrial growth, a turning point seems to be at hand. Shrinking re-pricing power goes hand-by-hand with lowering aggregate demand, which will eventually bite the sector. The level of orders is still 23% higher than a year ago, so there is some leeway ahead of the downturn.

Industrial Production (IP) and Purchasing Manager Index (PMI)

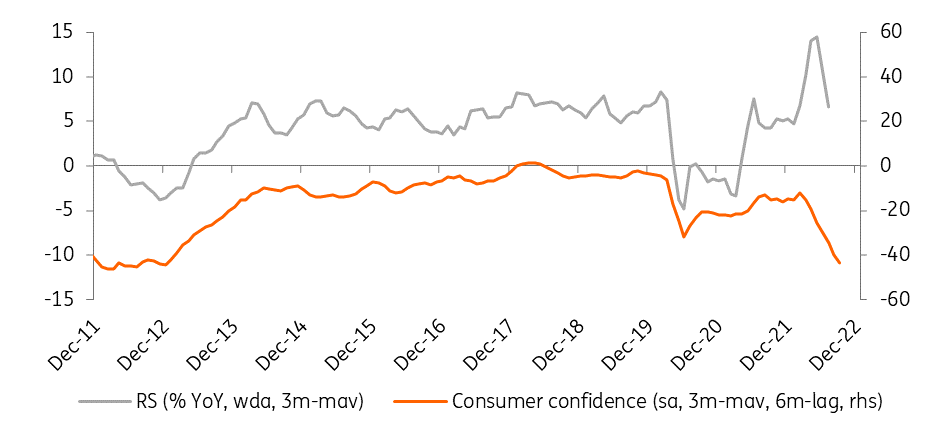

Retail sales show signs of weakness

Despite the first-sight good-looking 4.3% YoY growth in July, we see some red flags in the retail sector. The month-on-month growth came in at only 0.5%, so practically the base effect lifted the yearly performance. Moreover, we saw monthly declines in sales volume both in food and non-food retailing. The only part in retail sector which helped the overall growth was fuel. In essence, this one item ensured that retail turnover did not shrink continuously for four months. As we assume that this jump was a one-off due to an upcoming stricter fuel price cap regulation, this paints a rather gloomy picture. So, households have continued to adapt to higher inflation and the coming months will speed up this process as higher utility bills have been handed. Based on high frequency shopping data we see a significant drop in consumption during the third quarter.

Retail sales (RS) and consumer confidence

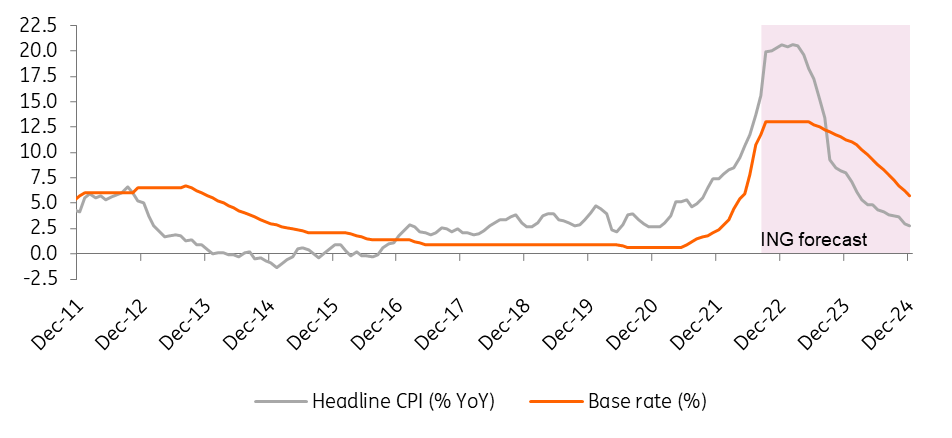

Inflation to hit 20% soon

Year-on-year inflation came in at 15.6%, a level not seen since May 1996. Price changes in food (especially in processed food), fast moving consumer goods and services were the main contributors to rising inflation. The changes in the utility bill support scheme will first land in the September figure, though Eurostat has already included it in its August figure which was showing a 3ppt extra impact. As the government extended the price caps into the end of 2022, we believe the inflation peak will come in at above 20% in December, resulting ein a 13.9% average in this year. Higher EUR/HUF forecasts and structural issues (eg, still strong repricing power of companies, expected wage support schemes) result in a higher inflation forecast in 2023. We see the average price increase at close to 15%.

Inflation and policy rate

Central bank ends rate hike cycle

The National Bank of Hungary surprised markets at its September meeting, hiking the base rate by 125 basis points to 13% and announcing the end of the hiking cycle. With this move it closed a mammoth tightening (16 months and 1,240bp). The goal now is to maintain the achieved strict monetary conditions and the focus shifts to tighten liquidity and improve monetary transmission. Markets have been sceptical so far about this change, which resulted in a new record intra-day EUR/HUF level at 424. However, we expect a turnaround as new liquidity measures will take effect from 1 October. These measures are the regular 1-week central bank bill auctions, the longer-dated deposit tool with floating rate and the stricter reserve requirement regulation. We see the NBH sitting out the storm, sticking to the 13% terminal rate at least until mid-2023, where we see a window of opportunity to start easing.

Real rates (%)

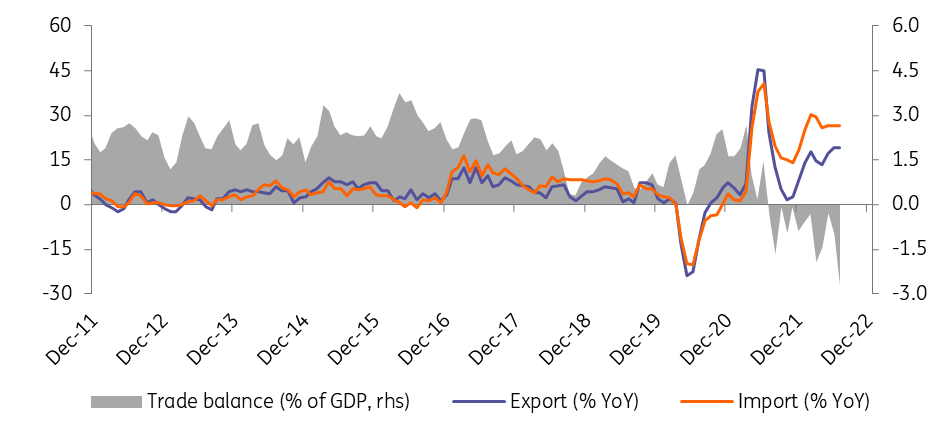

Trade balance surprises with a monthly surplus

The monthly trade balance showed a record high deficit of €1.1bn in July. This was the 13th month in a row with a shortfall in the trade of goods balance. The value of imports grew by 23% year-on-year mainly due to the rising energy bill of the country. Exports rose by 13% on a yearly basis, as production and exports of cars and electronics improved. The year-to-date trade deficit came in at €3.3bn, showing a €6.6bn deterioration over a year. On the export side prospects are uncertain at best, though the still high level of orders gives some short-term support barring a full-blown gas crisis. On the other hand, extremely elevated energy prices and a record weak HUF put further pressure on the country’s external balance. Meanwhile, lowering domestic demand limits imports somewhat. Against this backdrop, we see a 9% current account deficit in 2022 and a shortfall of 6-7% in the next year.

Trade balance (3-month moving average)

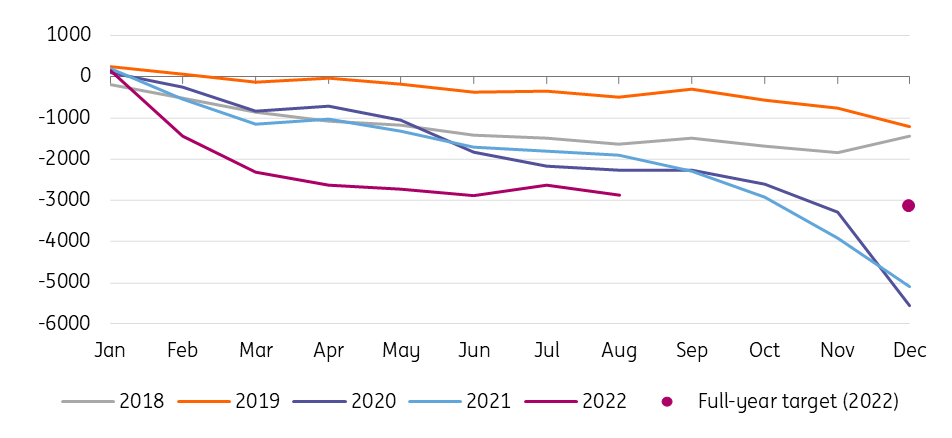

A technical revision to the deficit target

The Hungarian budget posted a HUF 236.2bn deficit in the month of August, after a surplus in the previous month. The cash flow-based year-to-date budget balance shows a HUF 2,872.7bn shortfall. The main reason behind the deterioration is the expenditure side, which is quite a surprise after the government announced a lot of spending cuts. As budget owners have failed to comply with government’s order, now the Finance Ministry is becoming stricter, overseeing all of the spendings, making sure that the needed spending cuts will go through the system. We see this rather a positive development, as government showing willingness to walk the talk. Also, there was a technical change in this year’s deficit target, which was moved it from 4.9% to 6.1%. This difference is coming from state guarantees put behind syndicated loans to utility providers to fill up gas reserves.

Budget performance (year-to-date, HUF bn)

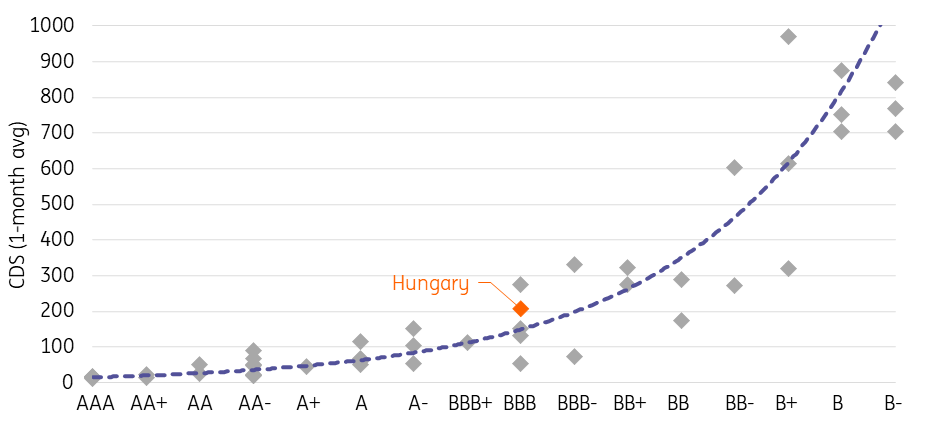

Negative rating action hinges on EU deal

After the second (and final) round of sovereign credit rating reviews ended in 2022, Hungary got away with pretty unscathed. Only S&P decided to downgrade the credit rating outlook from stable to negative, while Fitch affirmed the actual status and Moody’s skipped the review. However, in a non-review related note, Fitch Ratings raised attention that failure to obtain EU funding would be negative for Hungary. Considering that the Hungarian government is constantly working on law changes and has already accepted 16 in relation to EU recommendations, we see chances rising for a deal this year. We give an 80% chance to close the Rule of Law procedure in time to get access to the full RRF grants, while reserving a 10% probability for the deal slipping into 2023. We hold 10% chance for a failure as this is politics after all.

CDS and sovereign credit rating (Fitch Ratings)

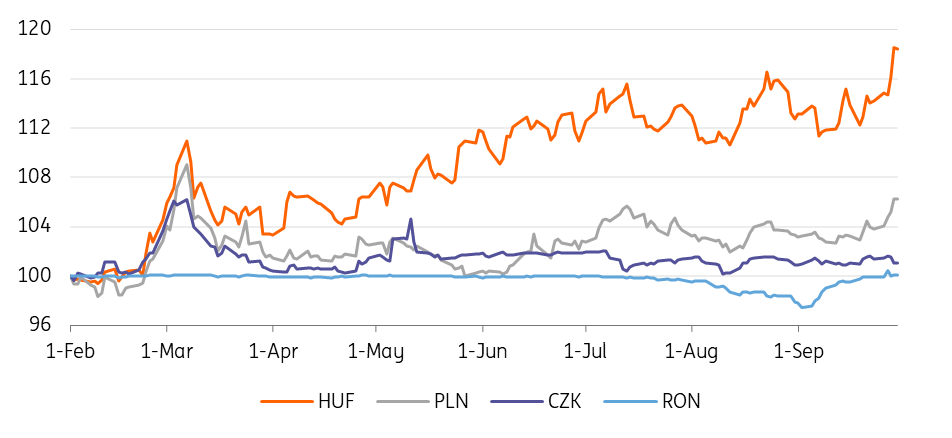

Forint breaks away from gloom by mid-2023

The support from the NBH's surprisingly large move at the September meeting was short-lived. A new round of energy woes (Nord Stream outage) popped up and related fear of external financing issues rose. These met with some fiscal uncertainty and the sudden end of the rate hike cycle, providing more than enough reason for a marked HUF sell-off. The forint weakened to new records versus all the majors. In the short term, we believe that the NBH's new liquidity measures will stop the bleeding and the forint will be able to come back to sub-410 levels. In the longer term, the topic of EU money remains on the table and will be with us until at least mid-November. We maintain our optimism related to the deal, giving the forint a boost to rally to 400 by the year-end. Looking into 2023, we expect an appreciation to 380 coming from reduced risk premium as winter ends, inflation drops, and economy starts its recovery from a technical recession.

FX performance vs EUR (1 February = 100%)

Yield curve normalization will have to wait

The NBH decision to choose the sudden stop instead of a gradual one found the market a bit unprepared. As a result, the entire IRS curve has moved down 15-40bp, a massive bull-steepening. The priced-in terminal rate has initially shrunk to 13.25%. However, as markets have started to figure out the expected impact of the new liquidity measures, a rebound has started. We see more of the same, as tightening liquidity will push yields of short-dated bills and bonds and FX swap yield higher. We see the new gravity line here to be the official central bank repo rate, which sits now at 15.5%. Interbank offered rates can go higher as well amidst a rising weighted average yield of central bank deposits as the new longer term deposit facility will pays a premium over the base rate. In a nutshell, normalisation of the inverted curve will be delayed for now.

Hungarian sovereign yield curve (end of period)

On the debt financing side, the Government Debt Management Agency is focusing on FX debt issuance with a roughly EUR 0.3bn worth of a green panda bond issuance in November. In our view, the agency might consider a USD-denominated bond issuance as soon as early 2023. These alongside the new retail bonds (showing a huge early success) will help lift some of the burden from the Hungarian government bond market in the remainder of the year. With the government inclined to reduce next year’s net financing need we see a further reduction in bond supply.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more