Monitoring Hungary: Taking turns

In our latest update, we reevaluate our Hungarian forecasts to take into consideration the turnaround in economic policies implemented in recent weeks. Though these will help build trust among investors toward Hungary, asset prices might remain in the grip of external factors in the short run

Hungary: At a glance

- We downgrade our 2022-23 economic outlook, mainly reflecting the changes in fiscal and monetary policies.

- The turns in economic policies and growing external price pressures uplift our inflation path.

- The National Bank of Hungary has flipped the switch again, becoming more aggressive, calling for a higher terminal rate.

- The unabated energy crisis keeps the country’s external balance under pressure despite some long-overdue changes.

- We see this year’s budget target within reach again, but there is growing uncertainty about 2023.

- Trust among credit rating agencies still seems intact, despite the countless challenges and unknowns.

- The biggest threat to the Hungarian forint remains the Rule of Law debate, while economic policy turns laid the foundation of a positive break-out.

- We believe there is still room to go higher in rates especially at the short end of the curve, resulting in curve flattening once again.

Quarterly forecasts

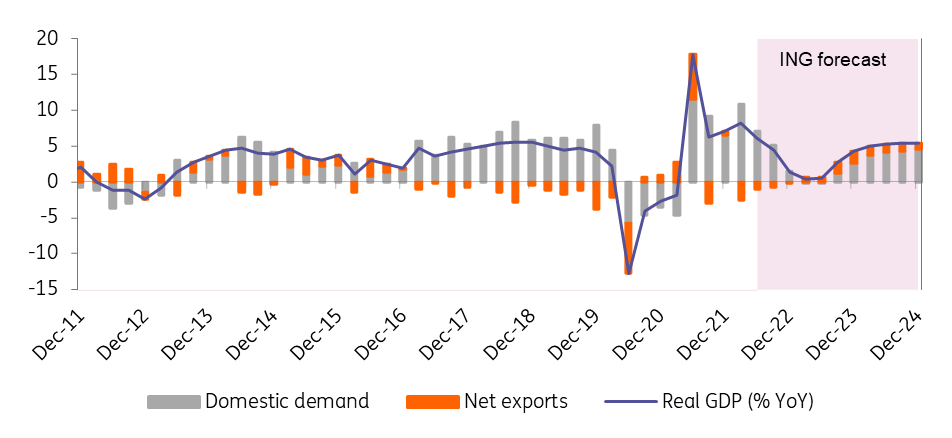

Technical recession is on the horizon

Incoming high-frequency data regarding second-quarter economic activity point to a good performance (around 6% year-on-year GDP growth) considering the circumstances. But shifts in monetary policy (from gradual to aggressive tightening), austerity measures on the fiscal side (tax hikes, expenditure cuts, revised utility bill support scheme), and the looming escalation of the energy crisis has led us to a negative revision of the GDP outlook for the second half of the year and 2023. Our base case predicts a shallow technical recession in the coming couple of quarters, yet full-year GDP growth could be around 5.0% year-on-year. In 2023, we see only 2% YoY growth with downside risks.

Real GDP (% YoY) and contributions (ppt)

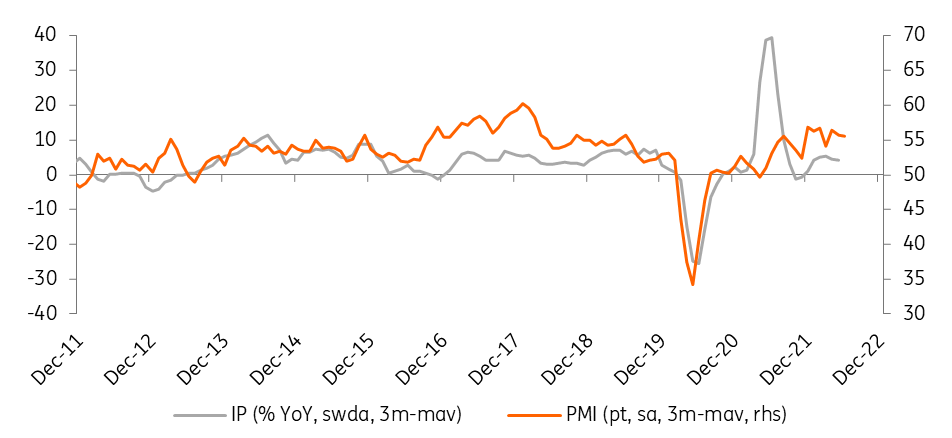

Industry is back on track, sort of

The sector's growth in May came in at 3.4% year-on-year, when adjusted for the working day effect. This is not a bad performance in this environment. Companies have slowly found alternative routes to buy supply-constrained spare parts. Important sub-sectors such as the car and electronics industries were able to raise their production in May. The big question for the next few months will be whether the two most important sectors (cars and electronics) will be able to further expand their production, and how much the food industry will be affected by supply disruptions (sanctions, war, drought). The still elevated manufacturing PMI (57 in June) and the packed order books (total stock of orders up by 30% YoY in May) are providing a glimmer of hope, which could be totally dashed by a full-blown energy crisis.

Industrial Production (IP) and Purchasing Manager Index (PMI)

Growth of retail sales slows

After extremely dynamic growth over the past few months, retail sales have slowed, yet the volume of turnover in the sector still expanded by 11.1% YoY. Food retailing showed stagnation on a monthly basis in May, which is unsurprising. Non-food retailing registered a 3.2% MoM drop, being the main driver of the slowdown. The positive impact of the first-quarter government transfers to households has started to abate. Fuel retailing is still doing well helped by the price caps on fuel prices. In all, the second quarter looks sound on consumption. However, changes in the tax system and in the utility bill scheme will reduce the real disposable income of households and probably translate into a drop in volume of consumption in the coming quarters, which will be a significant drag on economic activity and a main contributor to a technical recession.

Retail sales (RS) and consumer confidence

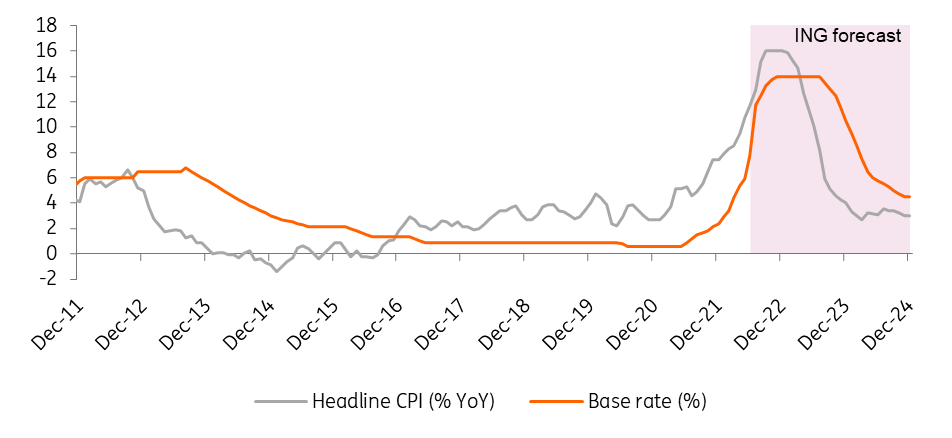

Inflation readings keep on rising

In June, the headline inflation caused less of a surprise with its 11.7% year-on-year figure. What has caused more of a shock is the core inflation reading, which jumped by 1.6ppt to 13.8% YoY. Price changes in food (especially in processed food) and in fast-moving consumer goods were the main contributors to the high figure. These alone would have been enough to revise our forecast upwards, but there is more. The changes in the utility bill support scheme and in the small business taxpayers’ itemised tax will raise inflation further. These will add 2-3ppt to the headline CPI reading from August over the next 12 months, according to our first estimation. This moves the peak to 16-17% in September-October, raising the 2022 and 2023 averages to 12.4% and 9.3%, respectively.

Inflation and policy rate

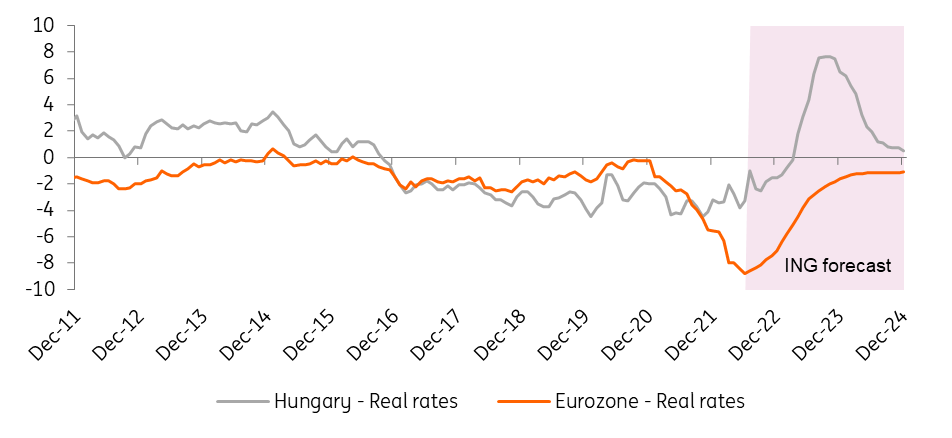

Central bank remains committed to tightening

After the surprise core inflation reading, and with underlying inflation strengthening to an extraordinary extent (2.0% month-on-month on average in the last three months), we predicted that the National Bank of Hungary (NBH) wouldn't be able to shift from its hawkishness, calling for a pair of 100bp rate hikes. The central bank indeed delivered as expected at its July rate-setting meeting with a 100bp tightening. With that, the Hungarian base rate moved up by a total of 485bp as a result of the last three decisions. We affirm our call that decisive tightening will continue (with another 100bp hike in August) and the NBH will probably lower its step sizes to be in line with major central banks. We see a gradual slowdown in the tightening cycle with a 14% terminal rate, with the last hike coming in December 2022.

Real rates (%)

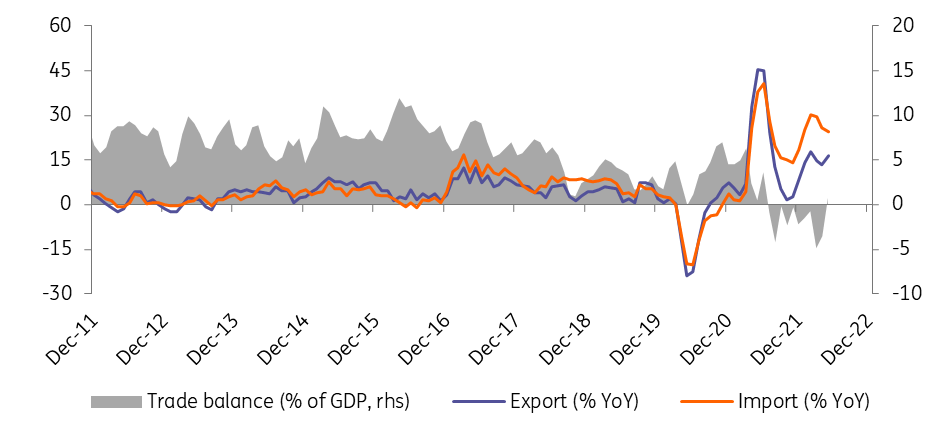

Trade balance surprises with a monthly surplus

The monthly trade balance showed a €153m surplus in May, surprising on the upside after 10 months of generating a deficit. The value of imports grew by 27% year-on-year mainly due to the rising energy bill of the country. Exports rose by 28% on a yearly basis, mainly due to the improving output in car and electronics manufacturing. The year-to-date trade deficit is close to €1.5bn, showing a €4.45bn deterioration over a year. With the increasing possibility of a full-blown gas crisis, export prospects are uncertain at best. Moreover, rising gas and electricity prices put further pressure on the country’s external balance. We downgraded our current account forecast (as a % of GDP) to 9-10% deficit in 2022 and to a shortfall of 5-6% in the next year with further downside risks.

Trade balance (3-month moving average)

Inflation boosts Hungary’s budget revenues

The budget posted a smaller-than-expected deficit in June, thanks to inflation which hit a 24-year high. Despite the ballooning energy bill, soaring revenues make it possible to meet the deficit target set at 4.9% of GDP. But rising prices alone wouldn’t do the trick. The government announced the first round of austerity measures in June, making a 3% of GDP adjustment with a mix of tax hikes and expenditure cuts. The second round closely followed after the declaration of an energy emergency in July. This package (tax hikes for small taxpayers and less utility bill support) will generate an additional 1.6% of GDP revenue, in our view. These make this year’s deficit target easy to reach, thus we don’t see any challenge in debt financing for the remainder of the year, even if there is an unexpected delay in closing the Rule of Law procedure for good.

Budget performance (year-to-date, HUF bn)

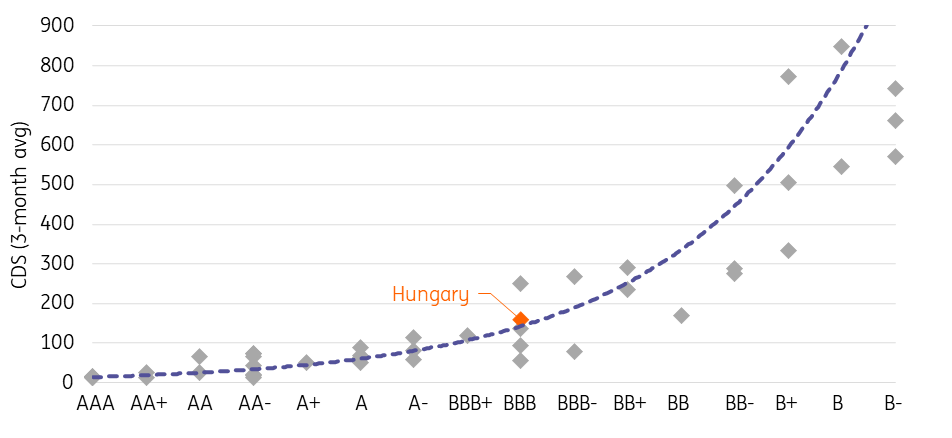

Chance for a negative rating action remains limited

Though there was the possibility of an outlook downgrade by Fitch Ratings in July, Hungary has avoided it for now. The base case for rating agencies remains – and we agree with them – that Brussels and Budapest will be able to settle the Rule of Law dispute by autumn, reopening the gate for incoming EU transfers. In case of a delay in this deal, we could see some negative rating action regarding the outlook, but not necessarily to the rating itself. However, a dead-end in talks (still a black swan event, as the government is well aware that too much is at risk with such an outcome) could result in a significant forfeiture of EU funds, triggering outright downgrades. But again, we expect an agreement to be reached by September-October, which could result in a significant net inflow of transfers during 2023, giving a huge relief in debt financing.

CDS and sovereign credit rating (Fitch Ratings)

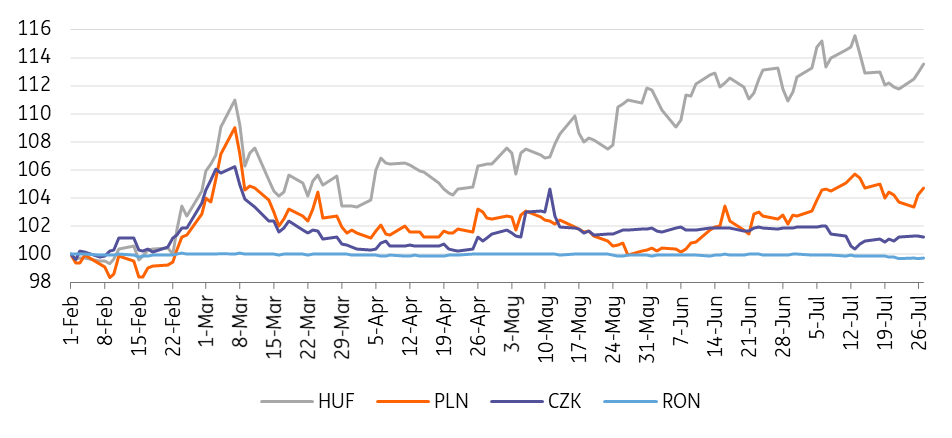

Forint remains in the grip of politics and geopolitics

The hawkish NBH and rising rate differential should protect the forint from another significant move above the 400 level, but on the other hand, it will not be enough for a strengthening below this level. Overall, we think this has reduced the forint's vulnerability to a possible dollar rally as a result of tomorrow's Federal Open Market Committee meeting or a meltdown in the European gas story, but it does not change the fact that its future path will be strongly driven by these issues. In parallel, early progress in negotiations with the European Commission could be a positive factor. For now, however, we rather expect a stalling in place around the 400 EUR/HUF level.

CEE FX performance vs EUR (1 February = 100%)

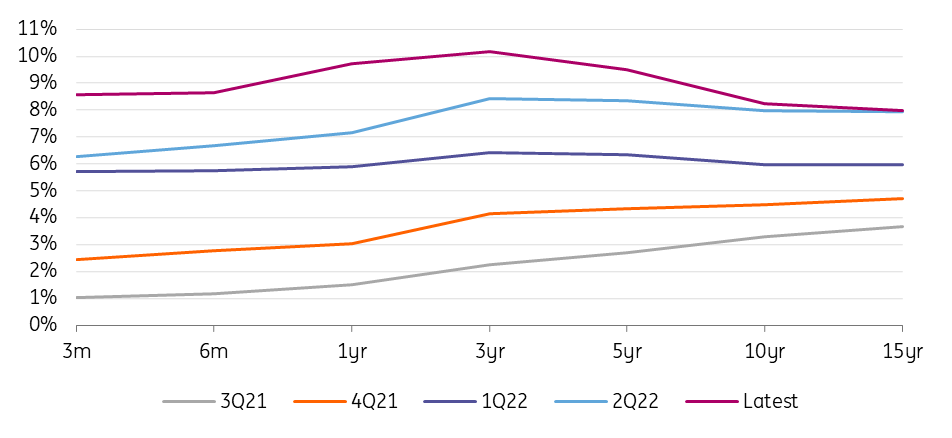

Flattener remains our call in rates

If we abstract from the miserable summer liquidity and painful bid-offer spreads, Hungarian rates remain the only space for the region's ratepayers, in our view. The market currently sees the terminal rate at 12.75%, well below our forecast. However, outright trades in current market conditions could be very painful. Thus, we prefer to play the curve, 2s10s flattener, which could return to its record lows of mid-July. Hungarian government bonds have richened significantly in nominal and relative terms and we can expect further tightening in ASW in the coming days. In the longer term, HGBs will be trapped between rising rates and improving (fiscal and geopolitical) fundamentals. We see the risk of a significant sell-off as limited at the moment due to the recent Fitch rating affirmation and positive news from the negotiations between the government and the European Commission.

Hungarian sovereign yield curve

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more