Hungarian inflation hits 24-year high and shows no sign of slowing

Both headline and core inflation readings were higher than expected in June. The latter was more significant and suggests more entrenched price pressures in Hungary. We are still months away from seeing the peak

| 13.8% |

Core inflation (YoY)ING forecast 12.9% / Previous 12.2% |

| Higher than expected | |

Inflation readings keep on rising

Inflation readings keep surprising on the upside, despite analysts adjusting their forecasts diligently. This time the headline inflation caused less of a surprise with its 11.7% year-on-year figure in June. Even though the monthly rate of inflation slowed from 1.6% to 1.5%, it is hardly enough to say that there has been a turnaround. What has caused more of a shock is the core inflation reading, which jumped by 1.6ppt to 13.8% YoY in June. We see two main reasons behind this higher-than-expected figure.

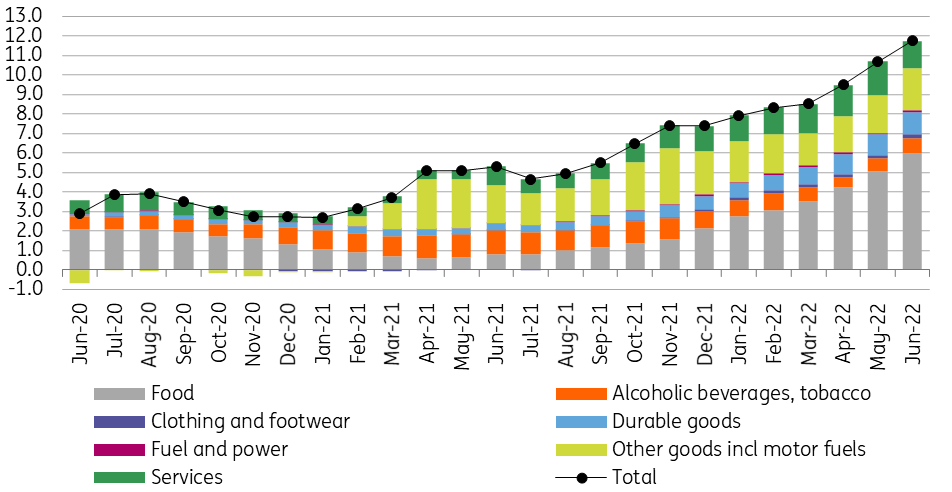

Main drivers of the change in headline CPI (%)

The details

- Food inflation accelerated further from 15.6% in May to 22.1% in June, which is responsible for a big chunk of the upside surprise. Though food inflation contains both unprocessed and processed food, the latter shows a significant strengthening. Some basic processed food items show a close to or above 40% year-on-year price increase. Due to strong economic activity, producers and retailers are keen to pass on the rising producer prices to consumers. With a close to 50% increase in agricultural producer prices in April, we see food inflation increasing further.

- Though signs pointed to an acceleration in durables inflation, it came in higher than expected at 12.4% YoY. Rising industrial producer prices are showing up in consumer prices as demand-supply mismatch prevails. Inflation also strengthened in the other goods and motor fuel category, which covers household goods, toiletries, pharma products, goods for recreation and education (besides motor fuels) – where most of the goods are part of the core inflation basket.

- The only relief in the June inflation print came from the category of services. The 1.2ppt deceleration from May is the result of the base effect. Last June, the economy had just started reopening, causing a significant repricing in services. On top of that, the government phased out free public parking while there was a one-off price increase in the telecom sector. So, in contrast with the 2.0% monthly inflation reading in June 2021, this June’s 0.8% price increase is more moderate. Although this looks good at a first sight, this is the highest monthly inflation in services over the past 11 months.

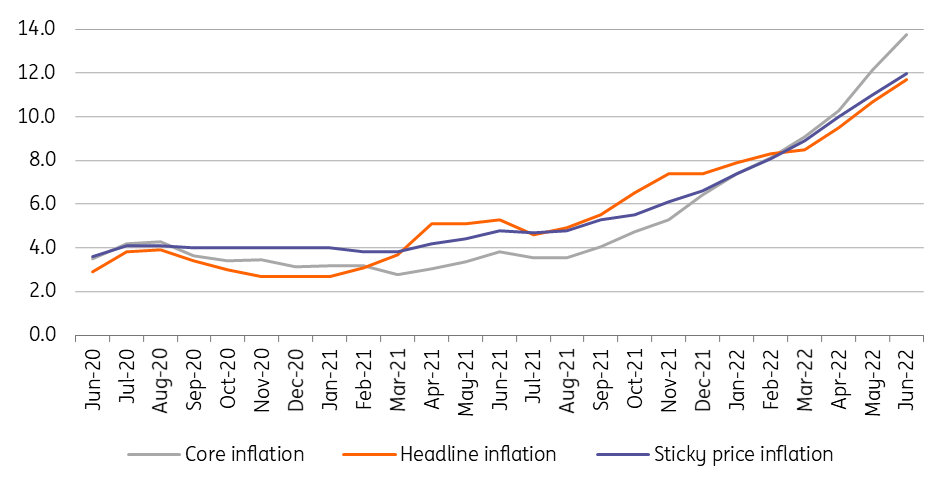

The composition of headline inflation (ppt)

Recent level of core inflation takes us back to 1998

Since there are market processes behind the price changes, the core inflation and the tax-adjusted core inflation have remained at the same level, 13.8% YoY. Regarding the core inflation, the last time the figure was this high in Hungary was mid-1998. Other underlying inflation indicators also suggest that high prices are becoming more entrenched. Sticky price inflation – a good predictor of medium-term developments in price changes – moved up to 12% year-on-year.

Headline and underlying inflation measures (% YoY)

No relief expected in the short-run, so we are changing our outlook

Inflation in Hungary is expected to strengthen further in the coming months. First of all, we expect the tax changes to impact both core and headline inflation from July. The government has raised the excise duty (alcohol and tobacco) and the public health product tax (certain sugary and salty products), while we also expect corporates to pass on some of the burden coming from “windfall” taxes.

On top of that, EUR/HUF reached a new record level versus major currencies (417 vs EUR in early July), which might trigger further price changes. In addition, there is no relief in sight for global commodity prices, and the labour shortage is also driving up labour costs.

In light of today’s upside surprises and taking into consideration the pipeline price pressures, we move our inflation forecast higher. The extent and timing of the peak in price pressure highly depends on price caps, which are in place until 1 October, but we see another delay in the phase-out. All in all, we expect headline inflation to peak in the 13-14% YoY range in September or October. On average, we forecast an 11.5% headline reading in 2022, with 7-8% inflation in 2023 with risks clearly tilted to the upside.

The central bank needs to remain aggressive

As far as monetary policy is concerned, as underlying inflation is strengthening to an extraordinary extent (2.0% MoM on average in the last three months), the National Bank of Hungary will hardly have an opportunity to give up on aggressive rate hikes. In our view, the recent inflation outlook suggests at least a pair of 100bp rate hikes in the next couple of months (with the possibility of emergency hikes should the Hungarian forint suffer again). In light of the latest monetary policy developments, our 9.75% terminal rate call is utterly outdated and now we instead see the peak in base and 1-week deposit rates at around 13% by the end of the year.

Download

Download snap