Monitoring Hungary: Risks accumulating

In our latest update, we reassess our Hungarian economic and market forecasts, as some high-frequency indicators show an improvement in economic momentum. Although we are sticking to our base case, a (so far minor) delay in the EU deal prompts us to highlight risks to our 2024 outlook

Hungary: at a glance

- The 90-day review period has been paused by the European Commission as it needs more evidence on the implementation of judicial reforms. Once the government has answered the nine questions, the clock can be restarted.

- With each passing day, the likelihood of a deal before the end of the year – our base case scenario – diminishes. In light of this, we revisit risks to our 2024 outlook, and therefore create an alternative scenario, just in case.

- We expect the technical recession to end in 3Q23, but a full-year recession likely cannot be avoided. In addition, next year’s prospects are increasingly uncertain.

- Despite retail sales and industrial performance pointing to an improvement in economic activity, we remain pessimistic on the full-year outlook for both sectors.

- The trade balance has displayed a marked improvement over the last six months, but the recent energy price rally could limit the upside.

- The labour market remains resilient, which bodes well for wage growth dynamics. At the same time this poses as an upside risk to the 2024 inflation outlook.

- Disinflation is shifting into higher gear, mainly driven by large base effects. We see several trigger points which could prompt reflation in 2024.

- Monetary policy is entering a new phase, with the base rate once again becoming the effective rate. We see a cautious NBH targeting a positive real interest rate environment.

- The government’s budget revision is still pending, but we suspect that the new 2023 deficit target could be increased to around 5% of GDP, questioning the feasability of next year’s target as well.

- We remain positive on the HUF as we have plenty of reasons for this - from positioning through monetary policy outlook to FX carry.

- In the rates space the market still seems to be in dovish mode, leaving room for more hawkish surprises. Market repricing is probably not over.

Quarterly forecasts

Full-year recession the most likely scenario

Hungary has been in a technical recession for a year now, with economic activity contracting in all sectors except agriculture in the first half of 2023. The positive contribution from agriculture was not enough to pull the economy out of technical recession and the collapse in domestic demand weighed on all sectors.

Although we expect the economy to emerge from technical recession in the third quarter of this year, – mainly on the back of agriculture – we see a full-year recession ahead. In addition, despite sticking to our base case scenario for striking a deal with the EU before the end of the year, we acknowledge that political risks are rising. This in turn increases the downside risks to our 2024 full-year outlook.

Real GDP (% YoY) and contributions (ppt)

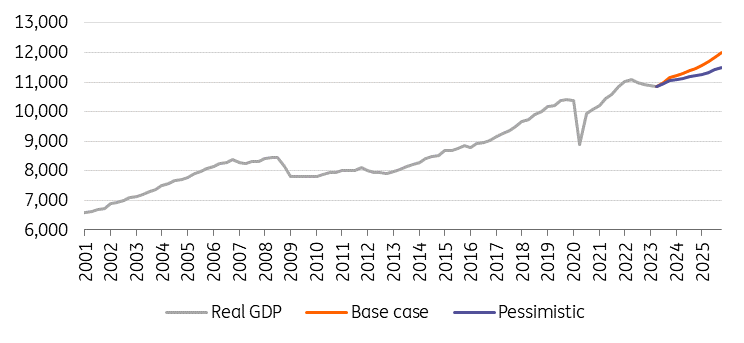

Our alternative scenario if EU relations take a turn for the worse

We expect the latest delay in the ongoing rule-of-law talks to be only a minor blip. Although so far we’ve been approaching the issue from a technical perspective, there is undeniably a political side to it. As a result, we highlight our alternative scenario. This sees a major delay in EU funds, with a deal only in the second half of next year, post EU-elections.

such a scenario is set to put further drag on economic activity (with lower investments, weaker business confidence), translating into weaker HUF and generating more inflation. This in turn implies an even higher interest rate environment than our base case, puttiong pressure on the budget and suggesting significant rebalancing needs. As a result, the growth pattern is likely to be closer to the likes of the early 2010s rather than a quick return to the golden years (our base case) as seen in the second half of the 2010s.

Our base case and the alternative scenario for real GDP (HUF bn)

Summer brought surprisingly good industrial performance

Industrial production surprised to the upside in July, as production volumes expanded by 2.8% month-on-month (MoM), limiting the year-on-year (YoY) decline in output to just -2.5%, adjusted for seasonal and calendar effects. At a sectoral level, the picture remains unchanged from recent months, with volumes expanding only in the electrical and transport equipment sub-sectors. As these sub-sectors are largely producing for export sales, we conclude that others are still struggling with domestic sales.

We may have seen a summer upturn, but the main question remains whether the turnaround can be long-lasting. We suspect that this is not the case just yet, and with recessionary forces building globally and which could weaken export prospects, we expect industrial production growth to remain negative for the full-year.

Industrial production (IP) and Purchasing Manager Index (PMI)

Retail sales struggle as real wages continue to slide

The retail sector is suffering from the cost-of-living crisis. The volume of sales in July fell by 7.6% YoY, adjusted for calendar effects, while on a monthly basis overall volumes declined by 0.2%. At the component level, both food and non-food retailing shrank, while fuel sales increased by almost 3% month-on-month. This is quite surprising in light of the steep increase in fuel prices.

Going forward, in the short-term the tourist season might boost retail sales, especially considering the World Athletics Championships' expected positive one-off effect. In general constrained household purchasing power remains a major drag on retail performance. Longer-term, depleted consumer confidence doesn’t suggest a quick recovery.

Retail sales (RS) and consumer confidence

We see limited consumption impact from the real wage turnaround

Average wage growth remained strong in July, rising by 15.2% YoY, albeit slowing a bit from June. After adjusting for inflation, real wages fell by 2% YoY, extending the negative real wage growth sreak to eleven months, the longest since the current wage data methodology was introduced. In our view, even after a turnaround in real wages, which should happen by September at the latest, the impact on consumption will be limited as the household confidence index sits at a decade-low.

At the same time, the resilience of the labour market is quite impressive despite the one-year technical recession The three-month unemployment rate rose to just 4.1% in the June-to-August period. Nevertheless, the tight labour market poses upside risks to inflation, with the expected 10-15% increase in the minimum wage next year set to lead to significant real wage growth.

Growth of real wages in Hungary (% YoY)

The oil price rally poses a risk to our current account balance call

The collapse in domestic demand led to a slowdown in economic activity in the first half of the year, which rapidly reduced the need for imports. In addition, as energy prices were significantly lower than a year earlier, the pressure on the trade balance from the import side continued to ease. Conversely, the export side continues to be supported by new EV battery plants, while car manufacturers are still dealing with some backlogs.

The rise in oil prices of more than 25% since the beginning of July may limit the upside to the trade balance as the energy import bill becomes more expensive. In this context, ING expects Brent oil prices to average $92/bbl in the fourth quarter of this year, clouding the short-term picture. We maintain our view that the current account will move into a small surplus in 2023, but highlight the recent oil price rally as a major risk factor.

Trade balance (3-month moving average)

Disinflation will shift into higher gear, but 2024 brings challenges

Headline inflation sunk to 16.4% YoY in August, mainly on base effects as prices rose by 0.7% compared to July. At the component level, food prices increased on a monthly basis as the government removed food price caps, while fuel prices rallied on the back of higher energy prices and stronger USD. On the other hand, services inflation has moderated, breaking a 13-month uptrend, indicating that the collapse in domestic demand has started to affect the pricing power of service providers as well.

Going forward, we expect disinflation to shift into a higher gear, helped by sizeable base effects. Headline inflation could well retreat below 8% by December. Next year, however, we see several risk factors that could trigger reflation - monetary conditions should remain restrictive as long as inflation returns to target on a sustained basis.

Inflation and policy rate

We expect the NBH to cut the base rate by only 25bp in October

At its September meeting, the National Bank of Hungary (NBH) delivered on its promise to simplify the monetary policy toolkit, effectively ending the normalisation phase. With the quick deposit tender gone by 1 October 2023, the reserve account is becoming the main instrument. The interest rate is tied to the base rate, currently sitting at 13%.

Going forward, the central bank will focus on incoming data, inflation risks, and market stability in its upcoming decisions, targeting an ex-post positive real interest rate environment. In this regard, as we expect headline inflation to fall to around 12.4% in September. We maintain our call that the central bank will only cut the base rate by 25bp in October. While acknowledging the risks of a 50bp cut, we believe that the EUR/HUF level and volatility could lead the Monetary Council to opt for a less dovish easing, thus providing renewed support to the HUF.

Real rates (%)

The new 2023 deficit target could be increased to above 5%

The Government Debt Management Agency raised this year's financing needs to HUF 4,133bn, bringing the year-to-date cash flow deficit to 80% of the full-year target, according to the latest August data. The current cost-of-living crisis has proved to be the Achilles' heel of the Hungarian budget, with the revenue side relying heavily on inflows from indirect taxes. From a cash-flow perspective, the situation is well under control, but the EDP deficit target is likely to be raised as well, after the government finalizes the fiscal revision.

Judging by policymakers' comments, we expect the new 2023 deficit target to be raised to above 5%, with limited room to announce additional consolidation measures. However, without changes to the structure of the budget, we believe that next year's EDP deficit target of 2.9% looks increasingly out of reach.

Tax revenues by main taxes, 2021 (in % of total taxation)

More hawkish central bank, stronger forint

Since the last NBH meeting, financial markets have remained in hawkish mode and, supported by rising core rates, have revised expectations for further rate cuts upwards, clearly positive for the HUF. Looking ahead, on a global level, a lower EUR/USD remains a downside risk in the short-term, however in the medium- and long-term it should in turn help keep EUR/HUF lower. On a local level, we believe NBH will be the main driver, at least until the end of this year. Although the market has already partially revised its expectations, it remains on the dovish side, leaving room for further appreciation on account of higher interest rate differentials.

Technical factors seem to be on the side of a stronger forint as well. Market positioning seems rather balanced and the market does not seem to be betting on further HUF weakness. At the same time, FX carry remains essentially double that of CEE peers and one of the highest in the EM space. Both should thus work in favour of a stronger HUF if the central bank confirms the hawkish bias as we expect. However there remain political risks, led by the EU money issue, which may become louder over the rest of the year. Overall, though, we remain positive on FX, with a year-end target of 375 EUR/HUF.

CEE FX performance vs EUR (30 December 2022 = 100%)

More room for hawkish repricing but long-term trend is clear

In the rates space, we have seen a significant upward re-pricing of market expectations for a NBH rate cut in recent days. The market still seems to bein dovish mode, with expectations more around 75-100bp for the meetings in the rest of the year. In our view, this leaves room for more hawkish surprises and probably that market repricing, supported by higher core rates, is not over. In particular, the short end of the curve still seems too low and, once the selling pressure from the core space is relieved, we may see a more pronounced flattening of the curve.

Looking at the 2s10s IRS, the HUF market seems to have almost closed the gap with CEE peers, as we expected. Given the central bank story the curve has moved too fast, in our view. In the long term we continue to see a lower and steeper curve, but in the short term we tactically expect some flattening to accommodate a cautious central bank.

Hungarian sovereign yield curve (end of period)

On the supply side forHungarian government bonds (HGBs), everything seems to be under control for now despite the recent revision of the funding plan. According to our calculations, the debt agency has covered roughly 80% of targeted HGBs issuance for this year and has also started to be more active in pre-prefinancing next year, with active switch auctions from the beginning of September. We don't have too many details for next year yet and the government deficit remains a major unknown, but the redemption profile seems more favourable than this year, giving hope that next year could also be under control.

On the demand side, however, we do not see as many positives. The government's recently introduced measures to boost domestic demand for HGBs will indeed continue to keep the market interested, but to a large extent this is probably already priced in. Combined with the hawkish central bank story, current expensive HGBs valuations and the aforementioned risks for the rest of the year, we prefer to look elsewhere within CEE peers at the moment.

Forecast summary

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download article