Four-quarter technical recession confirmed in Hungary

Hungary's statistical office confirmed the 0.3% fall in quarterly GDP in the second quarter of 2023, making the four-quarter technical recession official. Drivers of the poor performance reinforce our view of a full-year downturn

A true disappointment

When the Hungarian Central Statistical Office released its advanced estimation of the country’s second-quarter performance, the data caused a major negative surprise compared to the market consensus. The vast majority of the market, including ourselves, expected the technical recession to end after three quarters. We were all disappointed. The detailed data are difficult to interpret and present a somewhat mixed picture compared with the economic assessment from other statistical sources. However, today's release also helps to understand why we saw a 0.3% quarter-on-quarter decline in the second quarter, resulting in a 2.4% year-on-year fall in the volume of GDP.

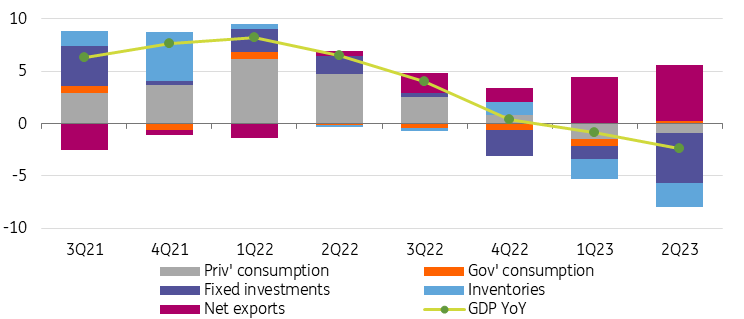

Hungarian GDP growth

Hungary’s GDP embellished by agriculture

Let's start our deep dive with the production side, where there is a good deal of controversy. Although agricultural value added surged by 67.9% year on year, this was entirely due to the base effect. Last year was purgatory for the sector, due to the impact of the Ukraine war, the related energy crisis and bad weather. So, such a huge annual improvement was always going to be on the cards. What wasn't expected was that the sector's quarterly growth was negative in the second quarter (-2.3% QoQ), contrary to the widespread expectation of a boom. Preliminary crop yield results suggested a nice improvement in the sector, although it seems that this will not be felt until the second half of the year.

In other sectors, we saw negative results continue to emerge. With high-frequency data suggesting a continued collapse of domestic demand, the yearly and quarterly drops in value added in industry (-5.7% YoY) and construction (-6.0% YoY) hardly come as a surprise. However, what is really disturbing is the weak performance of services with its 2.4% year-on-year contraction. It seems that the start of the tourism season wasn’t enough to salvage the tertiary sector during the second half of the year. With dropping production in industry and construction and with the shrinking purchasing power of Hungarian households, retail, logistics and leisure-related services collapsed.

Among services, the area of healthcare has seen a significant increase as a result of the fine-tuning of the healthcare system. Healthcare providers are being encouraged to request screening and follow-up tests after the initial patient visit, which has increased the demand for public healthcare, resulting in long waiting lists, which also increases the demand for private healthcare.

Contributions to GDP growth – production side (% YoY)

Investment activity has nosedived

Focusing on the expenditure side of the GDP, overall, there were more questions than answers in the detailed data. The actual final consumption of households shrank by only 1.0% on a yearly basis in 2Q23. This is an improvement on the first quarter, and is also confirmed by the 0.6% rise in volume on the previous quarter. Household consumption was flat on a quarterly basis, while high-frequency data suggested a significant decline based on retail sales, energy consumption and domestic leisure activities data, as well as the large underperformance of VAT receipts. So, this second quarter consumption data hardly fits the overall picture.

More interestingly, social transfers in kind also increased on both a quarterly and an annual basis. Perhaps this is also related to booming health services. Otherwise, the only explanation would be that the Overhead Cost Reduction Scheme is somehow accounted for here (as the government offers a preferential price for gas and electricity up to average consumption).

The increase in government consumption on a quarterly and annual basis is also a bit of a positive surprise. However, here we may be seeing the impact of a spending spree on the nation's military defences. The counterbalance for these positive surprises, which is dragging quarterly GDP growth into negative territory, is in gross capital formation. First of all, we have seen a big drop in inventories, while investment activity shrank by 15.6% year-on-year due to a high base and a 5.8% quarterly contraction. The high interest rate environment, the expiry of subsidised credit programmes, fiscal issues, the lack of EU funds and the slowdown in the real estate sector are becoming a drag on gross fixed capital formation.

Unsurprisingly, the contraction of the economy on a quarterly basis and the deepening of the year-on-year downturn in the second quarter are explained by the faltering of domestic demand, which subtracted 7.8 percentage points from GDP growth. Net exports offset this with a positive contribution of 5.4 percentage points. Collapsing domestic demand reduces the need for imports, so the annual and quarterly decline in import activity is hardly surprising. However, despite industrial production suggesting solid export activity from car and electric vehicle battery manufacturers, export activity fell on a quarterly basis.

In our view, this is a warning sign in the wake of the global industrial recession. On an annual basis, however, we have seen an improvement in the ramp-up of new capacity, which explains this solid positive contribution from net exports.

Contributions to GDP growth – expenditure side (% YoY)

Downward revision to full-year growth prospects

In light of the detailed second quarter GDP release, we are revising our full-year GDP forecast downwards from 0.2% to -0.5% YoY, as we now see a recession in 2023. Although we expect the economy to perform better in the second half of the year, we are concerned that the hole dug in the first half of the year is too deep to climb out of quickly.

We were surprised by the -2.3% QoQ performance of agriculture, but we acknowledge that at this point we are dealing with model estimates rather than actual economic performance. Given that the agricultural season typically starts in the summer, it is the third-quarter performance that should stand out. In our view, the Hungarian economy is likely to emerge from a technical recession in the third quarter, but based on sectoral developments, only agriculture could save growth in the third quarter with its expected large positive contribution.

Although real wages are expected to rise towards the end of the year, consumer confidence is at a 10-year low and much of the population has depleted their savings. As a result, despite the positive impact of real wage growth, we do not expect consumption to pick up significantly in the coming quarters. Export volumes have largely held up so far, but with global leading indicators pointing to a build-up of recessionary forces worldwide, this could weaken export prospects and thus limit the positive contribution.

In addition, the housing market is only just starting to bottom out, while we expect interest rates to remain in double digits for the rest of the year, dampening both private and corporate investment. As far as public investment is concerned, the tight fiscal situation and the lack of EU funds hardly bode well for a rapid recovery in investment momentum.

Looking ahead to 2024, we expect consumption to pick up as household purchasing power continues to rise. This will be supported by a tight labour market and improving consumer confidence as the economy becomes healthier and disinflation continues. The latter will help monetary policy to lower interest rates, which will help to improve the investment picture.

An improved business climate will support private investment, while incoming EU funds will help public spending boost economic activity as well. As domestic demand is expected to pick up, imports will do the same, while the growth of export activity will slow down due to the reduction of backlogs and limited external demand. As a result, we see a 3.4% GDP growth in 2024.

Securing a deal with the EU is necessary

In this regard, we believe that securing EU funds should be the government's top priority and we still believe that a deal can be struck before the end of the year. Failure to secure a deal with the EU would have devastating consequences. In the short term, markets would be hit by heightened volatility, not to mention the very real risk of credit downgrades by the rating agencies.

Over the longer term, the lack of fiscal space arising from missing EU funds would create structural problems. Austerity measures would have to be implemented to tackle the rising deficit, while the loss of public investment would put the economy on a slower growth path. All in all, we believe that an agreement with the EU is necessary, as market and structural risks pose an extremely serious problem. For this reason, our GDP forecast in the base case includes the hypothesis of a timely agreement between Budapest and Brussels.

Download

Download articleThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more