South Korea: Short term risks, long term payoffs

Korea was one of the most successful countries in Asia at combatting the Covid-19 pandemic in 2020, managing to avoid mass lockdowns. But it is now being tested as it lags behind the global vaccine rollout race. Strong current GDP growth is at risk if faster vaccination progress is not achieved

GDP and inflation on the rise

Korea experienced a decline in real GDP of 1% in 2020. Compared to most countries in the region, or even globally, this was a very good result. And it owes a lot to the approach taken by Korea to deal with the Covid pandemic.

By concentrating heavily on test/trace/isolation, Korea kept its daily infection numbers low, and the disease never spiralled up to a point where this process broke down. As a result, mandatory national, lockdowns were avoided, though there were of course a number of social distancing measures and restrictions put in place to support the testing process.

Korean GDP emerged from Covid relatively unscathed

Lockdowns in particular, as well as other restrictions, have been doing most of the economic damage in this pandemic. Consequently, Korean GDP emerged from the main Covid wave in Asia relatively unscathed. Currently, restrictions only extend to bans on nightclubs, karaoke bars other nightly entertainment facilities.

GDP beat expectations in the first quarter of 2021, rising 1.6% from the previous quarter, faster actually than the previous quarterly growth rate of 1.2%. That took GDP in Korea to pre-pandemic levels and suggests that by the end of the year, Korea may have made up all of the ground it lost in 2020.

The strength of GDP in 1Q21 owes more to a broad-based contribution than to any particular subcomponent. During the depths of the pandemic in 2020, depressed domestic demand meant that net exports provided an outsize lift to GDP. In 1Q21, net exports contributed nothing to growth, as rising imports offset all the export boost. But there were moderate gains in all domestic demand sectors, from private consumption, investment, some re-stocking and boosted by continued government support.

This is encouraging as it leaves the economy less exposed than if one single sector was bearing all the burden for economic growth, and gives us more confidence to upgrade our forecast numbers.

Contributions to YoY GDP growth (pp)

GDP strong, but so is inflation

We have already lifted our 2021 full-year forecast to 3.6%, and we are looking to raise it further, with a realistic chance that 2021 GDP growth exceeds 4% this year.

It is not just GDP that is making a strong recovery. After 28 months below 2%, headline inflation surged higher from 1.5% to 2.3%YoY in April. This wasn’t due to any particular surge in the April price level, which only rose 0.2%MoM, within the normal range of monthly volatility. But compared to a 0.6%MoM decline in prices in April 2020, it looks very strong.

Just like the US, the jury in Korea is out on just how much of this inflation increase is transitory and how much will stick. One way of answering this question is to see what is going on in the labour market and see if there is any embedding of higher prices in tighter labour markets and higher wages.

Unemployment, employment and the labour force

Labour data requires some verification

The evidence from the labour market in Korea, like so much else currently, has to be taken with a pinch of salt. Certainly, there is a coincidence in the recent pick up in inflation which matches a sharp decline in the rate of unemployment. And the unemployment rate has fallen in line with the rise in employment and a rising labour force, which looks encouraging. Scratch the surface a bit deeper, though and you find there is more to this than it first appears.

It looks like the younger generation is struggling to gain access to quality employment

Splitting the unemployment rate by different age groups, you see that there is still very high unemployment for the younger age groups, while the drop in unemployed at the 60+ age group suggests these individuals were pushed out of the labour market into retirement during the pandemic. It is better news for those of prime working age, which is probably better for future private consumption. But it looks like the younger generation is struggling to gain access to quality employment, which is worrying and argues for some structural labour reforms.

Unemployment rate by age cohort

Korea's slow vaccine rollout

Korea had a better pandemic than most, but it is having a really poor vaccine rollout. Like many countries in Asia, Korea has struggled to get access to physical vaccines, despite signing deals with some of the main producers in the west who have taken a “me first” approach to vaccine distribution. Vaccines are beginning to arrive now, but Korea lags behind even many developing nations in the region.

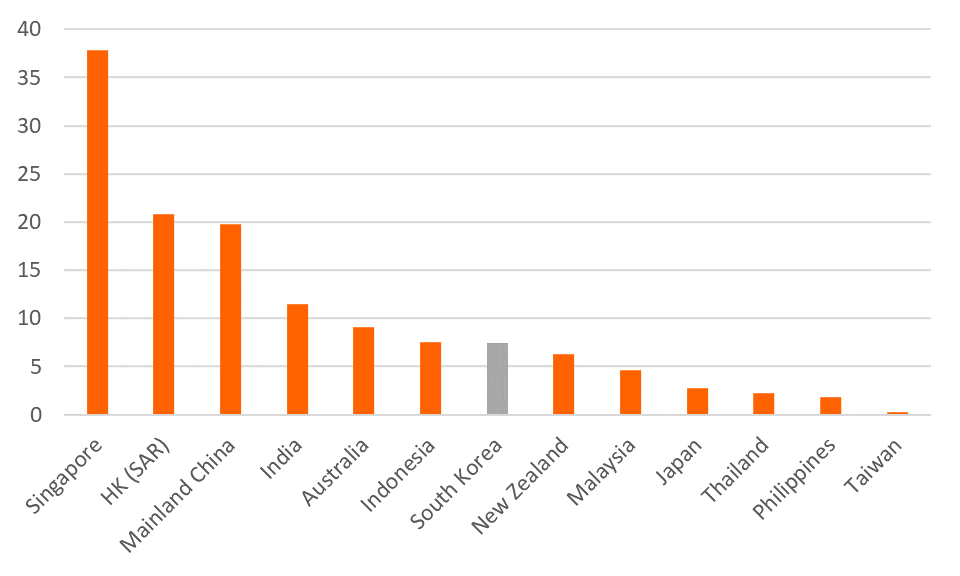

Asia - Vaccinations per 100 population as at 6 May 2021

Korea's domestic vaccine industry slow off the blocks

Korea does have a vaccine industry, but it has been slow off the mark compared with some others, and domestic vaccine companies have not yet started late-stage trials of their own vaccines. It will be some time before Korea’s home-grown vaccines come on stream for the domestic population. SK Bioscience has got a license to begin producing the Novavax vaccine, which it will start to produce in June, aiming at delivering 20 million doses by the end of 3Q21.

Korea's vaccine rollout has been slow off the mark

South Korea “secured” enough vaccines for the whole country quite early, making contracts with Astra Zeneca, Pfizer, Johnson and Johnson, Moderna and also the WHO Covax scheme. However, like many other countries, Korea quickly learned that there is a difference between having a contract signed on a “best-endeavours” basis and having actual vials of the physical vaccine in a fridge.

Obtaining the Astra Zeneca vaccine, Korea was slow to roll it out owing to confusion about its efficacy for older patients. This on/off approach to the Astra Zeneca vaccine has contributed to unease among the population about one of its most readily available vaccines – which hasn’t helped. The Pfizer vaccine only was only just beginning to be administered by late February.

Coronavirus cases

7-day moving average and cumulative total cases

Daily case numbers are still low in Korea, averaging a little over 600 cases per day on a 7-day average basis. Though as we have learned from India, it takes only a month to go from a totally manageable situation to an apocalyptically bad one. And India has vaccinated a greater proportion of its population than Korea.

Industry and exports

As the Korean GDP data shows, the economy continues to recover from the pandemic, and right now, is pushing ahead having recovered all lost ground to the pandemic. But it has not been an even recovery.

Korea’s manufacturing sector has done far better than the service sector. To some extent, this reflects the massive demand for consumer electronics that has sprung from lockdowns, and households need to upgrade both their working from home hardware as well as their entertainment systems.

Business sentiment by sector

Year-on-year figures are currently distorted by huge base effects as the comparison month last year was during the period of maximum economic shock. But the sector breakdown is instructive.

Contribution to YoY export growth by type (pp)

Semiconductor exports have done well, with both prices and volumes taking off (a great combination for corporate profits if you are a manufacturer of these products). But this has been a much less concentrated recovery than some in the recent past, and the initial electronics-focused gains have broadened out to other sectors such as autos, petrochemicals, and steel. Relatively speaking, mobile phones and computer exports have been quite soft.

Semiconductor prices rising

Total exports are back at the top of the range they have been stuck in since the global financial crisis but looked poised to break out on the upside before too long. Intra and extra-Asian exports have broadly risen in lockstep, but intra-regional exports account for almost two-thirds of Korea’s exports, and mainland China alone about 20% of the total.

Total Exports

$m

Production usually closely reflects export data, but at the moment it doesn’t overlay very well. Strong auto exports are not matched by strong auto production, probably owing to ongoing chip shortages which are hindering a number of industries, but especially the auto sector. And clothing is making a surprise bid for the top position in terms of year-on-year growth, though like so much currently, strong base effects are heavily distorting such comparisons, and we think it is probably better to skip quickly on in case we start to draw conclusions that don’t stand the test of time.

Production by type of product

Contribution to YoY growth, pp

The recovery in the service sector has been altogether less impressive, and that most likely reflects the fact that there are still social distancing restrictions in place. A stronger service sector recovery will likely go hand in hand with the vaccine rollout and further easing of restrictions. And given the pace of the current vaccine rollout, this is more likely to be a 3Q/4Q feature than a 2Q story.

Central Bank and markets

There hasn’t been all that much for the Bank of Korea (BoK) to do recently. During the pandemic, the BoK introduced unlimited liquidity provision through repo markets, enhanced dollar funding, expanded financial institutions collateral capacity, launched a corporate bond backed lending facility and provided KRW5tr to SMEs.

Policy rates (the 7-day repo rate) were reduced from 1.25% to 0.75 in March 2020, and then again to 0.50% at the end of May 2020. Since then, the BoK has not had to do anything with monetary policy as the onus for economic support passed to the government and fiscal policy.

And we don’t anticipate the BoK doing anything anytime soon either. There will, as we mentioned, be some near-term increase in inflation but no one is getting very excited about this base-driven event, and the consensus expectation does not anticipate policy rates rising before 3Q22, which is in line with our own thinking. It is worth noting that this will be considerably before rate increases are expected from the US Fed and this is one reason why are still anticipating some KRW appreciation on a longer-term horizon.

The other factor why rates may rise ahead of the Fed is the now widespread increase in house prices and growing concern over the high levels of household debt fueling this housing increase.

Residential property prices (YoY%)

What this rising household debt means is that any eventual rate increase the BoK does will have a proportionally bigger impact on increasing debt service and reducing disposable incomes. So the outlook may be a slightly earlier tightening than the Fed, but we don’t see it going very far before it starts to dampen the economy. We have rates at 1% in 2023, only 0.5pp higher than they are now. That might be enough.

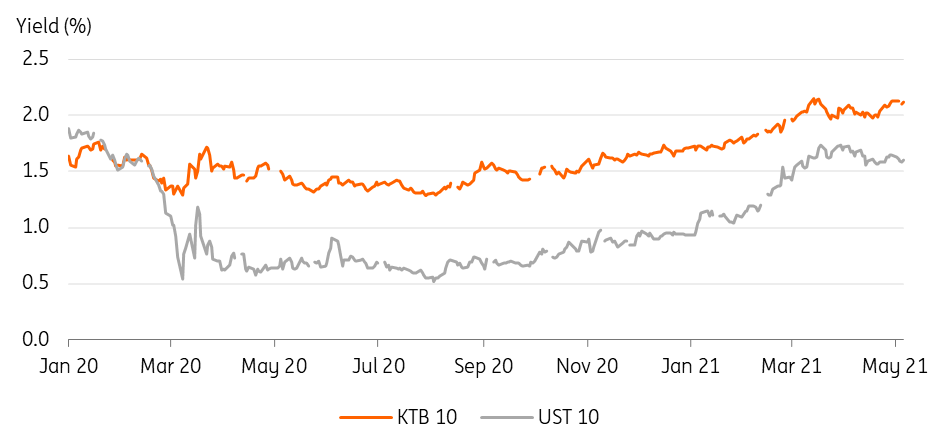

KTB yields should hit 2.5% by the end of the year

The KTB market meanwhile has been tracking movements by US Treasury yields (UST) closely. We anticipate UST yields will keep rising, reaching 2.25% by the end of the year, so we have little problem seeing KTB yields hitting 2.5% by the same time, though this would imply a narrowing of the current spread and potentially turning negative through 2023.

Korean Treasury bonds and US Treasuries

Government and fiscal policy

Since the start of the pandemic, the Korean government has provided ongoing support through expansionary fiscal policies, which with the latest supplementary budget in March this year, takes the total of supplementary budgets to five.

Korea has been quite cautious compared to some economies with its fiscal support

But Korea has been quite cautious compared to some economies with its fiscal support. The original 2020 budget had an expenditure of KRW512.3tr. The latest supplementary budget for 2021 shows an expenditure of KRW572.9tr, only KRW60.6tr (approx. 3% of GDP) higher.

The consolidated fiscal balance has deteriorated from -KRW71.5tr to -KRW89.9tr and the debt stock has risen from KRW731.5tr to KRW965.9, taking the debt to GDP ratio up from 37.2 to 48.2. Our own house forecasts show some slippage from these budget forecasts. Revenues may undershoot projections and expenditures have a habit of growing more than intended, but they are not massively different from these government figures.

And neither our nor the government's projections are particularly alarming. The government is also now committing to keeping the debt-to-GDP ratio below 60% of GDP and from 2025, keeping the deficit no larger than 3% of GDP - a sort of Korean "Maastricht criterion".

The net result of this is twofold:

- There is little if any likelihood of Korea seeing its long-term sovereign debt rating downgraded in the near term

- There is still room for more fiscal stimulus over the coming years and unlike some other more spendthrift countries, Korea will not face a fiscal withdrawal shock.

Sustainability

Back in 2020, Korea launched its Green New Deal, a programme we reviewed in “Asia’s Lamentable green response to Covid”, which you can read here.

One of the things we felt was missing from that programme was a binding commitment to emissions reduction. Since then, Korea has pledged to achieve net-zero carbon emissions by 2050, matching the pledge by Japan, and exceeding the net-zero carbon 2060 pledge by China.

Asia still lags a long way behind regions like Europe when it comes to emissions reduction. And within Asia, Korea is one of the heavier producers of greenhouse gas emissions per capita, producing more than China and Japan, though not as much as Australia.

Emissions per capita

Annual carbon dioxide - tonnes equivalent

The 2050 net-zero carbon pledge is an ambitious target given the starting point, but it is achievable. Government spending will have to start right away to ensure that this plan does not slip, though the upside is that the very substantial amount of spending we anticipate, could be supportive to overall economic growth over the coming decades. There will, of course, be substantial disruption along the way as heavy emitting industries face re-invention or closure.

The future's bright

Korea has come through the pandemic in a reasonable shape, compared to many other countries. It also has a competitive edge in the product the world wants above all else right now, semiconductors. That sets a bright backdrop for Korea this year and next.

Monetary and fiscal policy will remain supportive, though we may see some tightening of rates by late 2022. In the short run, we see the biggest risk to the economy being the slow vaccine rollout and the potential for Korea to see a new wave of infections. Longer-term, cleaning up the economy and transforming to a sustainable future will create a very challenging goal, but one whose pursuit could re-invigorate the economy.

Forecast summary

Download

Download article14 May 2021

It’s now or never This bundle contains {bundle_entries}{/bundle_entries} articlesThis publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more